Our Latest Real Estate Investment: 7 Acres of Lakefront

This post may contain links from our sponsors. We provide you with accurate, reliable information. Learn more about how we make money and select our advertising partners.

What happens when real estate plans don't work the way you plan for them to? Sometimes they end up working out just like they did for Physician on FIRE.

Here's the scoop on two investment properties POF decided to pursue– one worked out, and the other, not so much.

Today’s Classic is republished from Physician on FIRE. You can see the original here.

Enjoy!

We thought we had a good plan. Work another year or two, minimize our belongings, downsize to our 700-square-foot cabin as a home base, and travel extensively for a few years.

It was a good plan, actually. It still could be. But one great opportunity has us thinking a bit differently.

Our Latest Real Estate Investment: 7 Acres of Lakefront

Not long ago, we closed on ten lots, including 4 waterfront lots with 560 feet of frontage with a total of nearly 7 acres on a recreational lake Up North. A month ago, we weren’t in the market for lakefront property or any type of real estate.

How did this happen? The new property is about 75 minutes away from our current second home, but closer to my wife’s hometown, and very close to a property where my wife’s family spends nearly every summer weekend. To be exact, our property is 2 miles by lake or 4 miles by car from the family lake lot.

We weren’t actively looking for property, but with the frequent trips from our lake place to the family lake place, I couldn’t help but notice the “For Sale” signs along the lake. Eventually, curiosity got the best of me and I hopped on Zillow to see how much owners wanted for a property on this lake.

We already had our own uber-low maintenance place on a very nice lake, but most weekends, we would ditch it to be with family, sleeping in various spare bedrooms to avoid making the nearly three-hour roundtrip daily.

Every weekend, packing up a subset of the stuff we have at our cabin, which is already a subset of what we own, it’s tough to know what you have and where you have it, and wouldn’t it be nice if we had a place of our own just down the road?

Looking at Waterfront Property

So I found one property that sounded too good to be true. 4.6 acres with 100+ feet of shoreline for just under $100,000. That’s a lot of property at a great price. I saved it to my favorites, and we even tried to find the actual property on our own, but there was no realty sign on the road.

A few days later, we decided we should try to schedule a showing to see if it really was too good to be true.

We hopped online, did our waterfront search, and found a couple more properties that piqued our interest. One was an old resort with several outbuildings and more than an acre, and the other was this 7-acre property with a ton of frontage.

On a Tuesday, we contacted the listed realtor to see about viewing these three properties. The old resort was now under contract. The 7-acre property, which had only been on the market four days, had already had several showings, and the 4.6-acre lot was available, so we made plans to see the latter two that Friday.

On Thursday, we heard from the realtor. There was an offer on the 7-acre property and if we wanted an opportunity to make an offer, we would have to move up our viewing to Friday morning. The seller would be responding to the offer Friday afternoon.

Yikes!

Making an Offer on Our Waterfront Property

The 4.6-acre lot was shaped like a 12-inch ruler, sandwiched between two really long driveways with a power line running diagonally through it. The woods would have been great if the property was more square-shaped, but with a really skinny rectangle, there wasn’t much we could do with it, other than cut in our own ridiculously long driveway.

The 7-acre property, on the other hand, was roughly square-shaped, or at least trapezoidal. Four waterfront lots are separated by a township road (free plowing!) and the back lots have room for trails, tree forts, campsites… you name it. It’s got a creek with small fish and minnows and one large angry-looking snapping turtle when we were there.

The other thing we really liked about the property was the price. This frugal physician loves a bargain, and this property was priced surprisingly low. On our current lake, waterfront lots go for $2,000 to $3,000 a foot. On this lake, in a less glamorous part of the state, a quality lot could be had for $700 to $1,000 a foot.

The other thing we really liked about the property was the price. This frugal physician loves a bargain, and this property was priced surprisingly low. On our current lake, waterfront lots go for $2,000 to $3,000 a foot. On this lake, in a less glamorous part of the state, a quality lot could be had for $700 to $1,000 a foot.

The listing had been live for eight days when we viewed the property. The asking price was $175,000. When my eight-year-old son asked how much the other people were willing to pay, we gasped, but the realtor responded with something along the lines of “solid, but beatable.”

We offered $170,000.

The Waiting is the Hardest Part

Unlike Jim Collins, who had to wait on pins and needles for days when he made an offer on his “new” upper midwest lakefront property, we only had to wait a few hours.

A fair amount of the property, particularly portions near the lake, are low land full of cedar and spruce trees. It’s not swampy, but we had a contingency put in place to have a wetlands determination to ensure it was buildable land prior to closing.

We made our offer early afternoon and received a call from the realtor mid-afternoon. The seller was going to counteroffer the other interested party unless we were willing to remove the contingency.

Drat!

I had walked the property a second time that day with a relative who is familiar with where you typically can and cannot build. The property has lake homes on either side where the builders had obviously cleared and filled similar land. In fact, our property has an existing (albeit decrepit) structure on one lot, and a small log-sided shed or tiny house on another, and some filling and clearing had already been done.

Feeling confident enough that we would likely be able to build on any lot, or at least on the two with existing structures at a minimum, we removed the contingency.

My wife suggested that we drop our offer by $2,000 since we were no longer getting the wetland determination done. I hesitated, not wanting to lose this place over a couple of grand, but she did have a point — the seller was going to split the cost and now the burden and risk would be on us.

We lowered our offer to $168,000. I started feeling uneasy. Tom Petty was right; the waiting is the hardest part. How were we feeling at that point? To quote Jim Collins, who found himself in a similar situation:

“We’ll be disappointed if we don’t get it and horrified if we do.”

My better half saved us $2,000. Our offer was accepted.

Financing our New Lakefront Property

I haven’t carried any debt for nearly two years now, having decided to be debt free by forty. I saw no reason for this property to change that.

I dug deep into my pockets and came up with 37 cents and some pocket lint. I had to dig deeper.

I don’t believe in a large emergency fund, but between what I had in savings and a couple of upcoming paychecks, I could cover about $50,000 of it.

I needed another $118,000.

For a couple of years, I’ve been saving and scanning health care receipts, with the intent of growing my HSA balance and cashing in someday down the road. I have found the process tedious, cumbersome, and slightly risky if I were to lose the receipts and the digitized backups. I cashed out the receipts for about $7,000.

The rest would come from selling some funds in our taxable account. Usually, when I sell, I’m exchanging directly into a similar but not substantially identical fund. We call that tax loss harvesting, and I was able to do that to the tune of $46,000 in paper losses in 2016.

To decide which lots to sell, I essentially did the same exercise I do when I decide which lots to donate, but instead of looking for the biggest percentage gains, I looked for the smallest.

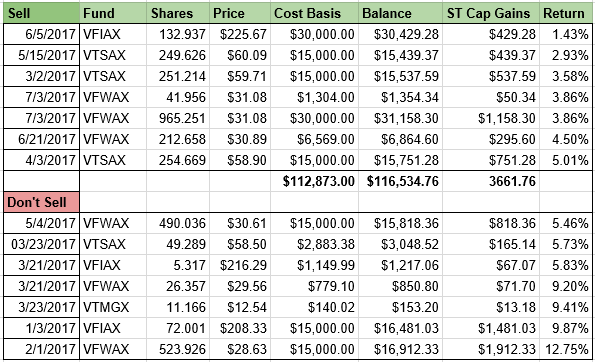

Here’s what that looked like, looking at this year’s taxable investments. I have been plowing money in because a) our expenses have been quite low this year, and b) I got a healthy tax refund after donating $100,000 last year.

Selling seven lots dating back to March of this year (be sure to use Specific ID as your cost basis in a taxable account), I came up with $116,000, taking $3,660 in short-term capital gains. Of course, I won’t owe anything, but will simply use up a little less than 10% of my carryover losses from last year’s tax loss harvesting efforts.

Taking Ownership of our Lakefront Property

It’s ours now. There’s no turning back. We went through the cabin’s dresser drawers and cabinets, looking for anything worth saving. We didn’t find much. I did set aside a few tools, a Sony PS2 with a few games, a campy 1970’s polyester shirt, and some funky drinking glasses.

We left behind mountains of clothing, dishes, half-empty whiskey and gin bottles, a few nudie magazines, and random knick-knacks.

We arranged for the Habitat for Humanity Restore to come and clear out all the appliances and furniture, and anything else worth salvaging. They came last Friday, and as of Monday afternoon, that red velvet sofa (and matching chair and coffee tables) have sold! Eventually, the cabin and the falling-down garage next to it will be coming down.

We’ve only just begun spending money on this property, I’m afraid. The next steps include:

- Determining where we will be allowed to build, and choosing a spot

- Coming up with a design and floor plan

- Clearing and filling to raise the land to be suitable to build and start a lawn

- Finding a spot for a tree fort

- Septic tank and drain field

- Drilling a well

- Building a tree fort!

- Building a home!!!

We are lucky to have family in the area, and they are excited to help us in all of the above steps. They happen to have a family business that deals with home construction and know all the trustworthy contractors, plumbers, electricians, and more who do quality work. Most likely, many of the people who work on our next project will be the same people who built us our first home ten years ago. This time, we plan to build a not-so-big house.

We are lucky to have family in the area, and they are excited to help us in all of the above steps. They happen to have a family business that deals with home construction and know all the trustworthy contractors, plumbers, electricians, and more who do quality work. Most likely, many of the people who work on our next project will be the same people who built us our first home ten years ago. This time, we plan to build a not-so-big house.

The New Plan

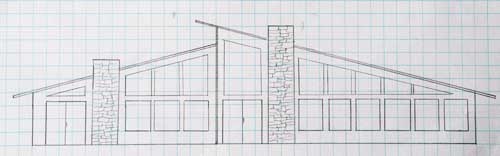

We’ll probably start building next spring and will have our new home ready to be lived in late fall. I’m a fan of mid-century modern design, and I’ve sketched out one idea for a home. The larger side (~1,300 sq. ft.) will be for my family, with the smaller side (~700 sq. ft.) as an apartment for friends, family, and perhaps AirBNB guests ($40 off for you). We’ll have a door or doors that connect the two that can be opened to combine the two places as one.

I’ve also sketched out a smaller version that would be 2/3 the size, but without the attached apartment, but here’s the larger version.

We still plan to make this new place our primary home base for a while, traveling extensively with our boys for several years. We’ll be selling off one of our best investments and our primary home once I am retired from clinical medicine.

The new place will, of course, cost more than the cabin that was going to be part of our original plan, but it will offer us significant advantages.

- It will be larger. We will still have to downsize, but not so drastically.

- We can easily use it year-round. The old place has to be drained and winterized and is not well insulated.

- No more condo associations. No more association rules or dues!

- We can rent out one or both sides when we’re not using them. We have enjoyed being AirBNB guests around the world, and I think we’d make good hosts.

- We will be closer to my wife’s family and can sleep in our own beds all summer long.

- Room for guests. Our friends and relatives can have their own adjacent space when they visit. Friends and family have stayed at our cabin, but only when we’re not there.

- Room to roam. We’ll build on a half-acre, leaving more than six acres to do as we wish. I’ve had a few fun ideas, but we’ll focus on getting a nice structure up on the first half-acre before making too many plans.

There are a few takeaways from our recent impulse buy.

- Don’t be too rigid with plans; anticipate changes and roll with them.

- Keep your eyes open. If we hadn’t gotten curious and taken the time to investigate, this opportunity would have quickly passed us by.

- A taxable account is great to ready cash, and prior tax loss harvesting can make accessing it painless.

- Family matters. We’ve moved around a bit, but our most recent move and our next one both put us very close to family.

2019 Update:

We came very close to starting to build on two of the waterfront lots. We had the permits, the custom house plan, and the money to pay for it. Admittedly, the cost to build was significantly higher than we had anticipated.

We compared what we would have to spend to build what we thought we wanted to the cost of existing homes on the lake and in the area. The difference was striking, and we axed the plans to build.

Our plans for the next several years include extensive travel, spending most of our summers in northern Michigan, but most of the year away from home. We decided this was not the time to build our next dream home; we don’t even know where we’ll want to be in four years when our older son starts high school.

We’re hanging on to one of the waterfront lots and two of the back lots and the others are for sale. If we get anything close to our asking price, we’ll profit handsomely.

As for our living situation, we fell in love with a $90,000 mid-century house in town. We’ve moved into it and will split time between it and our little second home on the lake.

It’s not what we expected to end up with, but we’re happy with this arrangement. It’s important to remain flexible!

[Update 10/12/2019: Yesterday, we sold one of the four waterfront lots with two back lots for a purchase price of $80,000. That’s nearly half of our original purchase price for 1/4 of the land. Although we’re not using the property as we thought we might, we have no regrets.]

Join our community at Passive Income Docs Facebook Group. Just click below…

Disclaimer: The topic presented in this article is provided as general information and for educational purposes. It is not a substitute for professional advice. Accordingly, before taking action, consult with your team of professionals.