Are Real Estate Investments Resistant to Inflation?

This post may contain links from our sponsors. We provide you with accurate, reliable information. Learn more about how we make money and select our advertising partners.

One of the common phrases heard in real estate circles is that investing in real estate is inflation-proof.

I thought I’d take a look at why that might be.

First of all, what exactly is inflation?

Inflation is simply the rate at which the price of goods and services rises over a period of time. This can be detrimental for you, as the value, or purchasing power, of your money, diminishes.In other words, if you could once buy bread for $2, it might now cost $2.50. If milk was $3, it might now cost $3.50.

Your dollar’s purchasing power diminishes over time. Does anyone remember when you could buy a soda for 50 cents?

In essence, although the number on the bill in your wallet hasn’t changed, it’s losing value just sitting there.

Why does inflation happen?

I have to start out by admitting that I am not an economist. I took a few courses on macro and microeconomics in college, but I am in no way an expert on the subject.

One big thing I do remember from back then is the concept of supply and demand. This is one of the most fundamental concepts of economics, and the main governing force behind pricing.

Supply and demand are linked and when one outpaces the other, there is a change in the economics or the pricing of a product or service tends to shift. This can ultimately lead to inflation.

To dig into it a bit, the most common reason for inflation is what economists refer to as “demand-pull inflation”. It occurs when demand outpaces supply. This leads to a willingness of buyers to pay higher prices for a highly desired product or service.

For example, imagine the scenario where the demand for a certain car is through the roof (maybe due to awesome new technology at a good price), but there’s not enough made for everyone to have one. People who really wanted the car might then be willing to pay even more to get their hands on it. You had better believe the car manufacturer will figure out a way to increase the price of it to meet that demand!

There’s also something called ‘cost-push inflation’ that occurs when demand remains the same, but the supply diminishes. An example of this is whenever there has been a shortage of oil, gas prices in this country skyrocket.

People also debate whether an increase in the printing of money causes inflation. The thought is that as you release more paper bills into circulation, the value of each of them decreases.

There have definitely been times in history when certain countries have tried printing money to revive their economy, and the result has been something called ‘hyperinflation,’ where the value of the currency plummets.

How is inflation measured?

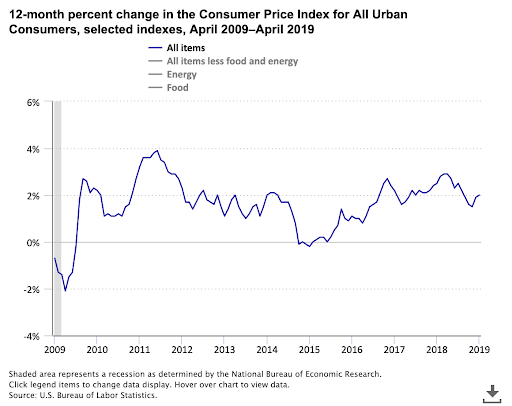

Inflation isn’t completely static. Every year it’s different, but over the last 100 years, it’s averaged a bit over 3% per year. In the last decade though, it’s averaged a bit over 2%.

So how is it most commonly measured?

Well, the US Bureau of Labor Statistics uses a metric called Consumer Price Index (CPI) to track it. It is the measure of the average change in the prices paid by consumers over time for a basket of goods and services.

These things include tracking prices of food, transportation, or health care, to name a few.

Is inflation always a bad thing?

Well, Ronald Reagan once spoke these words, “Inflation is as violent as a mugger, as frightening as an armed robber, and as deadly as a hit man.” Makes it seem like inflation is a pretty nasty character.

However, economists say that some inflation is not necessarily a bad thing because it forces people to not just hoard their cash. If the value of it is diminishing, people will put that cash to use. It encourages some spending and investments and that helps to grow the economy.

Who controls inflation?

Well in this country, it’s the Federal Reserve that controls inflation.

“The central focus of what we are doing at the Fed is to keep inflation from accelerating – and preferably decelerating.” – Alan Greenspan

Without getting into the weeds, they use monetary policy to control inflation, prevent deflation, and try to help promote a stable economy.

Why is real estate inflation resistant?

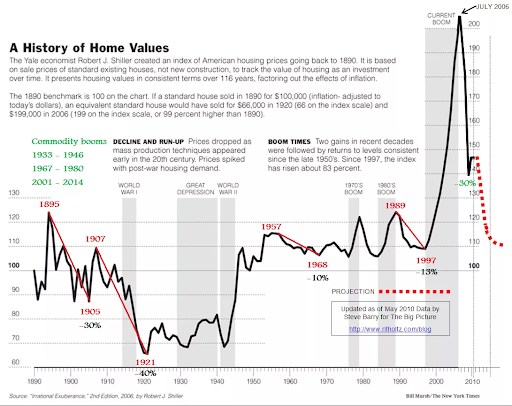

Different economists, like Shiller, have tracked housing prices as an investment over time:

Through his studies and countless others, they've shown that housing prices over the last 120 years have followed the rise of inflation if not exceeded it.

That's because, along with many other products (like bread and milk) mentioned before, housing isn’t a luxury, it’s a necessity. So people will spend money on housing. And just like the prices for those products will rise over time, so will the cost of housing.

We all know that appreciation of the value of a real estate investment is only one-way real estate investors make money. They also make money through monthly cash flow. This is calculated by taking the income (rent) minus expenses.

Well, as inflation and the cost of goods goes up, so do wages to match. As wages increase, so does the cost of the rent. So as a property owner, you're able to increase rents to fall in line with inflation. That's part of the reason if you've been a renter, the cost of rent seems to increase at least 3% each year.

If you took out a loan to purchase your home or a rental property, there's a decent chance you used a loan at a fixed rate. If so, the appreciation of your house value may be increasing in line with inflation, however, your fixed-rate payments will stay the same. You might be making a monthly payment of $5000 for 30 years, but in those later years, that $5000 that you're still paying is actually worth less as a result of inflation.

So as you can see, there are multiple reasons why real estate can provide a reliable hedge against inflation, and another added benefit of investing in real estate.

Any other reasons that real estate is inflation resistant? What other things are inflation resistant?

Disclaimer: The topic presented in this article is provided as general information and for educational purposes. It is not a substitute for professional advice. Accordingly, before taking action, consult with your team of professionals.