Buy One Property a Year and Retire Early?

This post may contain links from our sponsors. We provide you with accurate, reliable information. Learn more about how we make money and select our advertising partners.

There is a physician that I know, Dr. C., who is well known to be a very savvy real estate investor. Everyone thinks he lives the good life, and he’s at the age that most doctors start thinking about retirement. In one of our conversations, he let me know he had technically retired years ago, but had continued working simply because he enjoyed it. What doctor wouldn’t want that? So, of course, I asked him, “How did you do it?”

He readily admitted that he’s not particularly savvy or smart when it comes to investing. He just listened to the advice of a mentor:

“Buy one real estate investment property a year.”

I tried to nail down some specifics (i.e. condo, house, apartment building). He simply stated, “Doesn’t really matter. Whatever you can reasonably afford, just do it.”

So I went home to see what that might look like and tried to model it out on paper.

Here’s my disclaimer: this is my N=1, my one simplified example.

This might be a good time to quickly address the oft-debated simple vs complex model argument. I think the answer is that no one can definitively state which model truly has a better predictive value. This quote by a well-known British statistician, George Box, sums it up perfectly:

“All models are wrong, but some are useful.”

I believe this pertains to both real estate and stock market models. However, what we do know is that simpler models are easier to apply and to take action on, mostly because you feel you can replicate it.

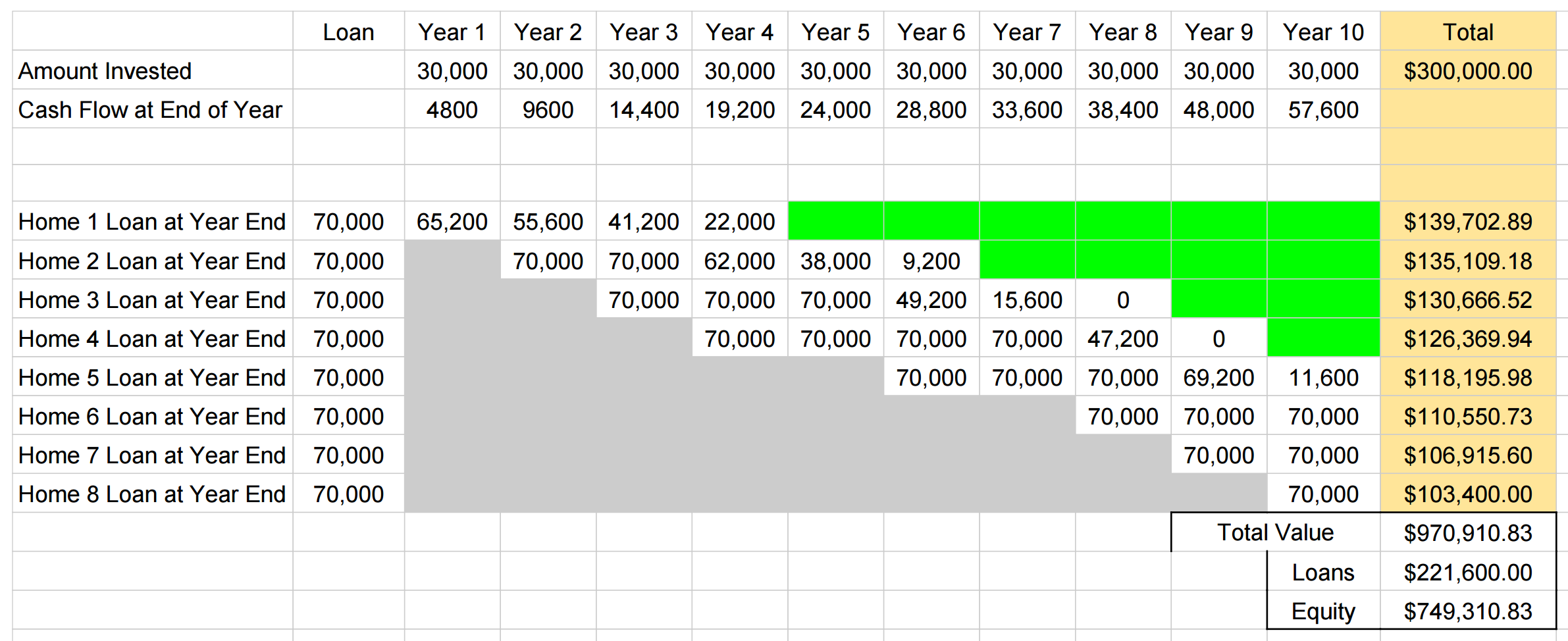

Buy a Rental Property Every Year for 10 Years

With that in mind, here is what it might look like if you tried to buy a rental property every year for 10 years. Here are the rules of this model:

- Each property purchased is a single family home.

- The purchase price stays constant at $100,000 (to keep the numbers round).

- Each year requires a 30% initial investment ($30,000 in this case).

- The home loan starts at $70,000 (= $100,000 purchase price – $30,000 investment)

- The max # of home loans at any one time is four. According to Fannie Mae / Freddie Mac, you can possibly have up to ten residential home loans, but after four it becomes a bit more difficult to get additional loans, so decided to keep it at four.

- Cash flow per property is $400 a month. This number was chosen because this is very attainable, as proven by my own rental property.

- Cash flow = Income – Expenses. Income = rent. Expenses = Mortgage Principal + Interest + Taxes + Maintenance + Property Management + Vacancy.

- All the cash flow throughout the year is saved and goes back into paying down the home loans at the end of the year.

- Once a property is paid off, the property cash flows $800/month. That’s because there is no longer mortgage and interest to be paid.

- If you have the max 4 properties, the $30,000 initial investment goes towards paying down one of the loans.

- Referencing the Case-Shiller index, used 3.4% as the appreciation rate.

What is not taken into account in this model?

- Equity pay-down over time, which works significantly in your favor but can get confusing for the calculation.

- Rents increasing over time, which would work in your favor

- Increased maintenance over time

- Any cash flow changes

- Taxes

- Depreciation

- Purchasing your own home

After all that, here it is. If the details become excessive, skip to the bottom for the summary. (At this point, you might want to have one window with the graph open on one side and one with the explanation on the other if you want to follow along easier.)

Year 1

- $30,000 invested and you have your first rental property. Congrats!

- Cash flow is $400 a month ($4,800/year).

- At year-end, this $4,800 reduces Home #1’s loan to $65,200 (= $70,000 – $4,800).

Year 2

- $30,000 invested and you have your 2nd rental property.

- 2 cash-flowing properties at $400/month results in $9,600 for the year.

- At year-end, this $9,600 reduces Home #1’s loan to $55,600 (= $65,200 – $9,600).

Year 3

- $30,000 invested and you have your 3rd rental property.

- 3 cash-flowing properties at $400/month results in $14,400 for the year.

- At year-end, Home #1’s loan is at $41,200 (= $55,600 – $41,200).

Year 4

- $30,000 invested, you now have the max 4 rental properties.

- Cash flow is $19,200 per year (= $4,800 x 4).

- At year-end, Home #1’s loan is $22,000, the rest are still $70,000.

Year 5

- Since you have max 4 houses, your $30,000 investment goes to paying off the rest of Home #1, and the remainder reduces Home #2’s loan to $62,000.

- Cash flow is $24,000 ($800/mo for home #1, $400/mo for homes #2,3,4)

- At year-end, Home #2’s loan is $38,000.

Year 6

- $30,000 investment buys Home #5.

- Cash flow is $28,800 ($800/mo for homes #1-2, $400/mo for homes #3-5).

- At year-end, Home #2’s loan is down to $9,200.

Year 7

- Since you have the max 4 houses, your $30,000 investment goes to paying off the rest of the home #2, and the remainder reduces Home #3’s loan to $49,200.

- Cash flow is $33,600 with 2 paid off houses and 4 cash flowing at $400/mo

- At year-end, home #2’s loan is $15,600.

Year 8

- $30,000 investment buys home #6.

- Cash flow is $38,400.

- At year-end, home #3 is paid off and the remainder goes to home #4’s loan.

Year 9

- $30,000 Investment buys home #7.

- Cash flow is $48,000.

- At year-end, home loan #4 is paid off, and the remainder goes to home #5’s loan.

Year 10

- $30,000 Investment buys home #8.

- Cash flow is $57,600

- Pays down house #5

Summary After 10 Years

- You own 8 rental properties at this point. You were very close to your goal of purchasing one a year and you didn’t need to violate the max four loans at a time rule.

- Four homes are completely paid off, four still have mortgages on them.

- Cash flow by end of year 10 is $57,600 a year ($4800 per month). If you had a $2 million portfolio at this point and started to draw down 3%, you’d have a very similar cash flow.

- Again, roughly figuring out the appreciation of each home using a rate of 3.4% yields total equity in the properties of around $750,000.

- Total investment has been $300,000.

My Thoughts

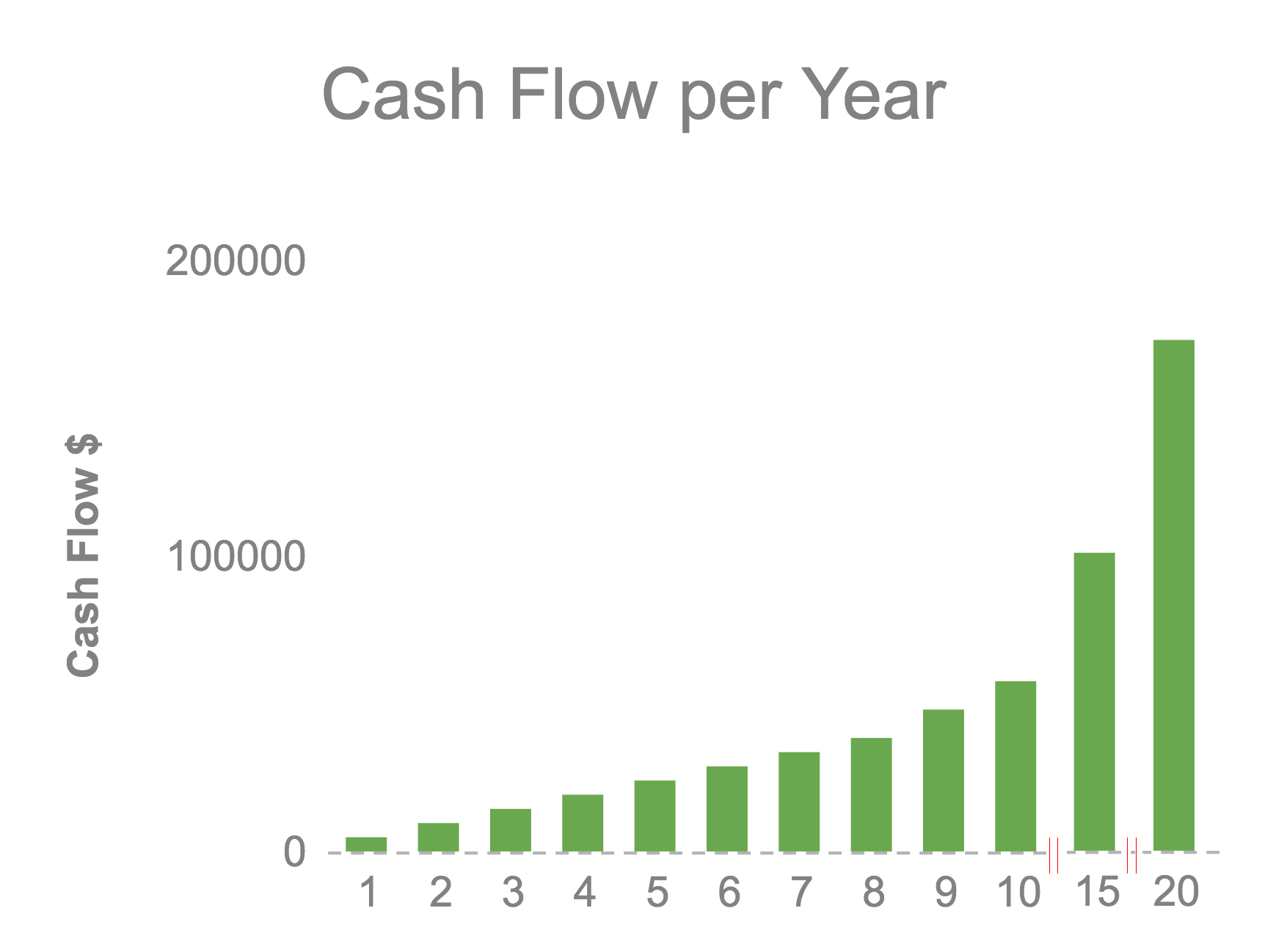

- You can start seeing a snowball effect happening, although it seems to just be hitting its stride by year 10.

- This is something most physicians could replicate.

- The cash flow is starting to amount to something substantial by Year 10. What would that cash flow by year 10 allow you to do? Would it cover educational expenses for your child? How many shifts would that allow you to give up?

Just for fun, I modeled it out for 15 and 20 years. The problem is that the model starts to break down because the cash flow becomes so overwhelming and I wasn’t sure whether to buy several new homes at a time or roll some of the cash back into the loans. But hey, we're just having fun here, so here are the results:

Year 15

- You own 12 homes, 10 of which are paid off by year-end.

- Cash flow is $100,800 a year ($8,400 a month).

- Equity in the properties is around $1.4 million.

Year 20

- You own 19 homes (very close to one a year!), all 19 of which are paid off by year’s end.

- Cash flow is $172,800 a year ($14,400 a month).

- Equity in the properties is around $2.8 million and growing.

I think it’s worth mentioning that if you were able to amass a nest egg of $6 million dollars and you withdrew 3% a year, that would put you somewhere in the range of $180,000 your first year.

At this point, I think it’s pretty safe to say that working is relatively optional and total retirement is a possibility. That's some serious passive income! Imagine starting this when you’re in your early to mid-30s when you first became an attending physician.

So Did I Follow This Advice?

I've had to play a little catchup but I've been fortunate to be able to get enough rental units to match the number of years I've been out an attending. Okay, that's only five, but I'm right on track to buy one rental property per year. I'll keep you updated…

Are you ready to start your journey by creating passive income through real estate? Then click below to the waitlist for our next class season. There is no obligation to join our waitlist! See you on the inside!

Disclaimer: The topic presented in this article is provided as general information and for educational purposes. It is not a substitute for professional advice. Accordingly, before taking action, consult with your team of professionals.