5 Great Ways to Improve Your Financial IQ

This post may contain links from our sponsors. We provide you with accurate, reliable information. Learn more about how we make money and select our advertising partners.

Eleven years. If you’re a physician, that’s the minimum amount of time you’ve spent after high school increasing your medical IQ just so you can call yourself a practicing doctor and treat patients. How much time and effort have you spent improving your financial IQ?

While I can’t find any definitive studies correlating Financial IQ and ultimate financial security, it’s obvious – the more you know, the more likely you are to set yourself up for success.

Unfortunately, personal finance isn’t normally taught in schools. How many of you were formally educated on how to balance a budget, credit scores and their implications, retirement plans, real estate, etc.? You have to learn all of this on your own.

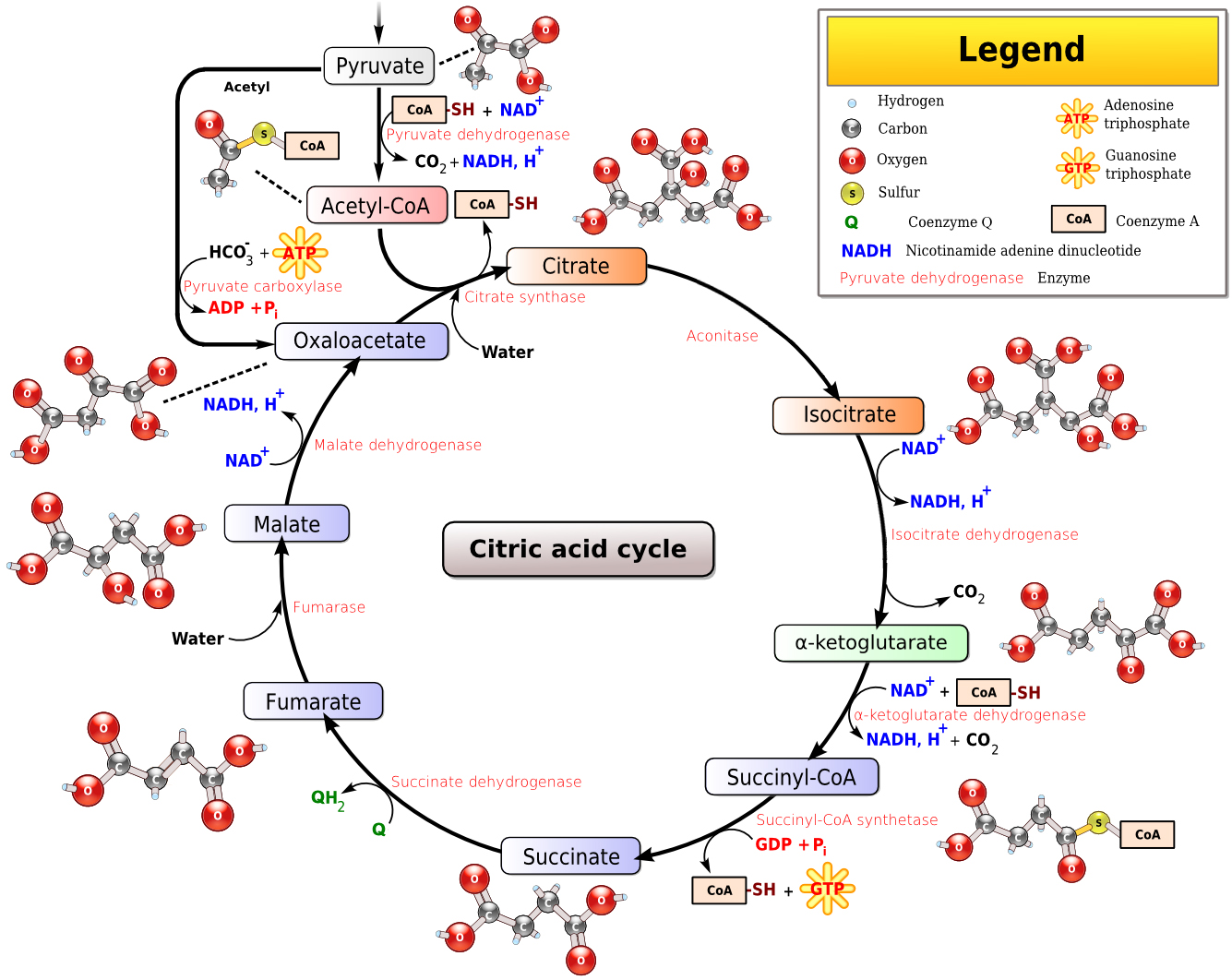

It may seem daunting at times, but I believe it’s easier to learn basic personal finance principles than it is to learn Gluconeogenesis and the Krebs cycle in all of its glory. (And most all of you have already learned that at one point or another.) Here’s a refresher for those who might’ve forgotten.

Well, there are resources out there to help you and it just takes some willingness and dedication to self-educate.

All that being said, here are 5 great ways to improve your financial IQ:

1. Read

- Books – Amazon, Public Library, Overdrive

- Websites – Investopedia, Wikipedia, Khan Academy

- Financial Blogs – Blogroll

- Forums – White Coat Investor, Bogleheads

2. Watch

- TV – Suze Orman

- Movies – Netflix, Amazon Prime have great movies on money & finances

- YouTube – Ask any financial question and you’ll get a video tutorial on it.

3. Listen

- Radio – CNBC, Bloomberg, Dave Ramsey

- Podcasts – Planet Money & the List of Podcasts Doctors Should Be Listening To

4. Talk

- Friends and Colleagues – How many of you have asked your friends and colleagues how they’re saving for their kids’ college tuition or how they’re preparing for retirement? I started doing that and I’ve learned more in some 5 minute conversations than reading 200+ page books.

- Family – Find a family member who seems to be in a good place financially and ask what they did to get there.

- Fellow investors – Don’t be afraid to go to local investor meetings, like Real Estate Investor Associations. Check Meetup to see if there are like-minded people getting together near you or consider starting one yourself.

- Experts – Financial advisors, real estate agents, professional investors, etc.

5. Figure out and track your net worth

- Set your financial goals first. I’ve heard that you should always run with the goal in mind. Great advice. Once I decided I wanted to be a physician, I was able to figure out the path I needed to follow to get there.

- Then you have to track your progress – your net worth. Without knowing this, it’s almost impossible to assess if you’re getting closer to your goals. I used to use a spreadsheet, but it was too time-consuming to update it constantly so I stopped. Then I found Personal Capital and it’s automated all of this. It not only updates my net worth in real time, but it sends me notifications on my spending.

Disclaimer: The topic presented in this article is provided as general information and for educational purposes. It is not a substitute for professional advice. Accordingly, before taking action, consult with your team of professionals.