How To Invest in Real Estate Using a Retirement Account and Avoid the Dreaded UBTI Tax

This post may contain links from our sponsors. We provide you with accurate, reliable information. Learn more about how we make money and select our advertising partners.

Over the past year, you may have noticed that the public market has fluctuated quite a bit–and that’s putting it mildly. Retirement accounts, like 401(k)s and IRAs, have dropped in value along with the market, sometimes drastically.

While the public market is notoriously volatile (especially in the midst of a pandemic), real estate has proven to be much more even and consistent.

What if there was a way for an individual to allocate funds in your retirement account for real estate investments, rather than the public market?

Today’s post is presented by MLG Capital, a private real estate firm that has found a way to do just that. By providing access to an investment strategy usually only available to institutional investors, MLG allows individual investors to take advantage of real estate’s stable returns without paying extra taxes.

While this is not a sponsored post, MLG Capital is a sponsor partner of our site.

As a bit of background, MLG Capital is a private real estate firm that has been in the industry for over 30 years. Across all investments made in that time, they’ve averaged a 2.3x multiple on an average hold period of approximately 6.5 years. Fund IV, their current offering, is a $200M Fund that seeks diversification across a basket of 25-30 smart real estate deals, targeting net returns to investors of 12-16%.

So, without further, ado, I’ll let Nathan Clayberg at MLG Capital speak for himself.

In a rapidly changing world filled with uncertainty, many investors have grown weary of the roller coaster ride offered by the public markets. After stomaching the near 40% drop in March, followed by a nearly equally rapid recovery, the next few months in the public markets are set to be anything but predictable.

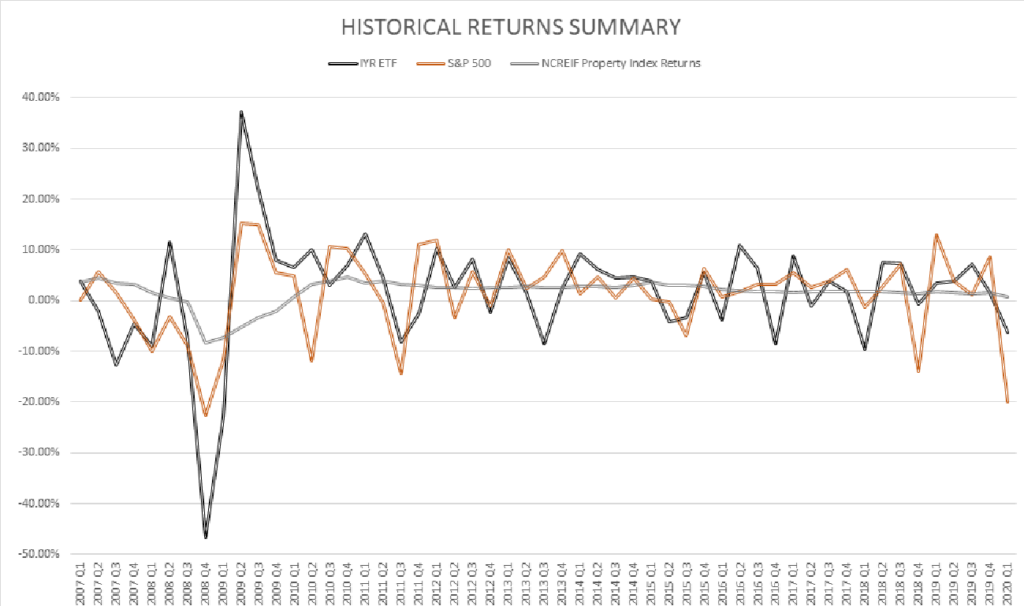

In the same time period, investments like private real estate have seen much less fluctuation in values, mostly because these asset classes don’t correlate with public equities. The image below tracks three commonly referenced benchmarks:

- The S&P 500, a leading indicator of US Large Cap Equities.

- The IYR ETF, which seeks to track the investment results of the Dow Jones US Real Estate, measuring the performance of the publicly traded real estate sector of the US Equity market.

- The NCREIF Property Index, which is a quarterly measure of the unleveraged composite total return for private commercial real estate properties held for investment only.

As shown in the chart, the publicly-traded REITs generally mirror the volatility of the S&P, whereas private real estate experiences much less fluctuation.

Investors often attempt to diversify their investment holdings by purchasing public Real Estate Investment Trusts (REITs). However, they usually don’t realize that REITs are traded on the same exchanges as bonds and securities. Because of this, these REITs are strongly correlated to traditional equity and fixed-income securities.

At MLG, we fully understand the importance of mitigating risk through diversification–our diversified fund structure is based on this exact concept.

And while most investors agree that diversification is important, it is often difficult to access investments in private real estate within retirement accounts, such as IRAs and 401(k)s.

More specifically, investing passively in debt-backed real estate through a qualified account can trigger what’s known as Unrelated Business Taxable Income (UBTI) within retirement accounts. In other words, if you’re investing in any deal that uses leverage (has financing as part of it), you will be subject to being responsible for paying taxes on UBTI. This can cause a significant impact on your returns.

For accounts designed to generate returns over the long term, this is a problem.

So what’s the solution?

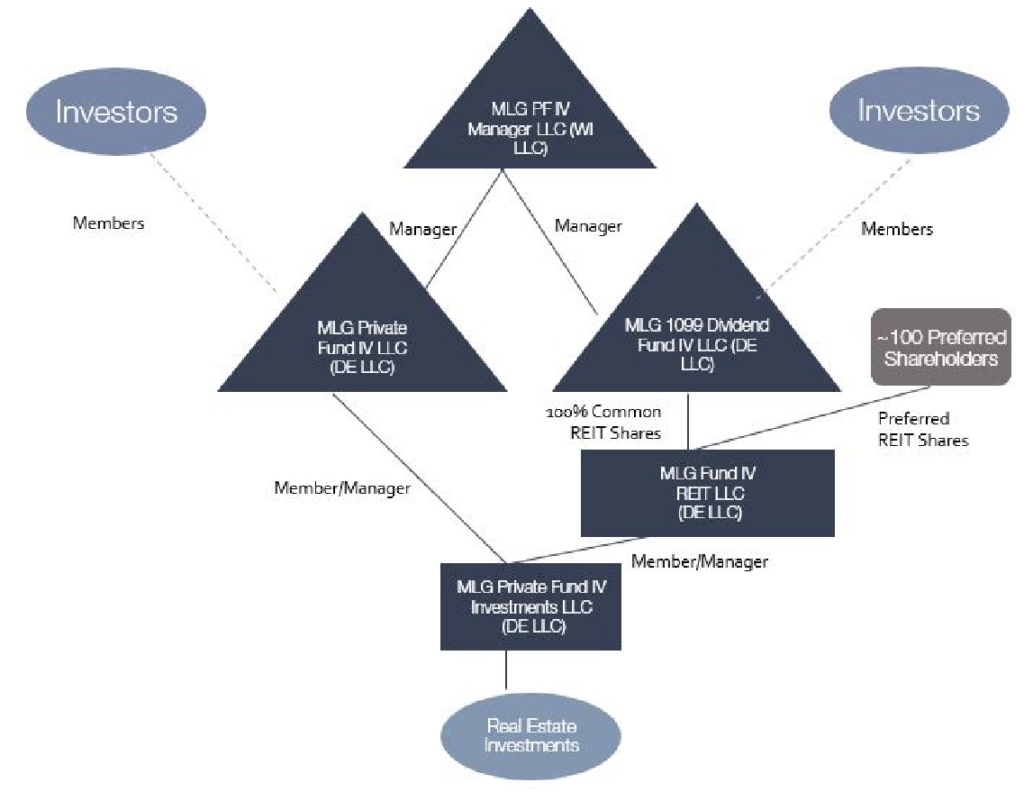

To solve this issue, and to still give investors access to private real estate investments, MLG has created an alternate way to access our current offering. In fact, it’s designed specifically for retirement account investors and completely avoids any potential UBTI issues.

This parallel fund is called the 1099 Dividend Fund IV, and it’s placed in a non-traded subsidiary REIT entity, between the investments and the investors.

Put simply, this structure (illustrated below) allows passive rental income to be reclassified as dividend income, which is not subject to UBTI.

This structure is actually relatively common amongst institutional investors, but MLG has worked hard to make it available to individual investors as well.

1099 Dividend Fund Investors receive the same business deal as normal investors with the same targeted returns, but in a structure that better meets their specific needs.

In short, the 1099 Dividend Fund IV allows individuals to leverage their retirement accounts into private real estate, which provides less volatility and more consistent returns than the traditional public market.

So if you’ve ever heard that it can be problematic to invest in private real estate using tax-protected accounts, know that there are solutions.

If you’re interested in learning more about MLG and the 1099 Dividend Fund, you can check them out here.

Disclaimer: The topic presented in this article is provided as general information and for educational purposes. It is not a substitute for professional advice. Accordingly, before taking action, consult with your team of professionals.