Investing in Opportunity Zones: What’s This Amazing Opportunity All About?

This post may contain links from our sponsors. We provide you with accurate, reliable information. Learn more about how we make money and select our advertising partners.

If you've been thinking about real estate investing, I'll bet that you've heard a lot about the tax benefits. Well, there's a recent benefit that has come to light that might allow you significantly minimize capital gains taxes on existing and future opportunities, while feeling like you're doing some social good at the same time.

This is thanks to a state and federal partnership that provides tax incentives for investing in what's called “Opportunity Zones.”

What are Opportunity Zones?

Opportunity zones are areas where the local government is hoping to promote economic growth. These areas are typically distressed due to closed industries, demographic changes, or other economic conditions.

With the assistance of local officials, each state's governor selects census tracts to be included in an opportunity zone. The United States Treasury Department then certifies these zones for inclusion in a federal tax incentive program.

Again the goal of designated opportunity zones is to bring new businesses and development into these areas. This might be through new construction or through renovating existing buildings. It might also be through the creation of new businesses that serve that particular area.

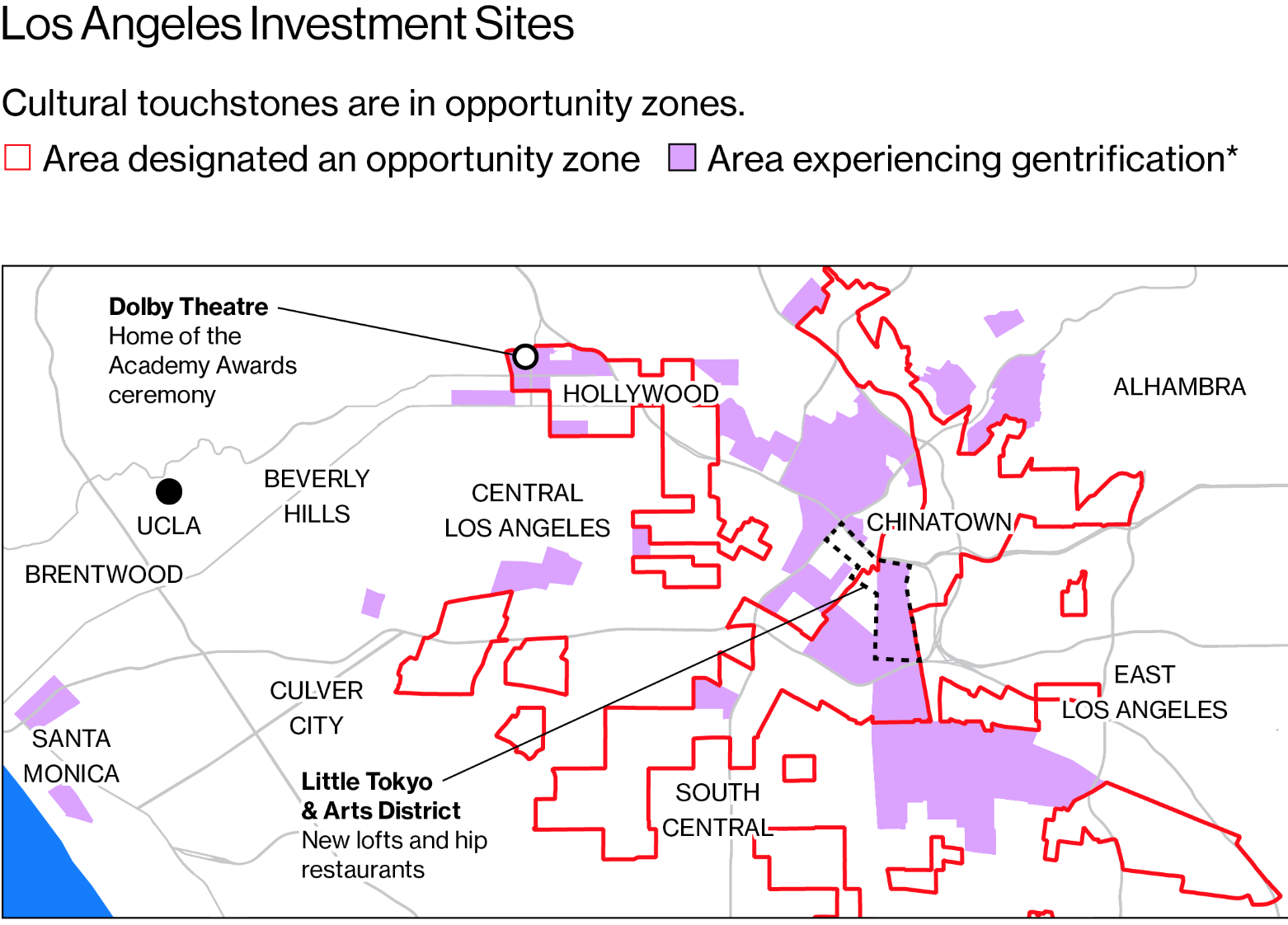

Here's an example of currently designated opportunity zones in Los Angeles.

Why Invest in Opportunity Zones?

Opportunity zones are a way to invest in areas that need an influx of attention and redevelopment. Because of the government's involvement in trying to grow the entire area, those investing in opportunity zones will have government backing through policy and dollars. It might make you feel good knowing you're helping to build a distressed community.

To entice investor participation in the project, the government has also thrown in significant tax incentives to seriously sweeten the deal. These tax incentives were part of the Tax Cuts and Jobs Act of 2017, effective beginning in 2018.

What are the Tax Incentives?

These tax incentives were created to encourage investors who have unrealized gains in their portfolio to “unlock” those profits and minimize the capital gains tax impact at the same time. This applies to a wide array of asset classes including real estate, public securities like stocks and bonds, and businesses.

There are three major tax incentives for participating in an opportunity zone.

1) Deferral of Capital Gains on Prior Investments

If you sell a property or an asset like a stock for a taxable gain and reinvest the proceeds into an opportunity zone within 180 days of the sale, you do not pay capital gains tax on those proceeds at the time of the transaction. Instead, the tax is deferred until you sell your investment in the opportunity zone or December 31, 2026, whichever comes first.

Example

Jim purchased $100,000 of XYZ stock 20 years ago and it has increased to $600,000 in value ($100k initial investment + $500k profit). He would like to sell all of his holdings but is looking for a way to minimize his tax burden.

So Jim decides to invest in an Opportunity Zone fund. He sells the stock and gets to take back $100,000 (his original investment and therefore not taxed). He also has a gain of $500,000 and invests it into an Opportunity Zone fund. He can now defer what he would've paid in taxes on that $500,000 profit until potentially as far as 2026, while that money is put to use. If he invested at the time of this article, that could be 8 years of tax deferral.

2) Reduction of Capital Gains

There's an additional tax benefit where you might also be able to reduce the taxes owed on those deferred gains depending on how long you stay in the opportunity zone investment. Let me explain:

- If you remain in the investment for 5 years, the basis for tax purposes of your original investment is increased by 10%. That simply means that you will only owe taxes on 90% of the amount of rolled-over capital gains you brought into the investment.

- If you hold the investment for 7 years, then the basis increases another 5%. So you will only owe taxes on 85% of the rolled-over gains when you decide to sell or 2026, whichever comes first.

Example

Using the previous scenario, Jim has at this point deferred taxes on his $500,000 gain and kept it in an opportunity zone fund investment.

- If he holds his investment for less than 5 years, he pays capital gains taxes on the full $500,000 when he exits the investment.

- If Jim holds the investment for at least 5 years, he pays capital gains tax on 90% of the original investment amount. So he only pays taxes on $450,000 (= $500,000 x 90%)

- If he holds it for at least 7 years, he'll pay capital gains tax on 85% of the original amount, or $425,000 (= $500,000 x 85%).

- You can see how this can add up to a significant amount.

3) No Tax on Investments Greater Than 10 Years

The third and possibly best benefit is that if you hold your investment in an opportunity zone fund for at least 10 years, the tax basis of the property becomes equal to the selling price. In plain English, this means that you would not have to pay taxes at all on the gains of your investment in the opportunity zone…. NONE.

Of note, this only applies to the amount of deferred gain that you've reinvested into the opportunity zone. Any “fresh money” that you bring into the deal would be taxed at a normal capital gains tax rate.

Example

Jim invested $500,000 of rolled over gains into an Opportunity Fund Zone in 2018. He doesn't have to pay taxes on these gains until 2026 at which point he pays taxes on $425,000 (instead of the original $500,000) because of the 15% reduction.

By year 10, his $500,000 investment has doubled to $1 million. He exits the fund and does not have to pay a single cent of capital gains tax on that additional $500,000 of profit.

How to Invest in Opportunity Zones

Sounds like a pretty amazing opportunity, doesn't it? Well, it did to me. So I looked into how to actually invest in these opportunity zones. In short, opportunity zone investments must be in the form of funds that qualify under Treasury and IRS rules. You can invest with professionally created funds or you could create your own.

It seems like there's a mad dash to create these funds because there is only so much real estate in these zones and based on the timeline of tax benefits, it makes sense for investors to jump into these things earlier rather than later to capture all of the available tax benefits.

These funds act like traditional real estate funds but invest entirely into properties located within opportunity zones. This gives you a passive way to receive the growth opportunities and tax benefits of investing in an opportunity zone.

In fact, I'm starting to see these funds pop up in many different places including some of the more popular real estate crowdfunding sites like EquityMultiple and Fundrise.

Am I Personally Going to Invest in an Opportunity Fund?

I'm definitely looking into the various opportunities. As I mentioned, in order to capture the full tax benefit, I currently have taxable stock accounts that have benefitted from gains over the last few years. This may be a great play for deferring those gains. It's impossible for me to know whether we're at a peak in the stock market, but the tax benefits seem tremendous.

Would I sell some of my current property to invest in this fund? I definitely won't be selling my apartment building for it. I might consider selling a single family if it appreciated enough to make it worth it.

I'd have to consider a 1031 exchange at the same time and see what made more sense. However, these opportunity funds are quite passive so the appeal is definitely there, plus all of the tax benefits.

Again, there are many opportunity zone funds out there, and I have to go through the same process that I do when I vet syndication or real estate funds. I'll let you know if and when I do decide to invest in one.

Is an Opportunity Fund Right for You?

As you can see, investing in opportunity zones can allow you to reap the rewards of traditional real estate investing along with substantial tax benefits. To decide if an opportunity fund has a place in your diversified portfolio, carefully review the fund's prospectus and consider talking to your tax and financial advisers.

There are other options for tax deferral including 1031 exchanges and some charitable trusts. Deciding which option works out best may require some calculations and discussion with your CPA.

Had you heard of opportunity zones before and do the tax benefits seem compelling to you? Find Passive Income Docs on Facebook and share your insight.

Disclaimer: The topic presented in this article is provided as general information and for educational purposes. It is not a substitute for professional advice. Accordingly, before taking action, consult with your team of professionals.