How to Vet a Real Estate Fund: Case Study (MLG Capital) Part 1

This post may contain links from our sponsors. We provide you with accurate, reliable information. Learn more about how we make money and select our advertising partners.

Real estate funds are a great way to invest passively in real estate, but are they the Holy Grail of real estate investing? Well, I'll leave that for you to decide.

Personally, I've made the decision to invest in real estate funds as part of my larger diversification strategy. As I recently shared with my newsletter subscribers, the income that this blog has produced has been awesome. Staying true to form, I'm using that capital to try and create more passive income for years to come.

So I've been asked, how do you go about vetting a real estate fund? Well, the process sounds simple: I ask them a series of questions, take note of their answers, and verify that what they say is true. However, it takes time to learn how to do it well, and to be honest, I still feel I have so much to learn. My hope is that you'll start to get comfortable with the questions you need to ask and how to evaluate the answers they give you as you follow along this journey with me.

For that to happen, I figured it was best to do a case study of a real-life situation. I'm currently vetting MLG Fund III (MLG is a current sponsor of this website). I've already had a phone conversation with their team about their fund but I made them write down their answers as well. Pain for them, win for PIMD readers.

Part 1 in this series deals with vetting the operator (MLG Capital) and what their core values and objectives are when putting together a fund. Part 2 is about vetting the specific fund in question. My thoughts are in [red].

What has made MLG and your previous funds successful and how do you expect to remain successful in the future?

MLG Capital can attribute its previous and hopeful, future success to four primary attributes: experience, discipline, innovation, and people.

Experience

Founded in 1987, MLG has invested in (88) assets, totaling approximately $1.4B of real estate throughout the United States. In addition to transactional experience, (31) years of investing experience as a company provides a unique lens into our investment criteria. Although no one can truly time the market and much of our recent success can be attributed to the appreciation of the overall real estate market, considerable discretion is applied to every investment.

Experiencing, navigating, and weathering the Savings & Loan Crisis, Dot Com Bubble, and Great Financial Crisis (~2008), we are uniquely positioned as a company to draw on lessons learned from the past three largest economic corrections in modern history to appropriately prepare and mitigate as much exposure as possible for future corrections.

[I love hearing that they've been through multiple up and down cycles. Makes me feel more confident that they've been tested and know how to weather the storms. I have invested with plenty of companies that have started doing their first deals in the last 8-9 years, after the Great Recession of 2008 (not that there's anything wrong with that), but to be honest, everyone looks like a genius with housing prices swinging up like they did and with the economy improving year on year.]

Discipline

In addition to experience, we deploy strict discipline and vetting to every investment. This discipline works in concert with our experience. We want to target the right areas to invest in and always ensure we’re making prudent decisions relative to school systems, crime, home values, household incomes, population growth, job growth and several other metrics we believe will thrive in growing markets and are sustainable in softening or troubled markets.

This discipline not only relates to demographic data but also our underwriting. We heavily scrutinize recent sales and lease comparables to determine how well we’re positioned within the submarket and overarching MSA. Our overall goals include tax-advantaged income, capital appreciation, and wealth preservation. To achieve these goals, we must thoroughly understand our assets and the markets in which they reside.

[It's good to hear that they value discipline but the proof is in the pudding. In order to properly vet whether they are in fact disciplined with their investments, I'll have to take a look at their prior investments and performance as well as the holdings that are already part of the portfolio of their current open fund.]

Innovation

We didn’t always have a fund. We were originally like most real estate groups – syndicators. We’d find an opportunity we liked, put it under contract, raise the equity, close the deal, and when it was time to sell – dispose of the asset. However, coming out of the Great Financial Crisis of 2008, we realized a major void in our investment offering, a void that still exists in the market today – diversification.

With syndication deals, an investor’s risk is siloed in that one deal, that one product type, and that one submarket. Our commitment to innovation led to the creation of a diversified fund structure offering our investors diversification through multiple deals, multiple product types, and multiple markets throughout the country.

Along with innovation via the fund creation, another major obstacle stood in our way: how do we thoughtfully achieve geographic diversification? When reviewing our third fund, we own assets in Colorado, Minnesota, Arizona, and Missouri – yet we don’t possess 30 years of relationships in those markets like we do in Wisconsin, Texas, and Florida. We accomplish this through individuals on the real estate team having an intimate familiarity with the local market. Those individuals will have far more knowledge than any individual or company who’s solely viewing the market through a national lens. There’s more nuance to the nationally produced “market report.”

To overcome this hurdle, we work diligently to travel to our targeted markets, meeting with every local individual who touches real estate – sales brokers, mortgage brokers, operators, property managers, the list goes on. Through these visits, a common theme surfaced. Local real estate operators are great at buying deals but not so great at raising money. That’s where MLG comes in. By proactively meeting with local operators to solve their equity problem, they’re simultaneously solving our geographic diversification obstacle. As a result, we’re now achieving geographic diversification for our investors with the brightest local real estate groups throughout the country. It’s a win-win-win, investors, operators, and MLG.

[Diversification is one of the main reasons I'm interested in investing in a fund. I'm starting to believe that the more diversified I am in the next coming years, the better. This is to mitigate some risk with increasing uncertainty of how the stock and real estate markets will perform.]

People

Lastly, to make this all happen, we need great people working tirelessly for our investors and with our local operators. We believe real estate is based on relationships and growing those relationships. To form and grow those relationships, you need great people.

We have more than 250 employees nationwide and our investment committee has an average tenure of more than 23 years with MLG Capital. Our youngest employee is 22 and our oldest is 76; and they both show up to the office every day. That commitment to MLG, our investors, and nearly one thousand partners throughout the country makes us special. We need seasoned professionals to lend their experience and discipline while also relying on young minds to propose innovative ideas to continually grow and evolve for our investors.

Regarding your previous funds (Funds I & II), have any outside investors ever lost capital?

MLG Capital has never lost an outside investor’s capital investment in a diversified real estate fund.

To repeat, over its 31-year history, MLG Capital has invested in 88 assets, totaling nearly $1.4 billion (i.e. sale prices of assets sold plus an estimated current market value of assets still owned) as of 6/27/18. Prior to the Great Recession of 2008, MLG Capital had never lost an outside investor’s capital investment.

MLG Capital has had 5 assets that lost some investor capital, and only 1 of those deals produced no preferred return nor return of capital. All properties that lost investor capital were purchased before/during the Great Recession and/or had loans that were sold to vulture banks during/after the Great Recession.

Historically, for assets already disposed of (including the deals that lost capital), investments made by MLG Capital have realized an average equity multiple of 2.44x (commercial 2.02x, multifamily 2.8x). For example, for every $1 invested, MLG Capital returned $2.44 before all promotes and income sharing (i.e. combined returns for investors and MLG).

[I appreciate the transparency, and knowing how many people and companies got slaughtered in the Great Recession of 2008, their track record is impressive. They have never lost any investor capital in a fund, but their fund started in 2011 so hard to say whether they've just been the beneficiaries of a good market. That being said, when the next down period does hit, it seems like they will be more prepared than most groups who have not benefitted from experiencing multiple cycles throughout their company history.

I asked for data on their previous investments to verify it all and they supplied the numbers to me directly as a prospective investor. Historical data doesn't guarantee future success, but you can learn a lot from it. You can also request it here.]

Can you explain to me the various fees involved in your funds?

Absolutely. MLG assesses fees at both the fund (equity) level as well as property (asset) level.

At the fund level, we assess a 1.25% asset management fee on INVESTED equity. This differs from many groups as some funds will begin assessing their asset management fee on SUBSCRIBED equity. Therefore, we only assess our fee once you’re accruing your 8% preferred return.

At the property level, we can assess refinance fees, property management fees, construction oversight fees, development fees, and real estate brokerage fees. Lastly, there may be expense reimbursements associated with entity formation, in-house legal, in-house accounting/CPA-review, travel and compensation to third-party agents for the sales of units.

It is critically important to note that all property (asset) level fees are contained within the pro forma of every deal. Therefore, the advertised project-level (gross) IRR (Internal Rate of Return – a way to accurately measure return on investment in an ongoing investment) in every MLG pro forma as well as investor-level (net) IRR in every MLG pro forma is inclusive of these associated fees and expenses reimbursements. Regarding our asset management fee, this is assessed at the fund level and paid via the fund rather than the property.

We believe it’s very important for us to be totally transparent on our fees and expense reimbursements. Should you want to read about our fees and expense reimbursements in greater detail, we highly recommend referencing p. 22 in the MLG Private Fund III Private Placement Memorandum (PPM). Should any further questions exist on individual fees included in the PPM, definitely contact us, we are more than happy to discuss at greater length. As well, groups that have reviewed MLG found us to be fair compared to industry standards.

[So I did go and read p. 22 in their PPM and their fees are all spelled out. They're standard fees as far as funds go and nothing stood out in particular to me. When comparing funds, there might be some slight differences, particularly in asset acquisition fee and property management fee. Would a small fee be a difference maker for me in who I choose? Honestly not for this sort of investment, as I ultimately care about the return after fees, but it's nice to know the fees are in line if not better than some other funds I've looked at.]

Do MLG principals invest in the funds themselves? Do they have any skin in the game?

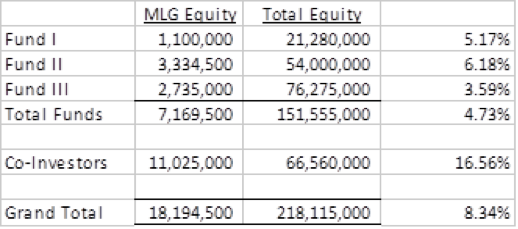

Absolutely. Below is a current breakdown of the to-date (6/27/18) equity contributions of the MLG principals. Although Fund III is currently lagging the 5% principal contribution target, we expect this to increase as fund closing nears.

[Whenever I invest in a fund or a syndication, I always want to see that the principals have some skin in the game. It's nice to know they have something on the line as well which means our interests and goals are more aligned.]

Have there been any criminal proceedings or investigations against MLG Capital, its principals, or key employees?

No.

[You should always ask this and if you have any uncertainty about it, run a background check.]

What are the major risk factors of your Funds and how are you mitigating that risk?

Although we highlight certain controllable risks below, we’d be remiss without strongly, strongly encouraging EVERY prospective investor to read our Private Placement Memorandum (PPM) to understand the full risks of investing in private real estate. (You can ask them directly for their PPM here.)

We must remind all our investors that risk is a critical consideration of any investment. How organizations and operators view and attempt to mitigate risk is what sets them apart. We believe there are four major controllable risks associated with real estate: Siloed Exposure (single asset syndication), Leverage/Debt Strategy, Underwriting Assumptions, and Operational Experience, and they’re all related. Unfortunately, no one can predict timing risks associated with the greater market, however by mitigating controllable risks, an investor can be better positioned to weather an economic downturn.

[I absolutely agree. Risk will always be a part of the equation. However, the major distinguishing factor between an effective vs. poor operator is the way they plan for and handle risk.]

Siloed Exposure (Single Asset Syndication)

Through syndication deals (how most real estate is still transacted) an investor’s risk is siloed in that one deal, asset type and market. Should softening occur within that market or asset type (e.g. Class A multifamily), an investor is highly exposed within that deal.

MLG attempts to mitigate that risk through its fund structure. Using its current fund, Private Fund III, MLG deploys even great measures of diversification. Most obvious is geographic; Fund III is currently diversified in seven states.

When analyzing asset types, Fund III currently owns multifamily, industrial, industrial flex, retail ,and office assets. This is where it gets interesting. Within those asset types, we further diversify by asset class/vintage. Fund III’s asset classes range from B- to A++, with asset construction vintages (ages) ranging from 1970 to 2016. Why? Individuals or companies renting class B- assets versus A+ assets are very different renters, however, demand still exists throughout the classes.

Therefore, although we own in the four major asset classes (providing initial asset type diversification), we further hope to address the demands of multiple tenant bases to further mitigate risk exposure.

[Once again, I'm a huge fan of diversification across asset classes and even tenant profiles. If I had the ability to create that diversification all on my own, I would. Unfortunately, I don't (yet), so the next best thing is to invest in a fund that gives me that diversification. It's kinda like investing in a mutual fund to spread your funds over a larger pool of investments.]

Leverage and Debt Strategy

Leverage and debt strategy is another major risk factor in real estate. Not dissimilar to your home, certain lenders will allow you to borrow up to 80% of the asset value. This follows the old adage, ‘Just because you can, doesn’t mean you should.’

Leverage can make returns look great. But at what cost? Should softening occur within a market, the more you are exposed to a lender, the greater the likelihood of a catastrophic event. In good times, “levering up” seems like a great idea – investors are elated, and operators boast major returns on their websites and in marketing materials. As Warren Buffet once said, “You never know who’s swimming naked until the tide goes out.” That’s leverage and realistic underwriting.

Although MLG targets a 13-15% net (after fees and promotes) return, this return profile is targeted at 65% Loan-to-Cost (LTC). In fact, MLG’s Fund III is legally governed to not exceed an aggregate 70% LTC on our Fund. As of 6/27/18, MLG’s Fund III is at 63% LTC (Fund II: 62% LTC, Fund I: 52% LTC).

[I'm also a fan of using leverage to amplify returns, but smartly. Targeting a 65% LTC is on the more conservative side and something I'm comfortable with.]

Underwriting Assumptions

Typically the most difficult risk factor to identify is Underwriting Assumptions. There’s another adage in the finance world, “We can make any deal work on paper.” That’s terrifying to think about, however with all the technology available to manipulate and financially engineer pro formas, poor and mediocre underwriting is becoming more difficult to identify unless you have a trained eye to look for the tricks. [The more you look at these pro formas, the better you will get at identifying red flags or inconsistencies.]

There are two main ways MLG mitigates this risk to our investors. The first is through our approval processes. Any deal purchased by MLG is subject to a four-level approval process. The deal is first softly underwritten by whoever receives it. If the demographics and high-level metrics check out, the deal is sent to our analyst team to perform a full underwriting. After the full underwriting, if approved by the analyst team, it moves onto an internal pre-committee and vetted by the entire junior MLG team. Should the deal make it out of the pre-committee, it will then finally be presented to our full principal investment committee to make the final investment decision.

The second way we reduce risk is simply by the way we want to share in the profit. This mitigation technique is wildly unique to MLG. We operate within a European Waterfall investment structure. This means that MLG shares in ZERO profit until our investors achieve an 8% return and we return 100% of their original investment. This is the foremost dictator of our low approval process – we want to share in the profit and if we can’t get you an 8% return and return 100% of your original investment, we don’t share in that profit.

[A Waterfall Structure is a commonly used term that tells you how profits are split between investors and operators. It's important to understand this in each PPM you read because it can make an impact on ultimate returns. I really like this particular structure because it makes sure that you as the investor is both paid and made whole on your original investment before they touch the profits. In essence, they're paid last. These are the things to look for and ask about when it comes to profit sharing and compensation.]

Operational Experience

Lastly, operational experience is the final major controllable risk. The primary driver of real estate value is Net Operating Income (NOI) (NOI = Revenue – Operating Expenses). Who directly impacts NOI? The operator. Even the greatest blue-chip assets can enter crisis with a poor operator.

To mitigate this risk, we ensure all our operators can act swiftly to asset crises. This may include a physical property crisis (i.e. flood, fire, etc.) or human capital crisis (i.e. terminations, poaching, etc.). The ability to react and/or anticipate these crises is a critical component to asset performance.

In our direct markets (Wisconsin, Texas & Florida), we self-manage. Given our critical mass in those markets, we are best positioned to respond to issues. In our JV markets, we will ensure our partners either maintain the critical mass to self-manage or we will jointly identify the most-qualified third-party manager in that market. MLG Capital also maintains all operational performance control rights giving us the unilateral authority to remove the operator for poor performance.

[I believe the operator is the largest component of risk. Just like it matters who the person is actually performing the critical parts of the surgery, it is all about who is running and managing these deals. This is why I believe you should spend as much, if not more, time vetting the operators and resist the urge to just jump straight into the details of the deal in front of you.]

Stay tuned for Part 2 where we start vetting the current MLG Fund III offering itself.

Disclaimer: The topic presented in this article is provided as general information and for educational purposes. It is not a substitute for professional advice. Accordingly, before taking action, consult with your team of professionals.