FIREd at 40! Musings From a Surgeon Day Trader

This post may contain links from our sponsors. We provide you with accurate, reliable information. Learn more about how we make money and select our advertising partners.

Ever dream of crushing it by picking the right stocks? Well, this strategy seems to get picked apart as a foolish venture by most in the financial blogging community.

However, there are some out there who are able to do it quite well, and some of them happen to be physicians.

Today's guest post is by one such physician who simply goes by name, The Stock MD. He's a recently retired surgeon, father, husband, and avid day trader. Oh and he's 40 years old.

Enjoy this guest post from The Stock MD and more articles on stocks and day trading on his site, THESTOCKMD.COM.

I was recently perusing one of the physician-only Facebook groups that I frequent. The group is focused on providing a collaborative platform for doctors to find alternative forms of income. For some, it’s a side hustle. For others, it’s a permanent way out of medicine. The most remarkable thing about this group is its sheer size: 51,000 members and growing! Simultaneously impressive and ominous. That’s a lot of doctors looking for something else.

Often, people post about their side gigs. Some notable ones that come to mind – a restaurant, brewery, clothing store, and art gallery. Interestingly, whenever someone makes such a post, it is uniformly greeted with well wishes and encouragement. But once in a while, someone posts about another type of side hustle: stock trading. What ensues is almost always negativity and discouragement. So what gives? When did trading stocks develop such a dirty connotation?

To answer this question, I must digress for a moment.

I know a little about trading stocks. I’m not an expert, but I’m not bad at it either. I’ve been doing it for over a decade. Indeed, I paid my way through medical school with trading income, and more recently, retired from my career as a surgeon. Yes, I FIREd at 40.

The issue with day trading is that it has an image problem, and nobody is necessarily in a position to fix it. But that’s ok because most of us don’t care. It’s not glamorous, and it doesn’t produce any eye-catching finished products like an exquisite restaurant meal or hand-crafted beverage that you can post to social media. What it does produce is money. So let’s use that as a starting point. Here’s my product:

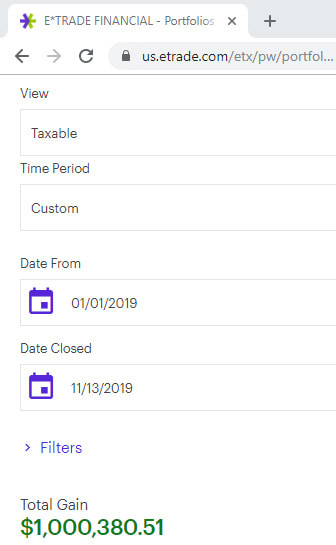

When I retired from medicine this year, I decided that I would set a trading profit goal of $1 million. Lofty? Yes, a little lofty. But I needed a strong win in order to justify leaving a career with a guaranteed mid-6-digit salary. So why not dream big and go for 7 digits? On November 13, 2019, I achieved that goal.

It’s hard to describe the feeling I had when I saw the 2 commas. I actually went out and bought myself a cake. I couldn’t tell anyone other than my wife. Social media norms allow you to post pictures of your nice car or house but seem to frown upon photos of your investment account gains. Again, day trading has an image problem due to the product it produces.

The truth is, that most day traders will lose money. It has been well documented in many notable journals. The numbers I have seen exceed a 90% failure rate. Brad Barber and Terrance Odean (from UC Davis at the time) have done some of the best academic research in this area. In 2002, their paper “ Trading Is Hazardous to Your Wealth: The Common Stock Investment Performance of Individual Investors ” examined 66,465 households between 1991 and 1996 and demonstrated that active traders underperformed market returns by 6.5% (11.4% for active traders vs 17.9% for market returns).

If I asked you for the failure rate of all first-time businesses, would it surprise you that the rates are roughly equivalent to that of day traders? But, you’d never see your Facebook colleagues chastising another doctor for opening a restaurant, even though it was likely doomed to fail from the beginning.

The process of day trading is simple. You buy shares of a company, and on the same day, sell it at a profit. You usually do this multiple times per day. On a busy day, a full-time trader will easily make over 100 trades. You can really do much more elaborate things, especially when using options. But let’s keep it simple for the time being. Selling all of your shares before market close means that you have the added security of sleeping with cash every night.

The advantage here is that it makes you immune to overnight events. War? Negative trade news? Black Monday? For a day trader, it doesn’t matter. In fact, market turmoil is a key activator for the volume and volatility needed to trade successfully. Trading is a learned skill, just like playing golf, or ice skating. Nobody and I mean nobody is naturally good at either when they first start. It takes time, many painful mistakes, and conviction to become good at it.

The reality is, that most doctors who buy stocks aren’t actually *day* trading. They are simply buying and holding for a period of time. Even still, they manage to lose money. When the average doctor ‘picks’ a stock, it’s usually without any of the necessary steps needed to succeed. Can you read a balance sheet? Did you listen to the conference call? Do you know the product roadmap? Are you familiar with how industry peers are valued?

I’m guessing for most doctors, the answer will be no.

Interestingly, for a day trader, none of this matters! Would it surprise you to know that many day traders enter and exit a position in a company without actually knowing what the company does?

So why is it that some of the most intelligent physicians that I know are among the most unqualified group of people for day trading? I’ve thought of a few things, most of which applied to me early in my trading career.

Insufficient Starting Capital

Trading requires starting capital. I wouldn’t suggest starting with less than $25,000. Why? Because pattern day trading laws exclude you from actually day trading until you exceed 25k.

Would you go to the Blackjack table with only $100 when the table minimum was $25? Sure, you could, but you would almost always lose. There is a minimal bankroll needed to be somewhat successful at Blackjack. I would say between 20 and 50x the minimum table bet. The same principle applies to trading.

Lack of Barrier to Entry

This ties into insufficient starting capital. If you want to open a restaurant, chances are you will have to spend a couple hundred thousand dollars or more. If you want to trade a stock, you can open most brokerage accounts with a nominal amount of cash, sometimes zero. I would be willing to bet that the restaurant owner, with hundreds of thousands at stake, would work hard to make it work. But with virtually no barrier to entry for opening a trading account, many people just have a go at it, and inevitably fail.

Insufficient Training

Trading requires discipline. You need to be able to react to lightning-fast movements of the stock. It takes time, and in my estimation, at least 2 years of relatively heavy trading to understand the mechanics of trading.

Emotion

You must be devoid of emotion while trading. People get emotionally tied to a loss, and often hold it beyond the point of no return. If you just wait a little longer maybe… Conversely, the emotional high of seeing a stock soar often prevents you from selling until it is too late.

Lack of Risk Management

Having tight stop-loss triggers and good risk management techniques such as protective puts is one of the key distinguishing characteristics of a successful trader.

Inability to Change Strategy

If your system works for a while, don’t ever assume it will work in perpetuity. In the past year, I have significantly changed strategies 3 separate times after finding that one method was successful for only a few months.

Missing End-Points

I never buy a stock without already having the selling price firmly in my mind. In fact, my sell orders are usually placed within a few seconds of the buy order execution. Learning to sell, and not let it ride for too long is critical for success. Yes, you will miss a few points on the upside, but a lower win is always better than a loss.

Bad Book-Keeping

As much as I hate that doctors have become expensive data-entry clerks, it is critical to keep contemporaneous and accurate medical records. Similarly, you must keep track of your trades. I have a spreadsheet containing every single trade I have made since 2009. I often go back and look at how performance was impacted during certain market conditions, and how a change in strategy affected my win rates. You can’t improve if you don’t track your results.

Lack of Time Commitment

Very few doctors have the ability to actually day trade while they are working. I do know a radiologist who manages to squeeze in some day trades. But for the most part, they are making intermediate-length swing trades. I did most of my day trading while post-call.

Wrong Temperament

Not everyone is equipped to handle the fast pace of day trading. Think about how you chose your own specialty. Some people love the fast pace of the trauma bay. In an instant, you make a life-altering decision. Others like the more cerebral side of medicine and choose specialties like psychiatry. I think traders tend to be the trauma types, but not always.

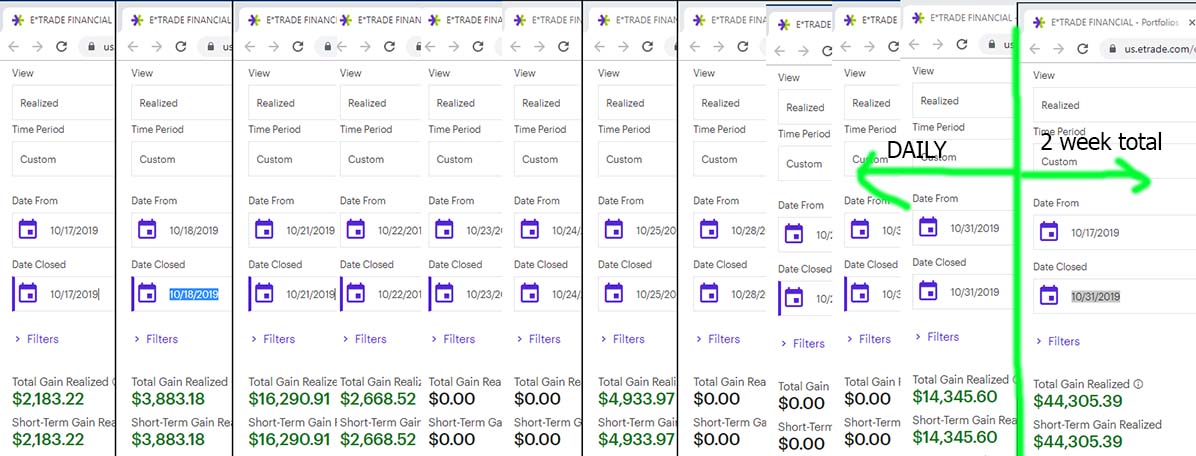

When you put all of this together, I can tell you that it is possible to make steady, daily gains as a day trader. Still don’t believe me? Ok, here’s an extract of my trade data in October/November 2019:

Trading data from the last 2 weeks of October 2019

Trading data, month to date in November 2019

As you can see, I don’t trade every day. Being retired means that I have the freedom to play with my kids any time I want. We also travel a fair bit. But when I do trade, I almost always produce profits. I had no negative days in October or November. You can see that I had two strong days in the last two weeks of October: +$16K on 10/21, and +$14k on 10/31. Obviously, these types of days are less common, but they occur frequently enough to sustain the positive momentum.

These bigger wins are usually part of a timed strategy, focused around major events like a product launch or earnings release. Also, note that the two-week total of +$44k in October projects to an annual profit of $1.1 million – this aligns well with my annual profitability goal.

You will also see that my November profits are much lower than in previous months because I reduced risk significantly as I approached my year-end goal. Never forget, that proper risk management is the key to success as a day trader.

So there’s my $0.02 for now. I hope to talk again soon.

-thestockmd

To read more on day trading, come join me at thestockmd.com.

Join our community at Passive Income Docs Facebook Group. Just click below…

Disclaimer: The topic presented in this article is provided as general information and for educational purposes. It is not a substitute for professional advice. Accordingly, before taking action, consult with your team of professionals.