How I Lost Over $100,000 on a Hot Stock Tip

This post may contain links from our sponsors. We provide you with accurate, reliable information. Learn more about how we make money and select our advertising partners.

When it comes to picking stocks, there is no shortage of advice. Perhaps one of your friends or colleagues has said something like, “you have to buy this stock, it’s gonna skyrocket!” Or maybe an industry expert calls a certain stock a “STRONG BUY.” Then, of course, there’s the attention grabber: Invest now! This stock is going to be the next Amazon (or Netflix)!

This time of year, I bet you've seen posts on major financial sites telling you the hot stocks for the year. It seems like everyone has the answer for quick glory. However, how often do you follow up to see how well those hot stocks actually performed?

Well, not too long ago, I got caught up in following one of those hot stock tips. As you might have guessed from the title of this post, it was a bumpy ride.

My Roth IRA and Where It All Went Wrong

Back in 2001, someone recommended a book to me called “Greed is Good,” the title based on the iconic saying by Gordon Gekko in the 1987 movie Wall Street. Contrary to the title, the book wasn’t about making all the money you can. Rather, it was about sensible investing and about avoiding spending money on things that don’t provide value, leaving more money for the important stuff in life. This made a pretty deep impact on me.

I was in medical school at the time, and I’d been doing some side hustles and making a little money. I opened a Roth IRA and began contributing to it a little bit at a time – all in all, I was beginning to be more financially savvy.

I began by investing in mutual funds, but then I realized that if I purchase the right hot stocks and they grow to be worth millions, I could withdraw those profits completely tax-free when I’m 59.5 years old. I told you, I’m a gambler at heart.

So, I began to search for the stocks that would make me a millionaire and began trading regularly. I started to follow certain “experts” in the field, and it was somewhat of a fun game for me. I made some money, and I lost some money, but overall the portfolio surprisingly grew.

However, once I hit residency a few years later, I read about the concept of “buy and hold” – where you would just buy stocks and simply hold them, avoiding racking up transaction fees and letting them grow over time. By then I began to realize that the odds of me “beating the market” were slim, and I was getting too busy to keep up with the day trading.

So, I decided to stick to nine stocks based on what was doing well for me at the time, and I told myself that I wouldn’t sell them and only buy and hold them.

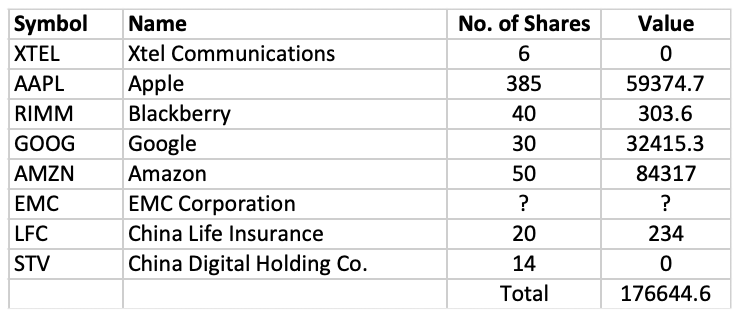

In September of 2007, I had a portfolio made up of the following stocks:

For seven months, everything went according to plan. Life got busier and I almost forgot I had this account.

Then, in April of 2008, someone came to me with the “hot stock tip of the year.” He told me that investing in Potash mining was the next big thing. What’s Potash, you ask? Well, it's a potassium-rich salt that is mined and often used in fertilizers.

Apparently, the Saskatchewan province in Canada was a hotbed of Potash activity as well as a few areas in the US, and that smart money was investing in it. In fact, I needed to get in now before everyone heard about it. Where did he hear that information? As it turns out, he received that info from someone in his investment group, who had heard it from someone else.

He then took it a step further and said I should sell all my other stocks and purchase stocks focused on this industry.

You might have guessed where this is going. I began to dream of millions of dollars and he seemed so sure that I gave him full access to my account and said go for it without doing any further due diligence myself. Why did I do that? Why would I trust him with full access to my accounts?

Well, because he was my own father.

He proceeded to sell all of my holdings and bought these two stocks: POT and IPI. It seemed to be working because POT jumped from $176 to $220 in just two months. What a great tip! IPI climbed 10% as well. I was crushing it.

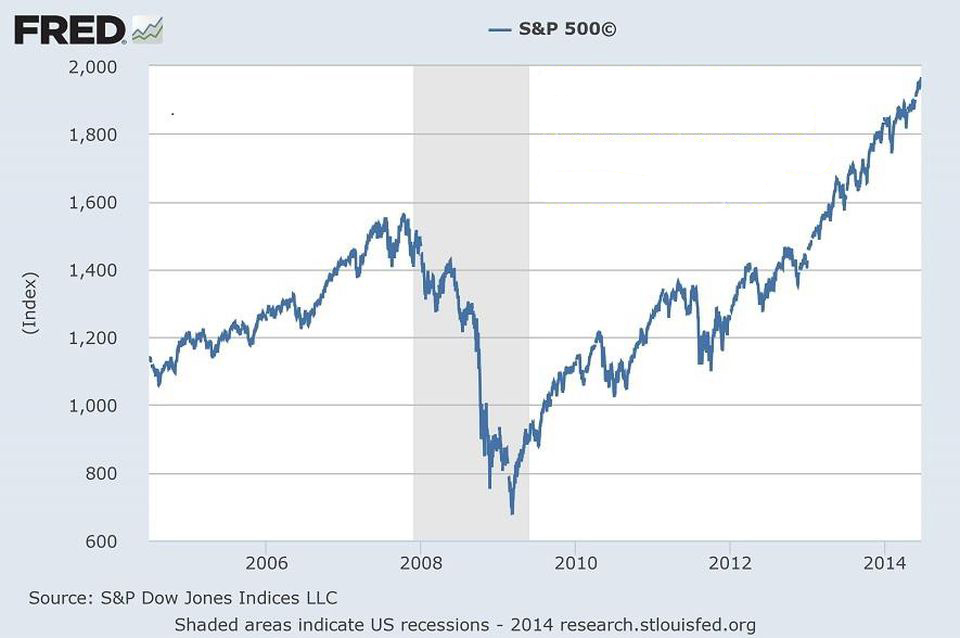

Then came the end of 2008, and everything was in free fall. Along with the rest of the country, I watched stock prices plummet.

Not wanting to sell and panic, I waited, watched, and waited some more. My Roth IRA account lost nearly 75% of its value over a few months. I couldn’t take it anymore. I wanted badly to get out of Potash. So, in March of 2009, I sold it all, locking in those glorious losses. I truly thought if I held on a bit longer, the companies were going to go out of business and I would lose everything.

Defeated, I sat on the cash for a while, a decent while. I was so gun-shy that I didn’t even want to contribute to my Roth IRA anymore. Eventually, a year or two later, I decided to buy back some of the stocks I previously held – AAPL, GOOG, etc. Of course, by now, my account wasn’t worth very much.

Through Google finance, I had a portfolio tracker that still had my old stocks in it. The value was multiple of what I currently had. It was a constant reminder of what could have been. Every time I looked at it, this feeling of regret would resurface, so I deleted it and never looked at what that value would’ve been–that is, until today when writing this article.

So for your enjoyment, here is what my portfolio would have been like today after stock splits. (EMC was bought by Dell and I have no idea what it would be valued or how many shares it would be.)

The total value using today's valuation would’ve been $176,644.60, which is not too bad for a Roth where I only made a few contributions and the limits were $3,000-$4,000 during those years. Those returns would have been amazing–and tax-free on exit once I hit age 59.5. I would've had 18 more years to grow this portfolio.

So back to reality, today it is nowhere near that value. In fact, it's more than $100,000 less. I’ve made contributions since and even taken advantage of the Backdoor Roth contribution.

What If I Had Kept POT & IPI?

This was a little harder to track because POT merged with another company to form Nutrien (NTR) in 2018 and stocks were allocated in different proportions. But taking into account what I think that value would be and IPI's current stock value, my best guess is that the portfolio value would've been ~$2,500 today. I'm glad I at least sold when I did.

Thinking Glass Half Full

I like to think that although I “lost” a significant amount of money, I gained something much more valuable, lessons in finance and behavior. Of course, it would’ve been nice to have learned that lesson and still have that cash, but that’s life.

So what did I learn for myself?

- I’m still a gambler at heart and need to be conscious of that when making big decisions

- I should never let my family manage my finances

- I should never blindly follow a hot stock tip

- I shouldn't keep thinking about the money I could’ve had or lost. It's too stressful. I need to move on, which is exactly what I’m going to do (right after this post is finished!)

I’ve told this story before, and people usually ask if I’m upset at my father. In full honesty, of course, I was a little upset as I watched things unfold. However, the thing was, the overall market was doing poorly as well. And I was the one that said yes. Who knows, if I hadn’t followed his tip, it might’ve been a tip from someone else. The chances of me keeping this exact portfolio this entire time were quite slim.

In the clarity of hindsight, I know that I should have kept my stocks (obviously). However, perhaps I could have invested in diversified index funds. Maybe I was someone who would’ve done better to have a financial advisor during residency. Or perhaps, if they had robo-advisors at that time, I would’ve done better with those.

Whatever could have been, I’m grateful for the lesson. Still, it would have been better to learn that lesson from someone else’s mistake, which is what I hope this post does for you.

Have you ever followed a hot stock tip and how did that work out for you?

Disclaimer: The topic presented in this article is provided as general information and for educational purposes. It is not a substitute for professional advice. Accordingly, before taking action, consult with your team of professionals.