My Personal Peer to Peer (P2P) Lending Experiment

This post may contain links from our sponsors. We provide you with accurate, reliable information. Learn more about how we make money and select our advertising partners.

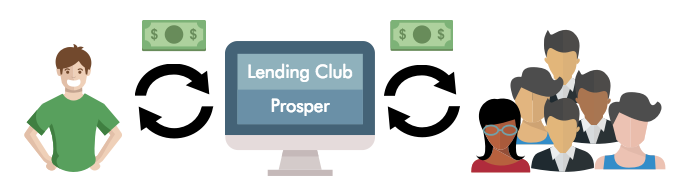

Recently, I’ve begun to hear a lot about something called Peer to Peer (P2P) Lending, but it just sounded scary to me. Just who would I be lending to, and what’s to stop them from running away with my cash? Sure, the projected returns sounded decent, but is it worth the risk?

I remained in the valley of indecision until, after a while, it actually came up in conversation with a friend. He said he had been getting annualized returns of greater than 10% for the last three years using P2P lending. He raved about how easy and “passive” it was. I was still hesitant, however, and voiced my concerns.

“It’s the same risk a credit card company is taking when they offer you a credit card,” he responded. “It seems to work pretty well for them, so why shouldn’t it work for you?”

I had to admit, that was a fair point. I decided that at the very least, I should give it a try. After all, I thought, investors are apparently seeing legitimate returns. After some more research, I found this to be precisely the case–and it’s backed up by years of data.

The next question was where to start. I found that there are two main companies: Lending Club and Prosper, and as part of an experiment, I decided to try both.

On October 30th, 2015, I invested $1000 into each of the platforms. It was actually quite easy to set up. I funded them directly from my bank account, and within a few days, my money was being put to work.

In an effort to keep it as truly passive as possible, I chose automated portfolio builders for both, set up with middle-of-the-road risk. Expected returns were ~ 7-9%.

I’ll publish my actual returns every couple months. If you’re curious, follow along with me. The results should be very interesting.

PLATFORM: LENDING CLUB

Portfolio Expected Return: 8.24%

Starting Value: $1,000

Ending Value: $1,046.32

Actual Growth: $46.32 or 4.6%

Annualized Return: 8.68%

Notes:

-

I noticed there was $153.16 in “Available Cash.” Somewhere along the way, automatic reinvesting got turned off and some cash was just accumulating in my account. I want to put my money to work, so fixed this immediately.

-

I’ve invested in 42 notes, 39 of which are current and active. One has completed, one is 30 days late, and one is 60 days late.

-

The late loans are reflected in the adjusted account value (Lending Club gets points for transparency here).

PLATFORM: PROSPER

Portfolio expected return: around 7.5%

Starting Value: $1,000

Ending Value: $1078.82

Actual Growth: $78.82 or 7.8%

Growth, Taking into Account Payments Past-Due: $34.12 or 3.4%

Annualized Return: 10.93%

Annualized Return taking out Past-Due: 4.76%

Notes:

-

Less cash is sitting in this account because I had automatic reinvesting set up correctly.

-

I Invested in 26 notes, 25 of which are current and one of which is in collections.

-

Prosper counts loans that are past-due (late) into total account value and into Annualized Net Returns, whereas Lending Club does not.

Summary

Overall, I’m satisfied with my returns. So far, both portfolios are at or above the projected returns. However, Lending Club assumes the late ones will default, while Prosper assumes they’ll get back into repayment. I’m just happy I haven’t lost any money.

It still feels pretty risky and I don’t know if I’ll ever get a real sense of security. Am I going to put my retirement savings into one of these P2P lenders? At this point, it’s very unlikely.

Perhaps when I hit my one-year anniversary with these platforms, and depending on the economy at the time, I’ll step up to a higher risk profile and shoot for even higher returns. I’d still like to have a deeper understanding of how my portfolios are put together, but the last thing I want to do is look through all the loans and choose them myself.

At some point, I realize I have to trust their process. If I don’t, I might as well place my money elsewhere.

Disclaimer: The topic presented in this article is provided as general information and for educational purposes. It is not a substitute for professional advice. Accordingly, before taking action, consult with your team of professionals.