When it Makes Sense to Utilize Private Real Estate Investments

This post may contain links from our sponsors. We provide you with accurate, reliable information. Learn more about how we make money and select our advertising partners.

This is a guest post from Clint Thomas & Justina Welch of Integrity Wealth Solutions, a flat fee financial planning and wealth management firm with a great understanding of how to integrate real estate investments into your portfolio.

This is not a sponsored post but they are a sponsor of the site and one of the few on our exclusive recommended financial advisors list.

It is common knowledge and an accepted practice to diversify an investment portfolio – spreading risk over multiple sectors of the market with the intent to lower volatility while obtaining a solid rate of return.

The central idea is that different segments of the market zig and zag at different times and a diversified mix of assets can take advantage of rising markets with growth-oriented investments while providing some protection in a down market with more conservative investments.

Many investors diversify across the core asset sectors, such as bonds, US stocks and possibly foreign stocks. While others might go a step further and diversify into publicly traded real estate investment trusts (REITs).

However, many investors neglect a huge asset class when constructing their portfolios, and that is commercial private real estate. Public REITs represent about a $960 billion market whereas U.S. commercial real estate represents a $13 trillion market.

In fact, commercial real estate is the third largest asset class behind U.S. traded fixed income and the U.S. stock market. For the qualified and the appropriate investor, private real estate can empower investors to access this cornerstone asset class and compliment their portfolios with a range of benefits.

Benefits of Real Estate

Diversification

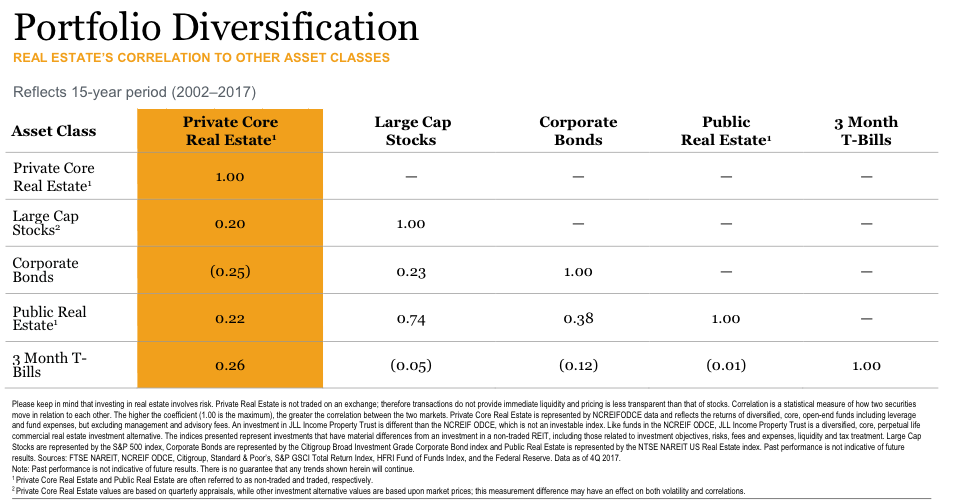

Modern portfolio theory suggests that the most effective way to maximize returns while at the same time minimizing risk is to add uncorrelated or low-correlated assets. Within the context of multi-asset portfolios (composed of stocks, bonds and other asset classes), commercial real estate may provide significant benefits, as correlations with stocks and bonds over time have been low.

While we are a big believer in adding public REITs to a diversified portfolio, there can be additional benefits to adding private real estate to gain even greater diversification. As you can see from the below chart, public REITs have a fairly high correlation (0.74) to the US stock market while private real estate has a much lower correlation (0.20).

Performance

High-quality core commercial real estate as an asset class has had strong historical performance with a lower standard deviation (volatility) than public REITs and the US stock market over the last 15 years. Private real estate delivered an 8.3% average annual return over the last 15 years with about half the volatility of the S&P 500 and a third of the volatility of public REITs.

The value of a private real estate fund is based on the actual value of property held by the fund. Conversely, in a public REIT, the share price value is determined by daily market forces, which means the share price of a public REIT may not reflect the actual value of the underlying real estate. In some cases, the share price can value the REIT 30% higher or lower than the actual value of the underlying real estate.

Private real estate values don’t move much daily but rather appreciate slowly over time, which is why private investments are less volatile than their public counterparts.

Both vehicles have pros and cons and the optimal portfolio has a combination of both. Public markets offer liquidity, but that comes at the expense of volatility and private investments offer investors low volatility, but with that comes illiquidity.

Potential Income

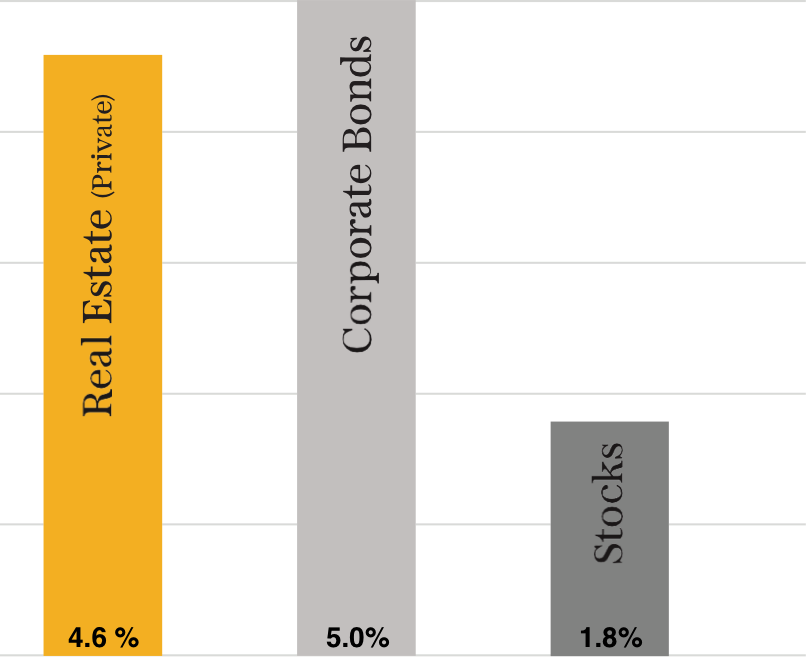

Income has been an essential component of the attractive long-term total returns provided by commercial real estate as an asset class. Historically, 70% of the total returns from commercial real estate, according to the NCREIF Index, have come in the form of income rather than capital appreciation.

Over the last 20 years, the annual income returns generated from investing in commercial real estate have been more than 2.5 times higher than stocks and lagged bonds by only 50 basis points.

HISTORICAL YIELD COMPARISON (1997–2017)

Inflation Hedge

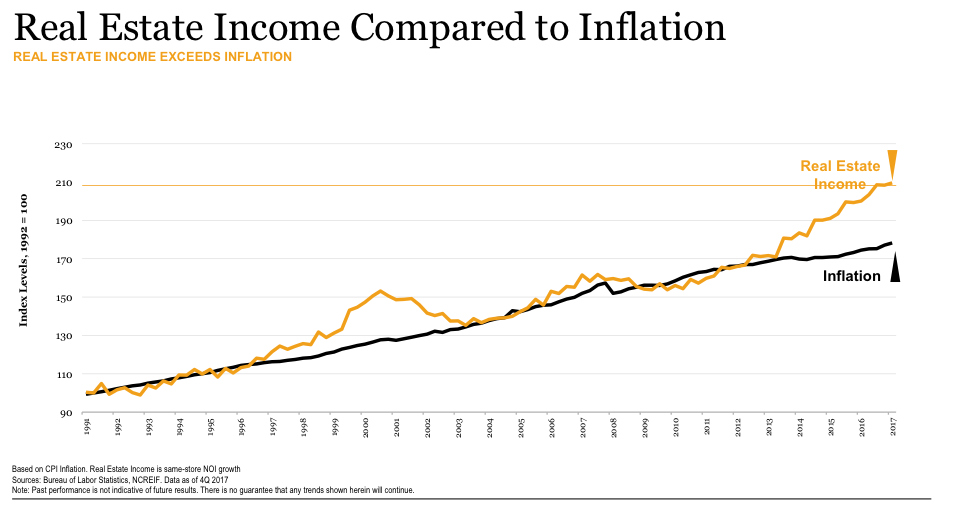

Real estate income over the last 25 years has increased at nearly the same average annual rate as inflation (2.92% vs. 2.31%). In contrast, bonds are a “fixed income” investment, which means the income they generate does not increase with inflation, exposing the investor to the risk that inflation will erode the value of future interest payments.

Similarly, principal payments do not grow at maturity, whereas real estate may appreciate over time, especially during periods of high inflation.

Conclusion

Investing in commercial private real estate is not for everyone. Generally, to invest in private real estate one should be an accredited investor, which means a minimum net worth of $1 million excluding the value of the primary residence or have an annual income of at least $200,000 over the last two years.

Another thing to keep in mind when allocating to private real estate is the fact that it’s typically illiquid, which means an investor’s capital may take months or years to unlock. So real estate is not an ideal investment for those who need capital in the short-term for living expenses or college tuitions.

However, the illiquidity of private real estate can be a benefit as it may help stave off knee-jerk reactions during a market sell-off. The ideal allocation to private real estate depends on each individual investor’s situation, which is a combination of their net worth, time horizon and short and long-term goals.

Have you considered utilizing private real estate investments to diversify your portolio?

This is a guest post is from the principals of one of our recommended financial advisors, Integrity Wealth Solutions. Integrity Wealth Solutions is a flat fee wealth management firm that specializes in asset management and financial planning. They have extensive knowledge in how to integrate real estate investments into your portfolio.

Disclaimer: The topic presented in this article is provided as general information and for educational purposes. It is not a substitute for professional advice. Accordingly, before taking action, consult with your team of professionals.