The Danger of Not Checking Your Portfolio (I’ve Made a Huge Mistake)

This post may contain links from our sponsors. We provide you with accurate, reliable information. Learn more about how we make money and select our advertising partners.

Legend has it that Fidelity tried to study which of their investors had the best returns. Was it better to log in frequently or to let your investments ride?

Investors were better off dead, or so the legend goes. The dead guys and gals couldn’t log in to their accounts and monkey with their investments. And that led to better results.

There is no such study, apparently (it was investors who forgot they had accounts with Fidelity), but the dead guy story persists to better drive home a point, and it’s a powerful one. In many cases, it’s better to lock the door and throw away the key than it is to open the door twice a day to make sure everything is okay.However, as I’ve learned the hard way, ignorance is not always bliss. In this case, ignorance was costly to the tune of over $75,000. I’ve learned from this mistake, and I hope you will, too.

The Danger of Not Checking Your Portfolio (I’ve Made a Huge Mistake

Family slow travel. That was the dream and we were now living it.

We had just spent two amazing months in Mexico. We had a few days at home, a trip to Minnesota and back, and I was catching up on mail while preparing for another two months away, this time in Spain.

It was a bit of a whirlwind, but we took care of the essentials and then enjoyed the many wondrous sites, sounds, and tastes offered by the cities of Valencia, Barcelona, and Madrid. As we departed for home the first week of March, a viral outbreak was taking hold in Italy and cases were beginning to spring up in the cities we had spent time in.

Fast forward a few weeks and the world is suffering the effects of a widespread pandemic, and the stock market is reflective of the expected drop in corporate earnings with about a 30% drop in equities as this post is written.

I like having a stock-heavy portfolio, but it’s times like these that I appreciate that 10% bond/cash allocation.

About that Bond Allocation

Before retiring early, within my employer’s 457(b), I had a 100% stock allocation, holding my bonds in the 401(k).

When I left the job, I switched to a 100% bond allocation in the 457(b) account, which represented roughly 5% of my total portfolio. I adjusted my bond allocation down in my 401(k) to maintain my desired allocation of 10% bonds across the portfolio.

The plan was to maintain a minimum of 5 years worth of spending ($400,000) in bonds, drawing down the 457(b) and rebalancing the 401(k) to maintain that level.

In the fall of 2019, I learned that withdrawals would not begin until the year after I officially separated from my employer. I thought I had already done so, but I did agree to maintain “as needed” per diem status to keep my privileges and a toe in the door in case a desperate need were to arise for my services. You know, in case of something unimaginable like a viral pandemic.

Since I wasn’t officially separated from my employer in the eyes of the 457(b) plan administrator, withdrawals were put on hold until April of 2021 and I didn’t pay much attention to that stagnant account.

Automated “Rebalancing”

Most of my investments are with Vanguard, but the 401(k) is held with TransAmerica. Transamerica has this really nifty auto-rebalancing feature that I wish I knew nothing about.

When I changed to the 100% bond allocation in the account in the fall of 2019, I changed both my current allocation and future allocation to the 100% Vanguard Total Bond Index Fund.

What I didn’t think to change was on a 3rd screen. I used to have the account split 50 / 50 between Vanguard’s Mid Cap and Small Cap Stock index funds. Once a quarter, TransAmerica would even them out for me.

I didn’t realize they would do a 180 on my portfolio and “rebalance” back to the two funds I had traded out of, though, and that’s exactly what happened on December 30, 2019.

It’s not like they didn’t tell me, though. They tried.

I had become immune to these emails. To see what transactions were made, you had to open the email, click on a link, login and find the right combination of clicks on the site to see the confirmation. It should have registered as meaningful, but in the busy days between trips, it was just another email to be filed away.

Ignorance is Bliss?

We enjoyed our time in Europe. My investments were on autopilot, and I did a great job of not checking the balances regularly, if at all. Other than an occasional glimpse at our total net worth on Personal Capital, I didn’t give my portfolio much thought.

That changed when we returned.

The lovely stock market gives and takes, and what it was giving me in early March was tax-loss harvesting opportunities.

I made a handful of swaps and in mid-March, I figured it was time to take a closer look at my current portfolio and update my spreadsheet.

When it came time to update the balance of the one bond fund I thought I held in the 457(b), that balance was zero. Here’s what it looked like on 12/30/2019.

Where I expected to see my bond fund, I had only small-cap and mid-cap stock funds.

D’oh!

I had thought I was about 90% / 10% stocks/bonds (exclusive of real estate investments) across my entire portfolio. It turns out I was 95% / 5%.

As a result, instead of still having $230,000 in the account (the bond fund had a return very close to 0% year-to-date), the balance was down to $154,000. That’s a $76,000 difference.

As the reality of that inadvertent trade made in late December sunk in, I had a visceral queasiness and realized there was nothing I could do about that lost money, other than wait as long as it takes for the market to rebound. It may take years. Most of the time, having more stocks in there would work out in my favor.

Not this time.

Never mind that my entire portfolio’s losses had reached seven figures. I expected to see that when I logged in. But I also expected to see my 457(b) balance relatively unchanged.

Ignoring the portfolio for 10 weeks was a huge mistake. If I had realized at any point in the first seven weeks of the year that I didn’t have the bond allocation I thought I had set up, I could have corrected it.

By the time I realized my error, I was out the cost of one Tesla S (or a Tesla 3 each for my wife and me). Well, that’s not entirely true. Since it is a tax-deferred account, 1/4 to 1/3 of the money belongs to the government. I’ll take a silver lining wherever I can find it.

Other Dangers of Not Checking Your Portfolio

Missed Tax Loss Harvesting Opportunities

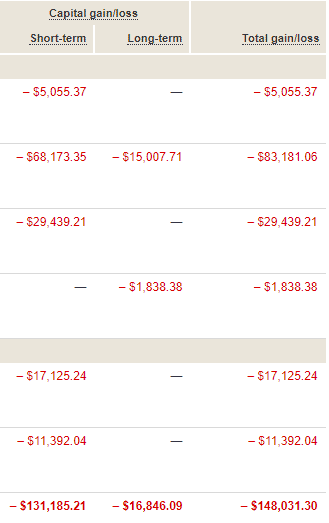

I mentioned that I have been busy taking advantage of tax-loss harvesting opportunities. In the first two weeks of March 2020, I harvested $148,000 in paper losses.

That’s enough to take a $3,000 deduction on my income taxes for the next 49 years. More likely, I’ll use a good chunk of it to offset gains from alternative investments I’ve made, like one from the sale of a microbrewery and another on some vacant lakefront property.

If you ignore your portfolio and pay no attention to the market briefs, you’re not going to know to check for losses. Please note that tax loss harvesting is not locking in a loss, since the idea is to buy a similar asset when you sell the loser and you remain invested.

What would be even better than tax loss harvesting would be never having a loss to harvest, but that’s never going to be the reality. You don’t get the rewards without the risk.

Undetected Fraud

Ignoring your portfolio could also mean that you miss a fraudulent transfer. Fortunately, I have no experience in this, but scammers are scheming across the globe, and they have been known to clear millions from an account in a matter of minutes.

The sooner you notice that something is missing, the more likely you will be able to recoup that money. You don’t have to watch over the portfolio like a hawk, but a weekly check-in is probably wise. If any balances are down significantly, you should have a good understanding as to why. Maybe you made a withdrawal or the overall market tanked in proportion to your losses.

Understanding What You Own and Where You Own It

If you’re relatively new to investing and still learning, it’s a good idea to check your balances at least somewhat regularly just to better understand what you own and where you own it.

As your financial literacy increases, you may realize that the portfolio you set up is not the portfolio you want. It may be that your portfolio is not as tax-efficient as it could be or that those auto-selected target-date retirement funds are no longer what you want in your 401(k).

As you progress in your education, you can write out a written plan, an Investor Policy Statement, and make sure your portfolio is well-aligned with the plan.

It’s Best to Check Your Portfolio Once in a While

If you’re prone to needless tinkering or can’t trust yourself to do the right thing in a bear market (i.e. stay the course), you may not want to check on your portfolio too often. In fact, you’d probably benefit from a trustworthy fee-only financial advisor to talk you off the ledge when necessary and keep you from making rash decisions. You’d very likely avoid stupid mistakes like the one I made, and if not, you’d have someone besides yourself to blame.

On the other hand, if you are a do-it-yourself investor and you trust yourself with access, do yourself a favor and keep tabs on what’s happening in your accounts. Log in to Personal Capital to see all account balances in one place or your check-in with your favorite broker or aggregator every once in a while.

I sure wish I had.

Fall 2020 Update

This post was originally published in March of 2020 when the newly-declared pandemic had caused asset prices to plunge. As illustrated, my 457(b) had lost $76,000 in value because of an inadvertent “auto-rebalance.”

I am happy to report that what I thought might take years to recover only took months. I stuck with the stocks that I had swapped into and by October 2020, the balance had gained $81,000 to reach a new high of $235,000.

I took this opportunity to change the allocation back to bonds with the plan to begin withdrawing these funds in April of 2021, as I have now done. A couple of strongly positive trading days passed before my allocation was switched back to bonds, and this is the final result of a topsy-turvy 2020. All’s well that ends well, I suppose?

Disclaimer: The topic presented in this article is provided as general information and for educational purposes. It is not a substitute for professional advice. Accordingly, before taking action, consult with your team of professionals.