Not All Income Is Created Equal

This post may contain links from our sponsors. We provide you with accurate, reliable information. Learn more about how we make money and select our advertising partners.

One of the most common financial pitfalls people make is thinking that all income is created equal. It’s an easy mistake to make; after all, a dollar is a dollar . . . right?

Well, that’s what I thought. What completely re-shaped how I spend my time and energy, though, is learning that one dollar can actually be worth less than another, simply based on how it's produced.

It’s a tricky concept to explain, so let’s jump right into some examples.

Is Your Income Being Devalued?

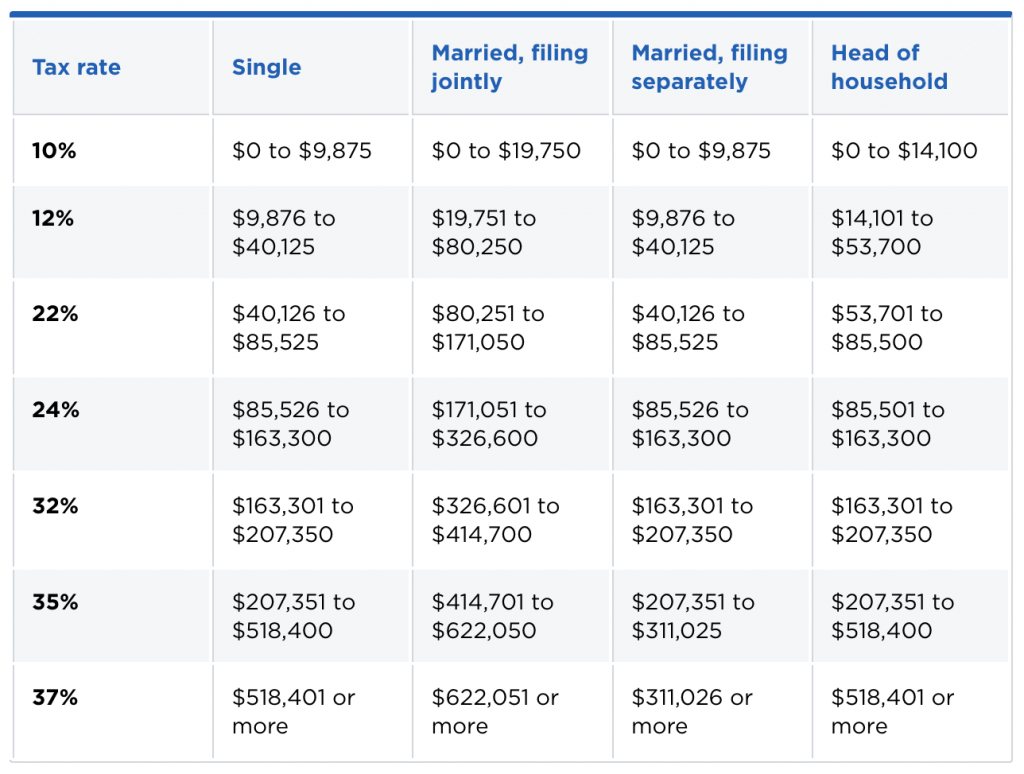

One of the best ways to illustrate this is to look at the 2020 tax bracket.

At its most basic level, this graphic shows that every dollar earned above $518,401 (when single) is taxed 2% higher than the prior bracket.

In other words, if you earn more than $518,401 per year, every additional dollar is worth 2% less than in the lower bracket.

Make sense?

This not only devalues your money, it devalues your time. After all, if you’re getting paid a certain wage per hour, your time is now worth 2% less at the highest bracket.

The point of all of this is to say that you need to figure out where the dollars are worth the most, and how to use the minimum amount of time and effort to create those dollars. That’s how you leverage your time for maximal benefit.

To put it another way, would you rather spend an hour to earn $250, taxed at 35%, or spend that same hour earning the same $250, but taxed at 10%?

The tax amount makes a huge difference–especially when we’re talking about numbers much greater than $250 (as we all know, it’s not what you earn that matters. It’s what you keep).

Income and the Cash Flow Quadrants

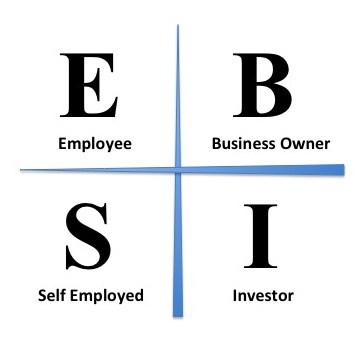

In order to put this all into perspective, let’s take a moment to revisit the CashFlow Quadrant, a concept presented by Robert Kiyosaki in his book of the same name.

The table is made up of four quadrants:

- Employed

- Self-Employed

- Business Owner

- Investor

The highest taxes occur on the left side of the quadrant. This is, in essence, where the dollars are worth the least.

The dollars on the right side, on the other hand, are generally worth far more.

Physicians and other high income professionals are usually stacked on the left side of the quadrant. Either we're highly paid hourly employees or we're running our own practices, but working like crazy to produce results and income.

Where we all need to be if we want to create financial freedom is on the right side of the quadrant where we own (not operate) the business or invest and create income passively.

I think this is a key concept that doctors need to understand.

Still another way to think about this is to categorize income in three ways: ordinary/wage, portfolio, and passive.

Ordinary / Wage Income

This is the money you make from your job. It’s where you put in time and in return, you get a set amount of money.

Physician income is ordinary income. It’s taxed at ordinary income rates which is in essence the highest rates.

Oftentimes, when people say to “tax the rich,” this is the group that gets disproportionately affected. These are the doctors, lawyers, and dentists; High-income earners that work really hard for their money. Unfortunately, they just don’t have a lot of tax benefits available to them.

As a side note, your 401k will also be taxed as ordinary income.

Portfolio Income

This is also known as “capital gains,” which are the profits you receive from the sale of a property or investment. As with any income, this is subject to taxes.

It’s taxed differently than normal income, though, and so working strategically, these taxes can be worked in your favor (for more information on this, be sure to read this post).

In short, money that you create from your investments, whether it’s the stock market or through real estate, can be taxed as capital gains.

Capital gains are currently taxed at 15-20% for this population. That’s a far difference from 30-37%.

Passive Income

As you know the is my favorite type of income. For our purposes, this is money created primarily through real estate or distributions. It's a result of being on the right side of that CashFlow Quadrant.

It’s taxed completely differently.

In fact, through the use of depreciation and bundling that with Real Estate Professional Status, it’s possible for the real estate income to be taxed at 0%.

0% vs 35%… think about it, then think about it again.

Time: Your #1 Asset

When you make your living exclusively through ordinary income, you’re essentially a slave to time. Time and money are completely linked. The only way to make more money is to put in more time – or figure out a way to increase the value of your time.

But no matter what you do, this income is capped based on the number of hours you can put in.

However, with portfolio and passive income, your money is not necessarily proportional to the time you put into acquiring it. This is what allows for true financial freedom.

It is crucial, then, to figure out a way to convert ordinary income to passive income, or to convert a low-yield dollar into a high-yield dollar.

Convert Physician Income To Passive Income

As physicians, we may get taxed more, but our higher income is an advantage (at least, initially). We just have to be aggressive about moving that income from the left side to right side of the cashflow quadrant – as much as possible and as early as we can.

Sure, we’ll take some early tax hits, but using advantages, like the Real Estate Professional status, can quickly move you to the right side of that quadrant.

The old saying summarizes it perfectly: you can’t earn your way to financial freedom.

The reality is that unless you break the connection between your time from your income, you’ll be working until you die.

Fortunately, it doesn’t have to be like that at all.

Take my friend, Dr. VM. He’s a very highly paid radiologist. He believes that early in his career, there’s no more efficient way to make a good income than to work hard at being a doctor.

He’s doing that diligently. But he’s also funneling a significant amount of those funds into passive real estate investments like funds and syndications. He has a couple of large investments and owns shares of hundreds of apartment buildings.

These investments are starting to create a significant amount of cash flow. In fact, within a few short years, he anticipates that his passive income will completely replace his active income and he’ll be in a position where he’s completely financially free.

Really. It's possible.

Once you see your money as a tool, it only makes sense to make as much of it work as hard for you as possible. And the best way to do that is to move it from the left side of the quadrant to the right; from ordinary to passive.

In fact, as this concept starts to make sense, you’ll see not just money, but income and time completely differently. It is not all equal. Understanding this is the key that will accelerate you on the path to your ideal life.

Disclaimer: The topic presented in this article is provided as general information and for educational purposes. It is not a substitute for professional advice. Accordingly, before taking action, consult with your team of professionals.