How Much Time Does It Take To Manage My Own Properties?

This post may contain links from our sponsors. We provide you with accurate, reliable information. Learn more about how we make money and select our advertising partners.

Physicians are busy people. Simply juggling work and family can be tricky enough, but when you add business ventures and investments, it can seem nearly impossible to do it all.

I’m often asked how I balance being a physician and father, while still having time to run and manage a real estate portfolio.

In fact, I think time (thinking there's not enough of it) is the main reason more physicians don’t build or manage real estate portfolios of their own.

It’s understandable; you don’t want to get called in the middle of the night with plumbing issues. You hesitate at the idea of tenant issues adding stress to your already stressful lives.

While it’s true that there are hassles in owning real estate and having tenants, there are ways to make sure that hassle is limited. Owning your own investment property doesn’t have to take over all of your free time.

It Really Is Possible

For proof that there are physicians making it work, I recently took a survey in our Facebook Group to ask how many people made their first investment within the past year. The response was amazing.

So many physicians made their first rental property investments quite recently. Many followed that up with a second or third investment–all within the same year.

If one property took that much time to manage, wouldn’t a second property double it and a third triple it?

How are people able to manage that?

Well, using myself as an example, I have six different rental properties in three states that I need to “manage.” Some are small, single-family properties, while others are small apartment buildings.

However, without exaggerating, I can tell you that I spend on average a total of 3-5 hours per month dealing with these properties.

How is that possible? How do I manage my own properties?

It’s simple, really. I don't… I hire good property management and I manage them.

What Does Property Management Do?

Well, simply put, they manage all the day-to-day stuff. They collect rents, manage repairs, maintenance and upkeep, and handle paying all the bills and expenses.

My mortgage, insurance, and taxes are set up to all pay through my lender. Some say it’s better to pay for these things on your own so you control the flow of money, but that’s another hassle factor and to me, it’s not worth the potential gain.

(Once, I actually forgot to pay one of the property taxes on time and the fee was extremely high. I realized I was looking only at the gain and wasn’t looking at the potential loss as well of paying my own tax bill. So when I factored that all in, I just decided it was easier to let the bank handle that.)

Every month, I receive a statement of the month’s income and expenses from my various property managers. I also have things set up for direct deposit into my bank account.

I review each statement really quickly–between all the properties, it takes less than thirty minutes in total. I don’t pick at every single detail; I look for any abnormal costs.

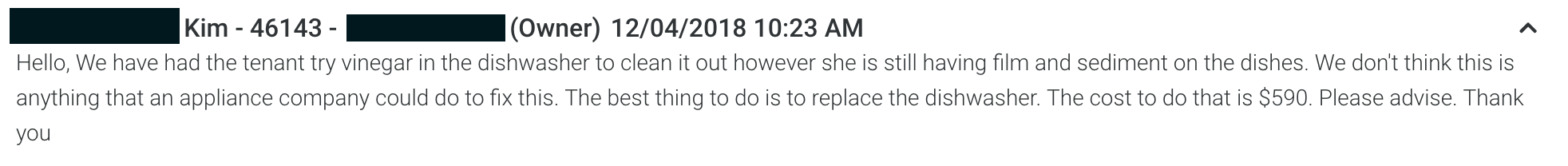

My property managers all have it in their contracts that if the cost is above a certain amount and it’s a larger repair, they will contact me to let me know.

That usually comes in the form of a quick email or a message in one of my portals, that might look something like this:

I might ask for a follow-up to see if they’ve gotten a second opinion, but oftentimes I just go with their recommendation. Again, I spent time on the front end to make sure I’m dealing with a trustworthy, intelligent, and experienced company. I hired them so that I don’t have to look at all the little details.

I’ll authorize a repair and just wait for a confirmation that it’s been done.

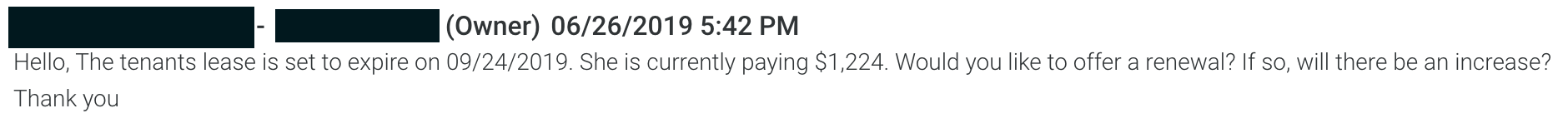

Then I might get a message like this one:

With something like this, I’ll shoot a quick message asking for some more details about the tenant's payment history. Has it always been on time? Have there been any other issues with the tenant? Then, ultimately, I’ll ask for their recommendation.

In this case, the tenant had several late payments, so I asked them about how the rental market in that area was doing, the market rent, and how quickly they think they could release it. They said it was a very hot market, and market rents were higher. So, I decided it was better to end this relationship and find a more responsible tenant.

When looking over statements at the beginning of each month, I might see things like plumbers and electricians having to go out and do repairs at different properties. But all those happened without me having to manage it and I was free to focus on other things!

But Doesn’t This All Cost Money?

Typical property management is anywhere from 6-10% depending on the size of the property (ie: how many units). I consider this the expense of doing business. It’s overhead just like anything else.

When you run a medical practice, rent and expenses are all a part of it. When you invest in a mutual fund, there are fees, hopefully very low, but you still have to consider them to figure out what your net return is.

I do the same thing for real estate by looking at returns net of property management and other expenses. You have to look at the overall returns and see if it makes sense within your investment goals and risk tolerance.

I also consider “time” as part of the equation. Sure, I could make more money if I didn’t have management. But it would take far more time, and my time is actually worth quite a bit more to me.

Since I believe my time is more than what I’m paying management, I feel like I’m leveraging them to attain even better returns.

So in summary, here’s how much time I actually spend on my investment properties every month:

- < 1-hour reviewing statements

- 1-2 hours making important decisions

- 1-2 hours on the paperwork that might be needed, taxes, documentation, call with CPA

Now, the time spent on any given month might occasionally stray outside the norm. That can depend on what stage the property is in.

If I'm looking to purchase a property, the vetting period is definitely more involved. It also requires a good deal more time to get the paperwork sorted out.

If there are times when we’re doing heavy construction or renovating, I want to be a little more hands-on in knowing the progress of things.

But when the properties are stabilized, like they are now, it's all very manageable.

You Can Make It Work

Time is a hot commodity, and I know how valuable it is. If you’ve thought about investing in real estate but haven’t made a move due to the perceived time commitment, just know that you can make it work however you want. You can enjoy your time and the returns you’ll receive.

How much time do you spend managing your rental properties a month? Want to check out our FB group for physicians, Passive Income Docs?

Disclaimer: The topic presented in this article is provided as general information and for educational purposes. It is not a substitute for professional advice. Accordingly, before taking action, consult with your team of professionals.