Maximizing Real Estate Tax-Efficiency and Cash Flow

This post may contain links from our sponsors. We provide you with accurate, reliable information. Learn more about how we make money and select our advertising partners.

One of the most powerful aspects of investing in real estate is the tremendous tax benefits, the primary one being depreciation. If you want to see how some of the numbers might work when considering these tax benefits, keep reading.

This Today’s Classic post is republished from The White Coat Investor. The original post can be found here. Enjoy!

I’ve been looking at lots of syndicated real estate deals over the last year or so. I have noticed a common theme among them and it finally dawned on me the reasoning behind it. These deals are generally structured to have a down payment of around 1/3, and generally last 5-7 years. The reason for this is to maximize the cash flow that can be protected from taxes by the depreciation, while still being able to take advantage of a decent amount of leverage, and having a number of years over which to spread the transaction costs.

How to Maximize Your Real Estate Investments for Tax-Efficiency and Cash Flow

Cash Flow

The best way to maximize your cash flow is simply to pay cash for the property. Using the 55% rule, about 45% of the gross rents will go toward non-mortgage expenses. So a $100,000 property with a capitalization rate of 6% (cap rate = net operating income/value of the property) would have gross rents of $10,909 and a net operating income of $6000. The best way to maximize your cash flow ($6000) is to have no mortgage expenses, i.e. to pay cash for the property.

Tax Efficiency

Likewise, the most tax-efficient property is one in which you put zero down. Not only will the expenses eat up all the gross rent and then some, but you can (and will probably have to) add money to the property, increasing the value of your investment in a very tax-efficient manner. In fact, if you really want a tax-efficient investment, you could overpay for the property too and use the losses each year and when you sell it to offset your regular income (or if you make too much, at least your other passive income.)

Getting Positive Cash Flow

However, most real estate investors don’t want to feed money into their properties. At a minimum, they want it to at least pay for itself. What is the minimum amount of money you need to put down to get that?

Well, it depends on the cap rate of the property and the terms of the loan. Let’s assume that same $100K, cap rate 6 property. Let’s assume a 5%, 30 year loan. If you put down 10%, you have a loan on $90K. Your total mortgage payments would be $5,575, so you’d be slightly cash flow positive. Your gross rents would be $10,909, your non-mortgage expenses would be $4909, and your mortgage expenses would be $5,575. You’d be left with $425, or $35 a month in positive cash flow, for a cash on cash return of 4.25%. If you only put down 3%, you would have zero cash flow and your cash on cash return would be 0%.

Maximizing Cash on Cash Return

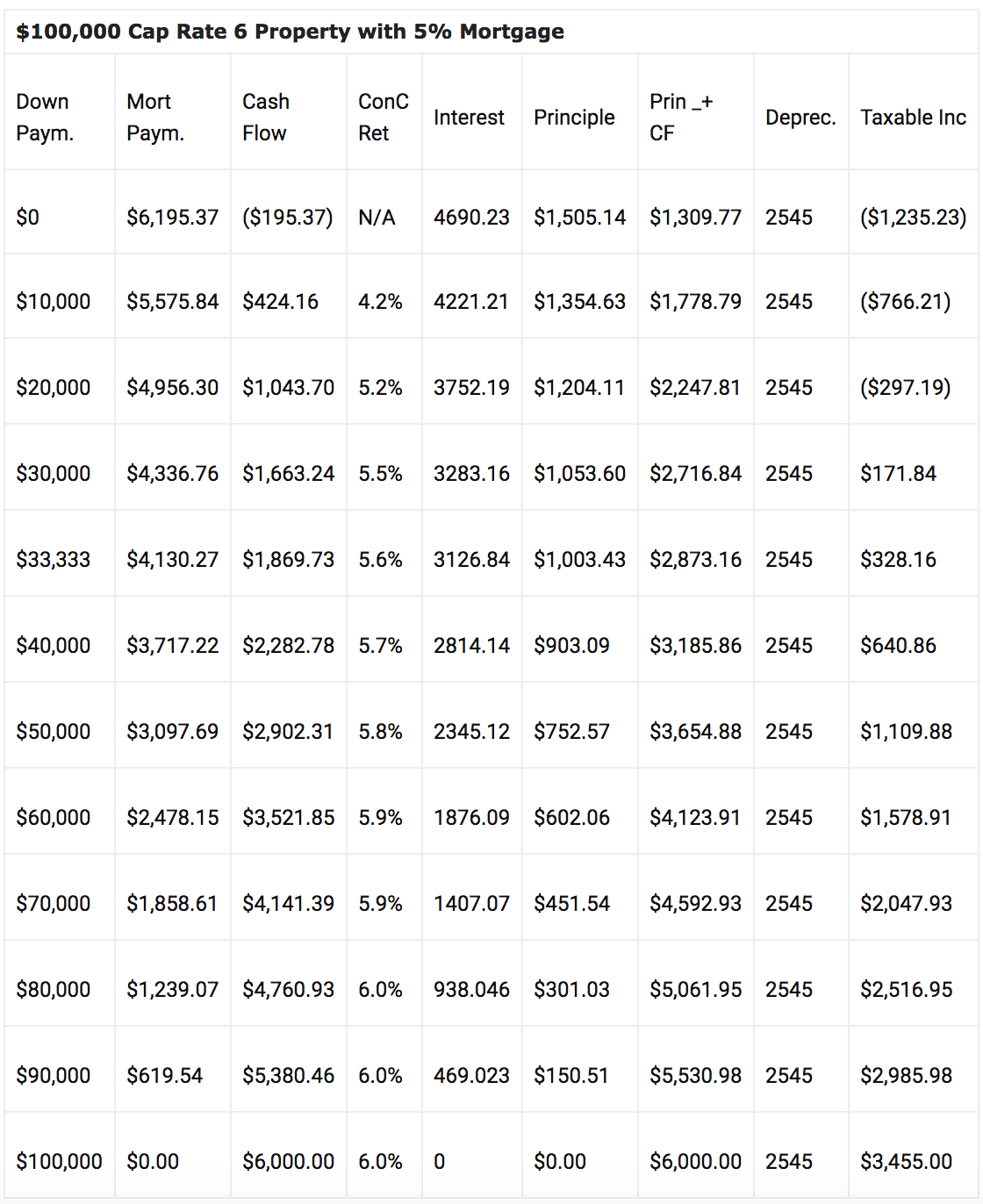

If you put down 100%, you would have a cash on cash return of 6%. If you put down 3%, you’d have a cash on cash return of 0%. If you put down less than 3%, you’d be feeding the beast (technically a negative infinity cash on cash return). As seen below, the more you put down, the higher your cash on cash return. This simplistic example, of course, ignores the fact that if you put 20-50% down you’re going to get better mortgage terms than if you put 0-20% down.

| $100,000 Cap Rate 6 Property with 5% Mortgage | |||

| Down Payment | Mortgage Payment | Cash Flow | Cash on Cash Return |

| $0 | $6,195.37 | ($195.37) | N/A |

| $10,000 | $5,575.84 | $424.16 | 4.2% |

| $20,000 | $4,956.30 | $1,043.70 | 5.2% |

| $30,000 | $4,336.76 | $1,663.24 | 5.5% |

| $40,000 | $3,717.22 | $2,282.78 | 5.7% |

| $50,000 | $3,097.69 | $2,902.31 | 5.8% |

| $60,000 | $2,478.15 | $3,521.85 | 5.9% |

| $70,000 | $1,858.61 | $4,141.39 | 5.9% |

| $80,000 | $1,239.07 | $4,760.93 | 6.0% |

| $90,000 | $619.54 | $5,380.46 | 6.0% |

| $100,000 | $0.00 | $6,000.00 | 6.0% |

Random Pondering

So, if the best way to maximize cash flow is to put 100% down, and the best way to maximize tax efficiency is to put 0% down, and the best way to get the maximum cash on cash return is to put 100% down, why are all these deals structured with about 1/3 down? Perhaps its the benefit of depreciation.

Depreciation

Although there are several different methods of depreciation, the simplest is to simply depreciate the value of the building (not the land) over 27.5 years. So if the land on our Cap Rate 6 property is worth $30K, and the building is worth $70K, then you get to depreciate $70,000/27.5 = $2,545 per year.

That means that $2,545 of your positive cash flow PLUS the amortization on the loan (remember only the interest portion of the mortgage payment is deductible) comes to you as tax-free income. (Yes, depreciation has to be recaptured when you sell, that’s why you exchange properties until you die and pass it to your heirs with a step-up in basis.) So let’s remake the chart a bit.

So what do you see? At around 1/3 down your entire annual return is tax-free. The appreciation (if any) is tax-free until you sell (and if you exchange, eternally tax-free). The cash flow and amortization are completely off-set by the depreciation.

So what do you get? At 1/3 down, your property might be worth 2% more due to appreciation (a 6% gain on your original investment), you paid down about $1,003 on the mortgage, and you got $1,870 almost tax-free ($328 was taxable) to spend on whatever you like. Not a bad return on a $33,000 investment-14.6% pre-tax and with a 35% marginal tax rate, 14.3% after tax. Now you see why these real estate guys get all excited about this stuff.

Years Two Through Seven

So what happens in year two? Well, the mortgage is paid down a little bit more. You raised rent 2%, and depreciation stays the same. Let’s look at another chart demonstrating perhaps why these deals are often structured over 5-7 years.

| Year | Cash Flow | ConC | Int. | Prin. | Prin. + CF | Taxable Inc | Tax-free Inc | After tax Ret | Leverage |

| 1 | 1870 | 5.6% | 3127 | 1003 | 2873 | 328 | 1542 | 14.3% | 3.00 |

| 2 | 1990 | 5.6% | 3077 | 1054 | 3043 | 498 | 1491 | 13.7% | 2.81 |

| 3 | 2112 | 5.7% | 3024 | 1106 | 3218 | 673 | 1439 | 13.3% | 2.64 |

| 4 | 2237 | 5.7% | 2969 | 1162 | 3399 | 854 | 1383 | 12.8% | 2.49 |

| 5 | 2364 | 5.7% | 2911 | 1220 | 3584 | 1039 | 1325 | 12.5% | 2.36 |

| 6 | 2494 | 5.7% | 2850 | 1281 | 3775 | 1230 | 1264 | 12.1% | 2.24 |

| 7 | 2627 | 5.7% | 2786 | 1345 | 3971 | 1426 | 1200 | 11.8% | 2.13 |

Several things to notice that happen after 5-7 years. First, the percentage of your cash flow that is taxable increases each year and at year 7, the majority is taxable. Second, your after-tax return decreases each year. This is primarily because you are becoming less and less leveraged each year.

In fact, after about 8 years, your leverage has gone from the original 3:1 to a factor of 2:1. Finally, I’ve been completely ignoring transaction costs both in doing the cash on cash returns as well as in the total returns. The more years you spread these costs over, the less of a bite into your return they take each year.

There are a couple of other factors, of course, that explain why these exchanges often happen after 5-7 years. First, investors don’t like to tie their money up forever. We’re not immortal. Second, those who are putting these deals together often get additional flat or asset-based fees for structuring the deal, buying the property, and selling the property. The more complete round trips they do, the more they get paid.

Transaction Costs

Just for fun, let’s look at the effect of transaction costs. Let’s assume transaction costs of 4% to buy (exactly the fees on a recent syndicated deal I looked at), and 5% to sell. In my experience, on a private residence 5% to buy and 10% to sell is a pretty good estimate, but with an investment property, especially a syndicated one, it would hopefully be less.

Obviously, if you can achieve lower costs, then your returns will be better. Keep in mind these percentages are based on the entire value of the property, not just your equity. So if you sold after just one year, your cash on cash return would be just 5.0%, instead of 5.7%, and your overall return would be -13%, instead of +14.3%. It would be slightly better than that after tax because you could deduct your losses!

So even though your property was cash flow positive, and appreciated while you held it, you still lost money due to your hold period being too short to make up for the transaction costs. In my $100K property example, the total round-trip transaction costs are in the $9-10K range. Spread over 7 years, it’s $1,392 per year, lowering the return by something around 4% a year.

Boosting Returns

So in the end, this Cap Rate 6 property, leveraged 3-1, ends up with an annualized return of around 10%, about the same as historical returns on stocks. If it appreciated faster, or if it had a higher Cap Rate, then your return would be a little higher.

So if you’re buying real estate expecting outsized returns, you need to do a few things to make sure it happens. First, you need to buy property with a higher cap rate than 6. Second, you need to buy property that will appreciate faster than 2% a year. Third, you could leverage it up a bit more or get better terms on the mortgage. For example, if you had a cap rate 9 property and a 3.5% mortgage, the first chart in this post would look like this:

| $100,000 Cap Rate 9 Property with 3.5% Mortgage | |||

| Down Paym. | Mort Paym. | Cash Flow | ConC Ret |

| $0 | $5,253.27 | $3,746.73 | N/A |

| $10,000 | $4,727.94 | $4,272.06 | 42.7% |

| $20,000 | $4,202.62 | $4,797.38 | 24.0% |

| $30,000 | $3,677.29 | $5,322.71 | 17.7% |

| $33,333 | $3,502.20 | $5,497.80 | 16.5% |

| $40,000 | $3,151.96 | $5,848.04 | 14.6% |

| $50,000 | $2,626.63 | $6,373.37 | 12.7% |

| $60,000 | $2,101.31 | $6,898.69 | 11.5% |

| $70,000 | $1,575.98 | $7,424.02 | 10.6% |

| $80,000 | $1,050.65 | $7,949.35 | 9.9% |

| $90,000 | $525.33 | $8,474.67 | 9.4% |

| $100,000 | $0.00 | $9,000.00 | 9.0% |

Pretty hard not to get excited about figures like that! Add in some appreciation, a little leverage, and the tax benefits from depreciation and you could make out like a bandit on a deal like that if held long enough.

Conclusion

Overall, I think about a third down is a pretty good balance of having positive cash flow but being able to shield most of it with depreciation. You get the benefits of leverage, while still being able to avoid being underwater even in a nasty real estate downturn. A 5-7 year holding period allows you time to spread the transaction costs over multiple years while allowing you to get out as the investment becomes less tax-efficient. However, be aware that a longer hold period may be more appropriate for your goals with the investment.

Disclaimer: The topic presented in this article is provided as general information and for educational purposes. It is not a substitute for professional advice. Accordingly, before taking action, consult with your team of professionals.