Online Term Life Insurance Quotes: PolicyGenius Versus Term4Sale

This post may contain links from our sponsors. We provide you with accurate, reliable information. Learn more about how we make money and select our advertising partners.

Life insurance is important if you have an income that others rely upon. Get multiple term life insurance quotes from 2 of the most popular online aggregators.

Today’s Classic is republished from Physician on Fire. You can see the original here.

Enjoy!

We recently covered disability insurance and the mistakes that doctors make. Today, I’d like to look at another insurance task that is important for many high-income professionals: getting term life insurance quotes.

This is the good kind of life insurance that exists for one reason. It ensures that anyone relying on your income will be financially secure if you suffer an untimely and early death. There is no investment component. Like home, auto, and umbrella insurance, it’s important coverage to have, and ideally, no claims will be filed.

Term life insurance is not for everyone. If you’re already financially independent, you don’t need it and can drop the coverage. Your family can be considered self-insured. The next time you forget to do that thing you’ve been saying you’d do, you can take comfort in knowing that you’re not worth more dead than alive to anyone.

Also, if there’s no one but you relying on your income, there’s really no good reason to insure against the loss of your income in your absence. You could name your parents, siblings, or nieces and nephews as beneficiaries, but if they’re not counting on you to take care of them, you could forego life insurance altogether.

Many readers of this blog, however, ought to have term life insurance coverage. If you’re the type that prefers a personal touch, reach out to one of our recommended independent agents.

If you would rather do your insurance shopping online, two of the most popular options for instant quotes include PolicyGenius and Term4Sale. I have no relationship with the latter, but PolicyGenius has been a paid advertiser on this site and we have an affiliate relationship, meaning if you work with them after following a link from this site, you’ll be supporting our charitable mission. So thank you for that!

Online Term Life Insurance Quotes: PolicyGenius Versus Term4Sale

Let’s say you’re 30 years old with a negligible net worth but a solid salary and you plan to be financially independent in about 20 years. Spending about $100,000 a year, you’d be FI today with $2.5 Million.

You also understand that in 20 years, you’ll need more than $2.5 Million because inflation will have eroded that purchasing power. So it makes sense to buy a larger policy. You might need closer to $4 Million when you’re 50 to enjoy the same standard of living.

On the other hand, you’ll be making progress towards financial independence with a growing net worth, so the closer you get to age 50, the less the insurance policy has to cover.

You could approach this a couple of ways. One is to split the difference and opt for a $3 Million 20-year term policy. Or go for $4 Million. This stuff is pretty cheap.

Another approach is to ladder multiple policies. You could get a $2 Million 20-year term policy and a second $1 Million or $2 Million 10-year policy.

With the laddered approach, your beneficiaries would receive $3 Million or $4 Million if you were to die in the first decade, and $2 Million plus your life savings if you perish after the first 10-year term policy expires.

Let’s enter these numbers into the quote generators, and see what we come up with. We’ll compare PolicyGenius and Term4Sale for the following policies:

- $3 Million, 20-year term

- $2 Million, 20-year term

- $2 Million, 10-year term

- $1 Million, 10-year term

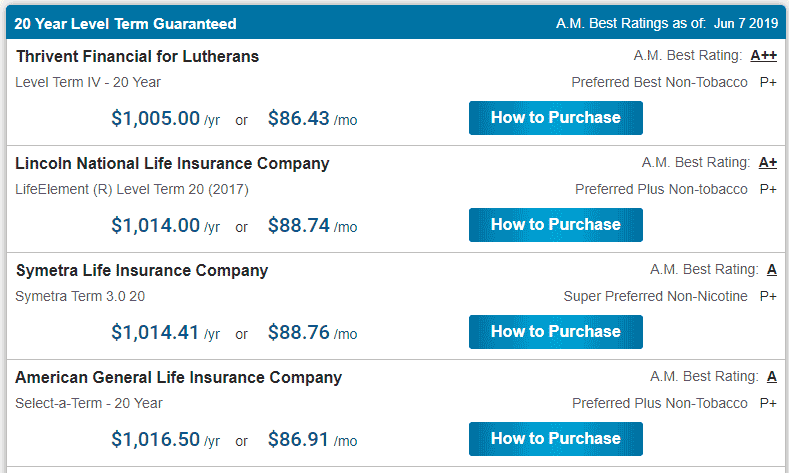

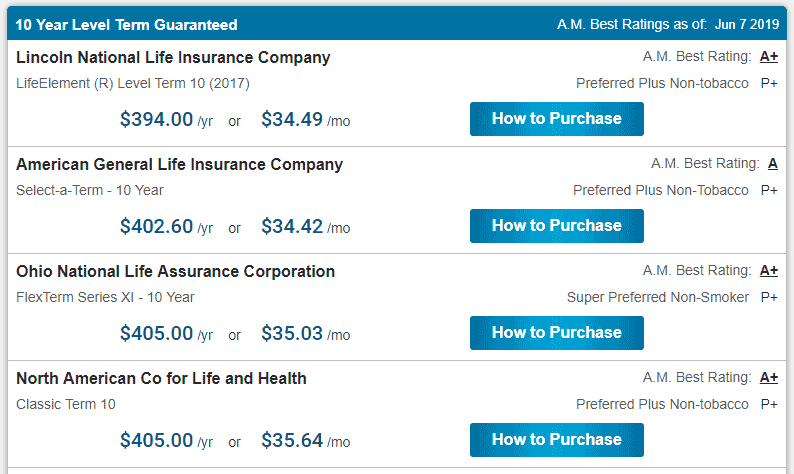

$3 Million, 20-year term

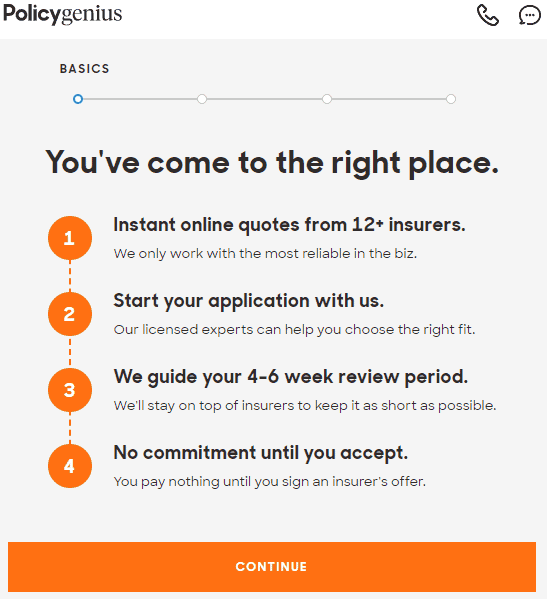

We’ll start with Policy Genius. You’ll be walked through a series of questions before arriving at a page that allows you to quickly change the dollar value or the term length.

First, you’ll be congratulated on coming to the right place and given a rough timeline on what will happen next if you choose to purchase a policy.

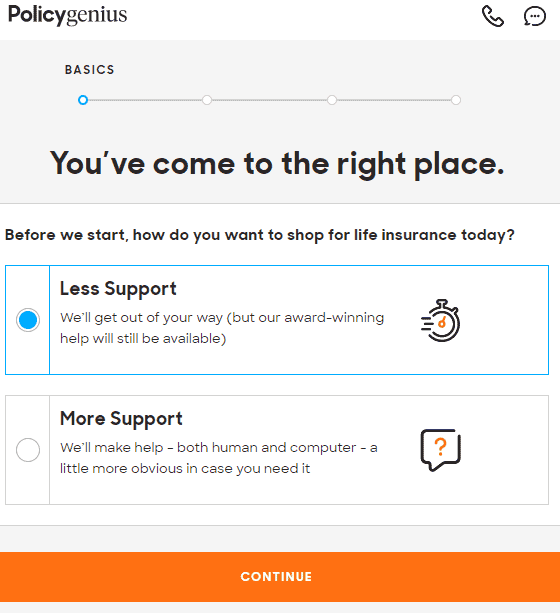

Next, you can choose between a quick, online-only quote, or a little help from a support person. We’re choosing to do this online, so we’ll opt for “Less Support.”

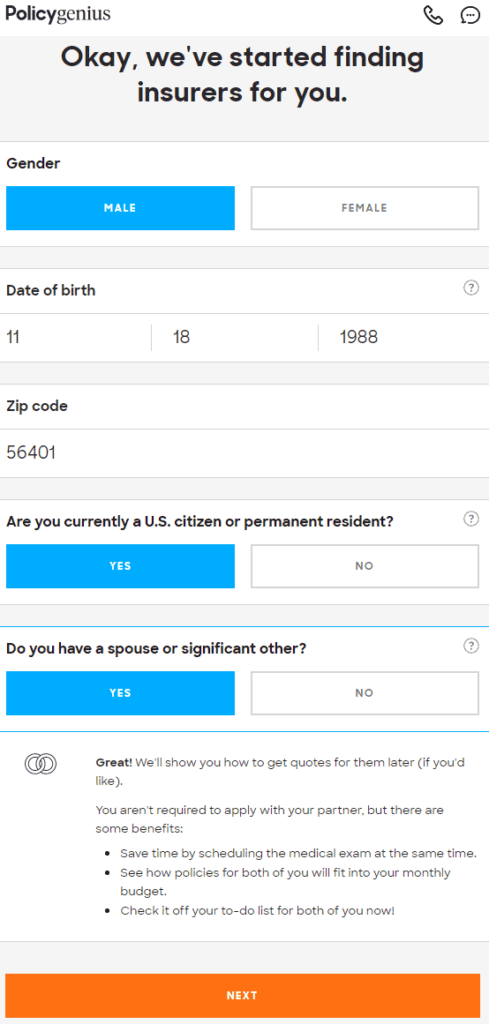

After we continue, select a gender, enter your date of birth (we’re researching a 30-year old today, so I added 13 years to my actual birthdate), and your zip code.

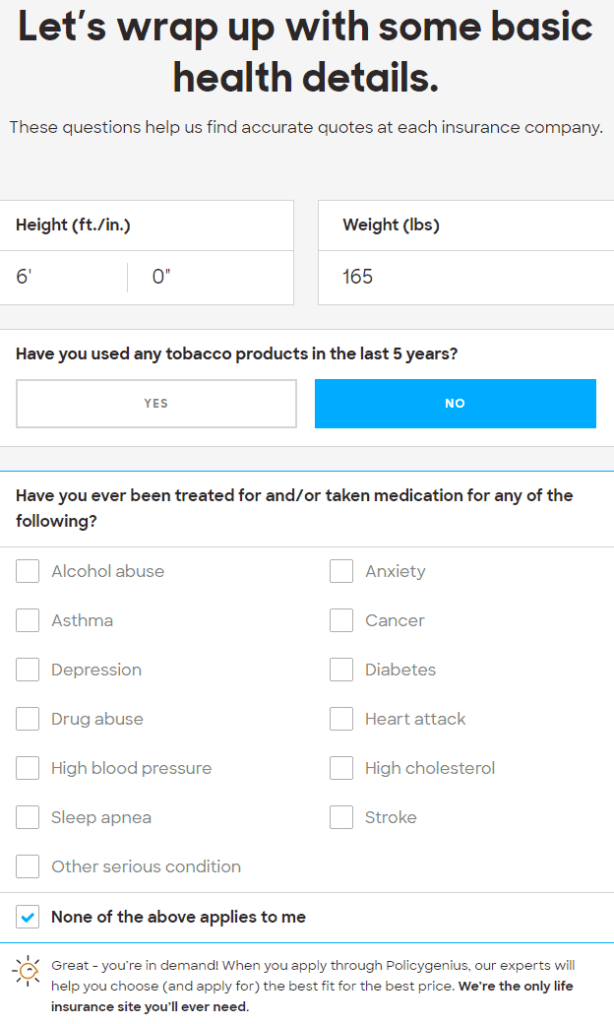

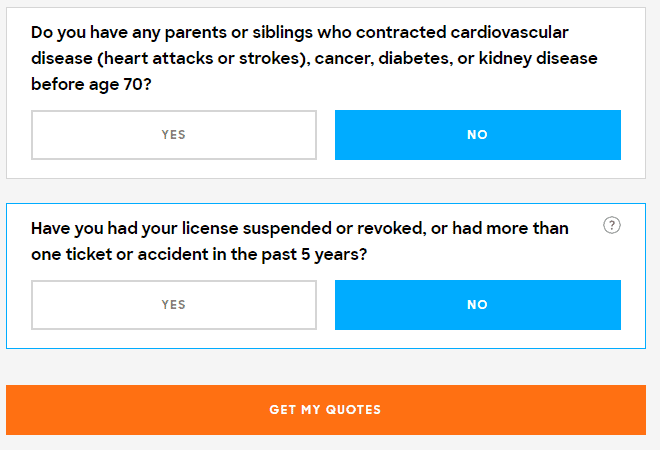

Finally, your rate will depend on your current health, so you’ll be asked to answer a few questions.

Fortunately, I haven’t been treated for any of the above, and I’ve got a normal BMI. I expect I’ll qualify for the lowest rates available. My family’s been pretty healthy, too. Answer two more quick questions, and we’ll get our quotes.

I’m glad they asked about actual traffic tickets I’ve gotten rather than the number of times I’ve been pulled over. #leadfoot

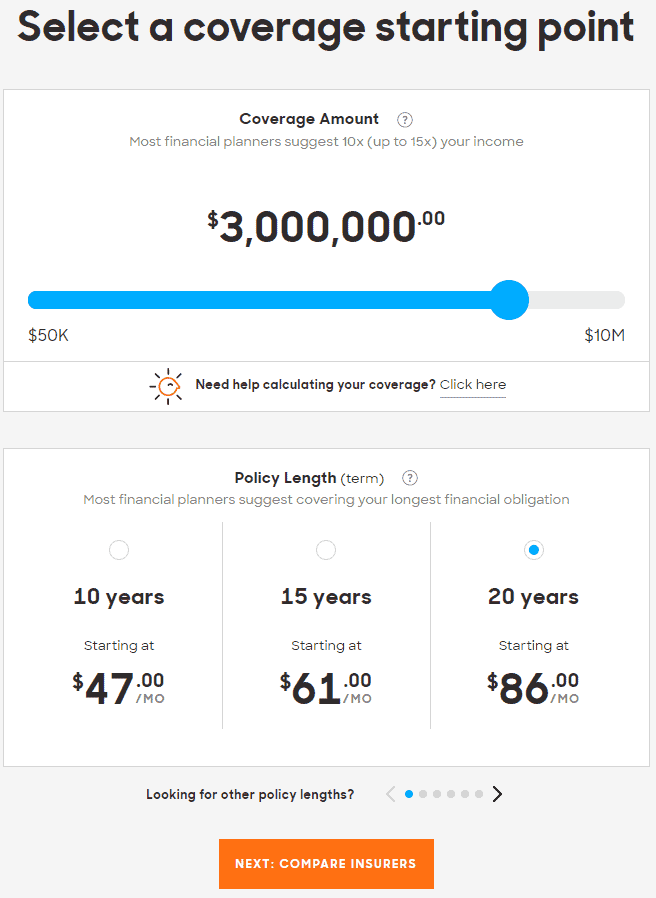

On the next page, I select the value on the slider and choose from among the terms offered. If my desired term length isn’t displayed, others are quickly available via the arrow above the orange button.

I guess they rounded down. $86 a month becomes $86.91, offered by AIG. That seems reasonable for a $3 Million, 20-year term policy. $1,042 a year.

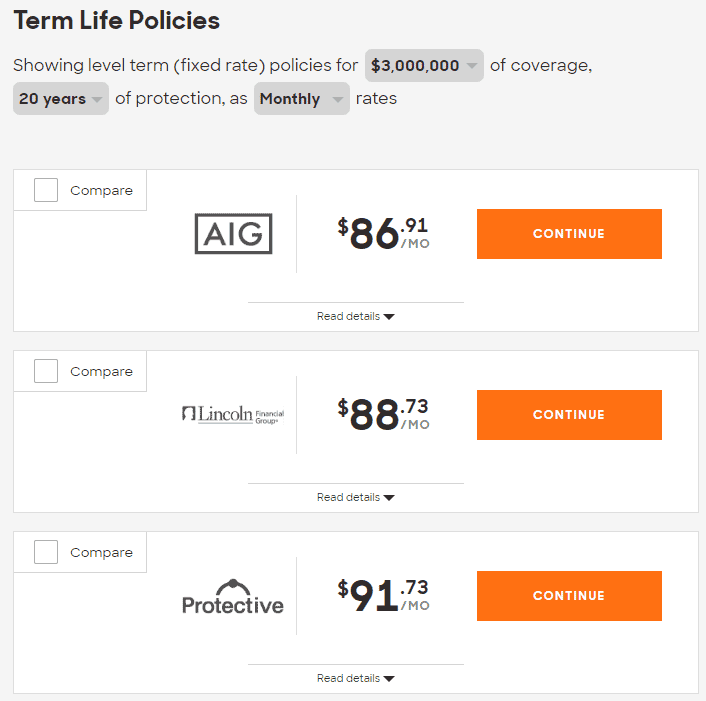

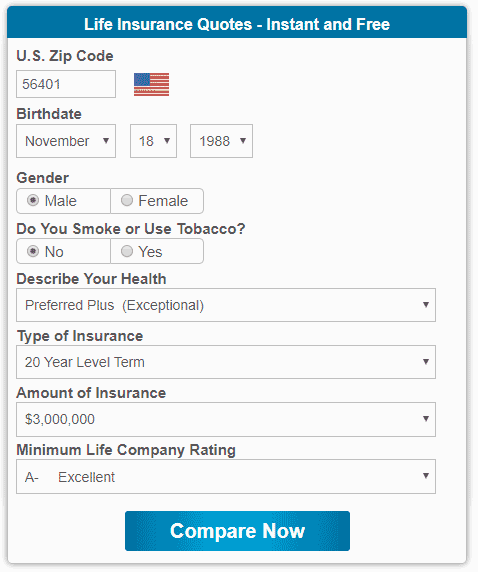

Term4Sale asks fewer health questions and puts everything on the front page. This makes it easier in some ways, but you have to guess whether your health is Average, Above Average, Excellent, or Exceptional.

I chose “Exceptional” as I figure that’s going to give us the lowest rates for comparison. I also noticed that there’s no “Below Average” option. Maybe they don’t want to insure anyone with poor health, or it could be that no one wants to admit to being below average in anything.

With the form filled out, we will hit “Compare Now.”

I’m not Lutheran, but to save 48 cents a month, I could be! You’ll also note that they have the same AIG quote of $86.91 a month.

The two are close enough to be called a tie, but Term4Sale gets the nod here by about 0.5%.

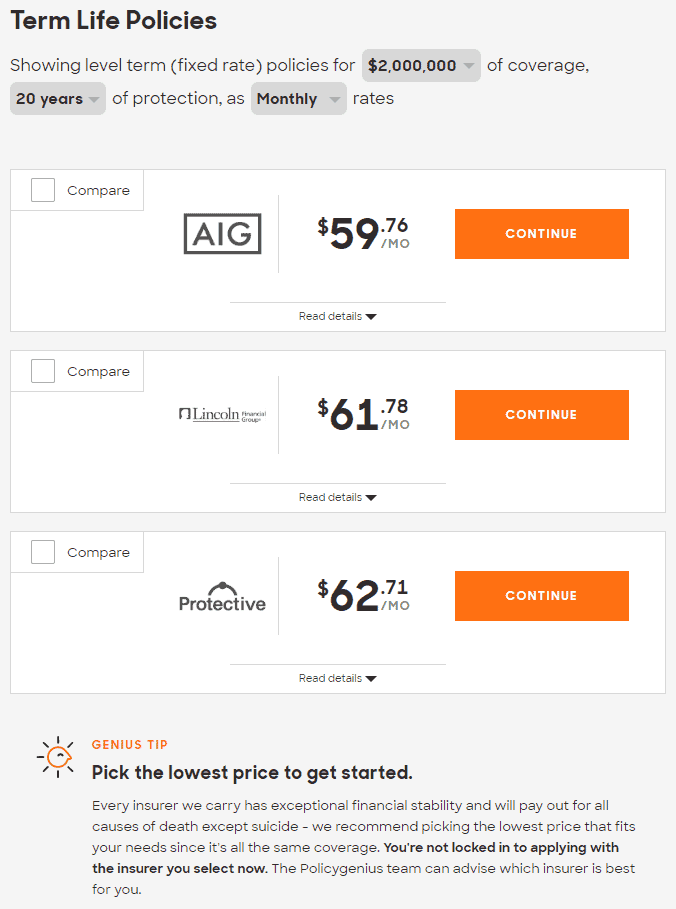

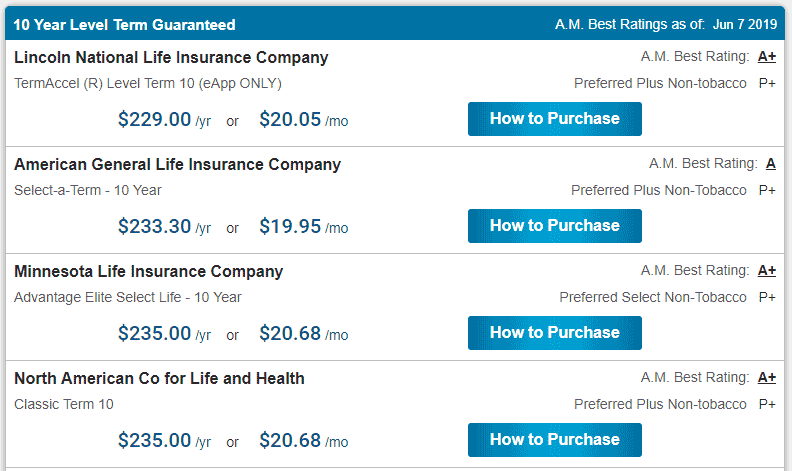

$2 Million, 20-Year Term

If you’re interested in less coverage or laddered coverage, you’ll want to check out a $2 Million policy.

PolicyGenius makes it very easy. Change 1 dropdown box and a new set of rates appear.

At Term4Sale, you’ll click on “Modify Your Quote” which brings you back to the front page where your pre-selected choices remain. Change the value of the policy, click on “Compare Now” and you’re back to a list of quotes.

Once again, AIG offers the best rate at $59.76 and is available on both platforms.

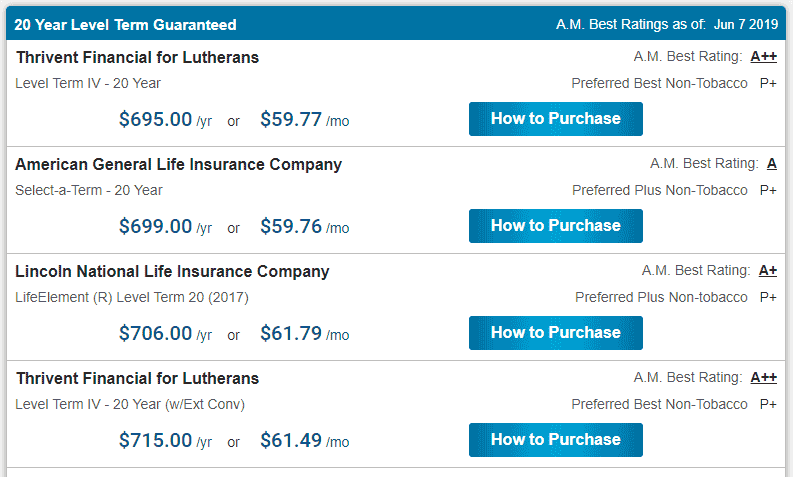

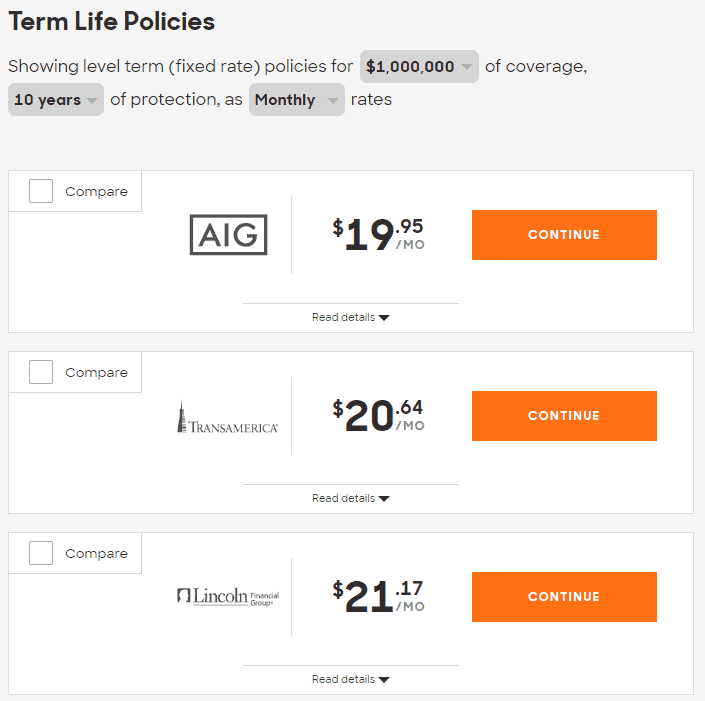

$2 Million, 10-Year Term

If you’re going to progress rapidly to financial independence like I did or would like to ladder multiple policies, you’ll want to look at a 10-year term policy.

When combined with the $2 Million 20-year term policy we just priced out, you’ll have $4 Million in coverage the first 10 years and $2 Million in coverage for the next 10 years.

We’ll start with PolicyGenius and a change of the dropdown box.

Interestingly, the policy costs more than half of the 20-year policy, even though the 20-year policy covers an additional 10 years when you’ll be older (and just a little more likely to kick the bucket). There is clearly a volume discount with term life insurance.

Term4Sale shows the following rates for the same $2 Million, 10-year term policies:

It looks like PolicyGenius will save you two cents a month on the Lincoln policy, but both offer an AIG policy that’s a few cents cheaper.

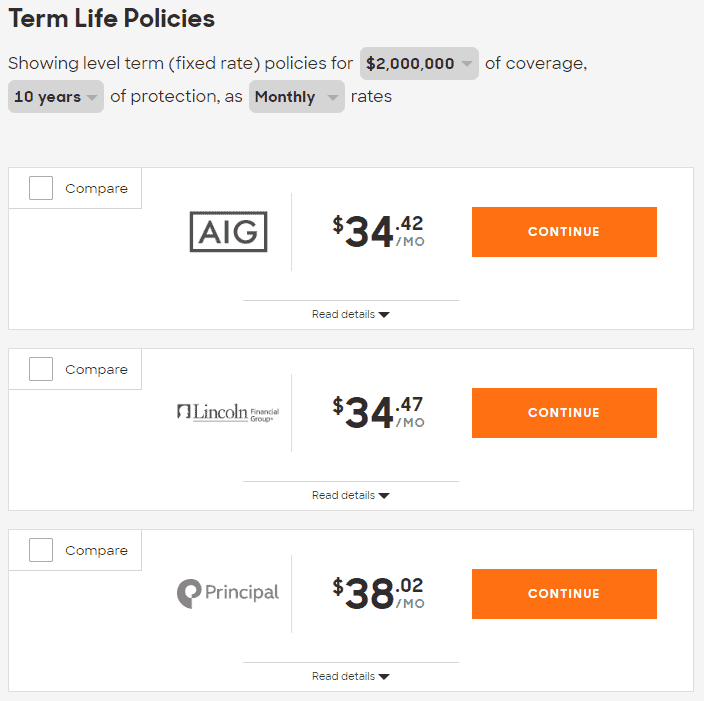

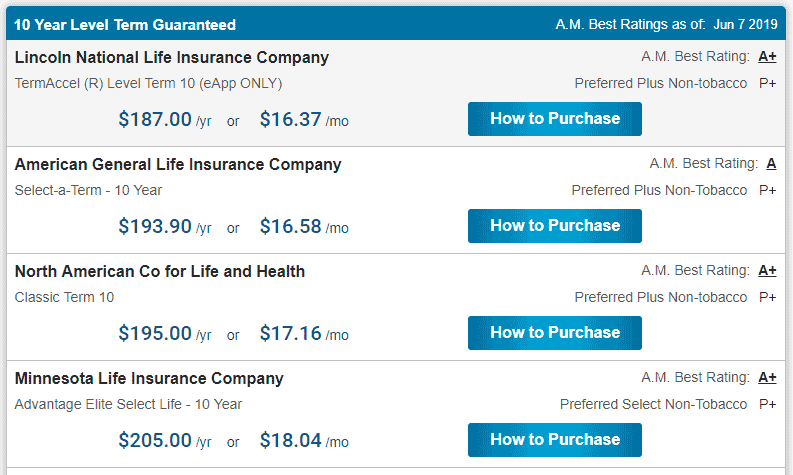

$1 Million, 10-Year Term

If you’re comfortable with $3 Million in coverage those first ten years and $2 Million thereafter, you could ladder the $2 Million, 20-year term policy with a $1 Million, 10-year term policy.

Or you could be like me and underinsure with this as your only policy. Things worked out for me as I’m still alive and kicking, but in hindsight, I should have had a bigger policy.

We’re under $20. Not bad! But still more than half the price of the $2 Million, 10-year term policy. Again, there’s a volume discount for coverage.

Not surprisingly, we see nearly identical numbers from Term4Sale.

If you’re a woman, you may know that disability insurance tends to cost more for your gender, which is why you should look for a unisex policy.

Does the same hold true for term life insurance?

Not at all! In fact, you get the Double X Discount for this stuff. Here’s the same search results with only the gender changed to female.

What Happens Next?

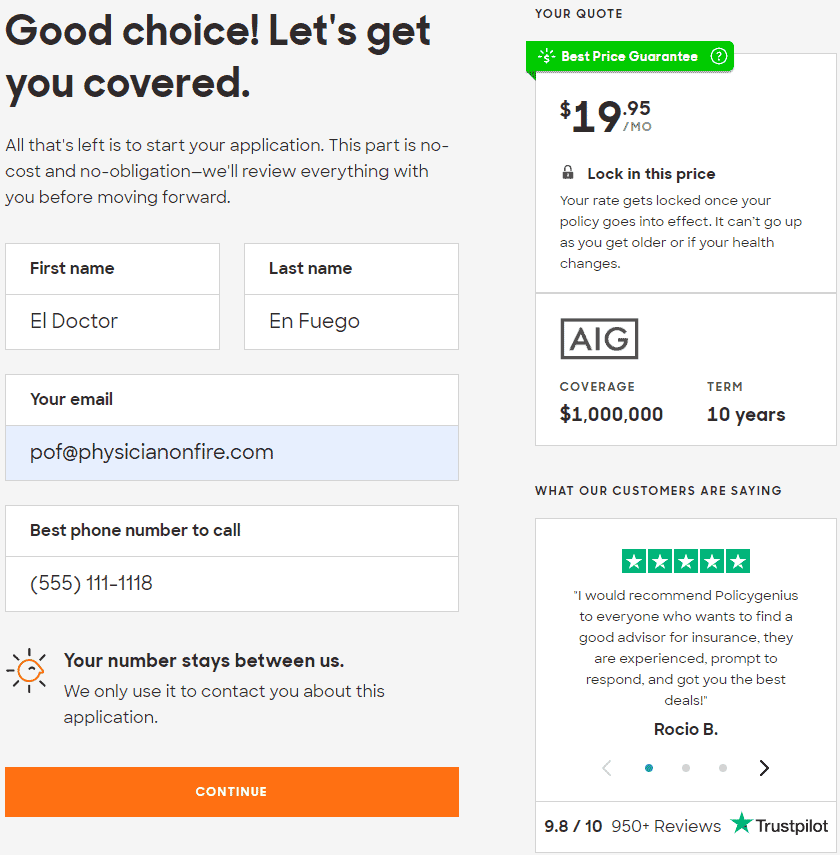

You’ll notice each of the quotes above had a button next to them offering for you to “Continue” or learn “How to Purchase.” Clicking on them brings you to a screen where you’ll be asked to share your contact information.

PolicyGenius also locks in the rate at this point, assuming your answers were truthful.

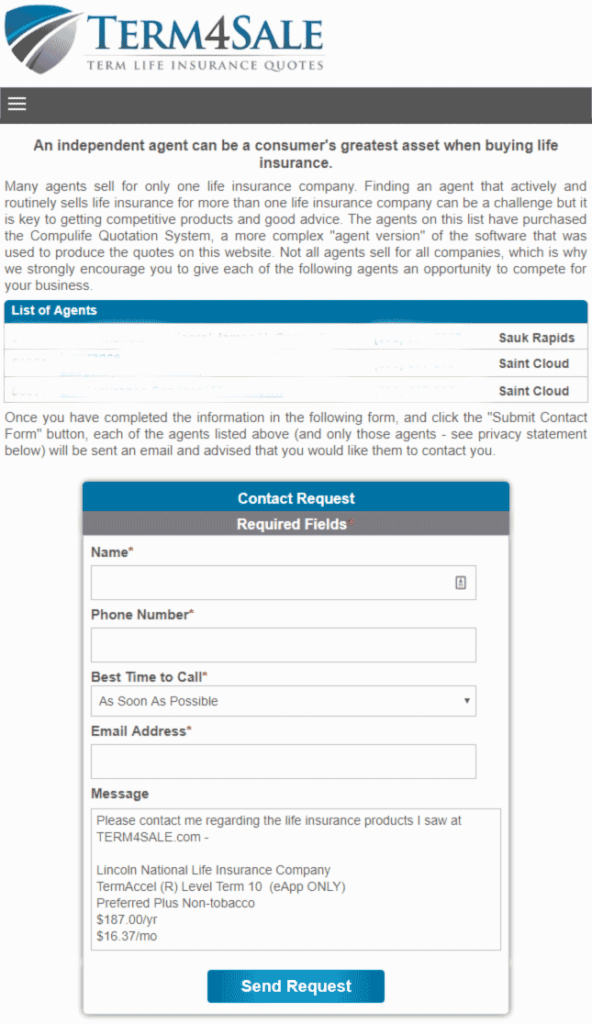

Term4Sale gives you a list of agents with the disclaimer that they may not actually sell policies from each of the companies listed. Your information will be shared with each agent and they encourage you to let them compete for your business.

The Bottom Line

You’re not going to find a lot of variation among the offerings from online aggregators of term life insurance quotes.

There’s nothing wrong with deciding how much you want, figuring the cost, and following through with the policy.

However, if you’re going to ladder policies, there are companies that will offer a volume discount by adding a rider rather than issuing two separate policies. You won’t find that option in the search engines, but an independent agent could put together a quote for a situation like this.

Term life insurance only gets more expensive as you age, and each year that goes by is another opportunity to pick up some of those diagnoses that the underwriters frown upon. If you’re not financially independent and people depend on your income, be sure you have adequate coverage.

Do you have term life insurance? How much coverage and for what term? Do you have laddered policies? Do these look like attractive prices to you?

Disclaimer: The topic presented in this article is provided as general information and for educational purposes. It is not a substitute for professional advice. Accordingly, before taking action, consult with your team of professionals.