Rule 506(b) vs Rule 506(c) – What’s the Difference?

This post may contain links from our sponsors. We provide you with accurate, reliable information. Learn more about how we make money and select our advertising partners.

I remember when I first started investing in passive real estate investments. Honestly, it felt like I was trying to learn a completely new language. I’d hear terms like “accredited investor,” “internal rate of return,” “equity multiple…” You get the idea. Suffice it to say, I often ended up very confused.

Fortunately, I did grasp the meaning of those terms relatively quickly. But then something like “506(b)” and “506(c) of Regulation D” would pop-up from time to time. For a long time, I simply couldn’t remember the difference and relevance of these terms.

However, as I began investing in more private real estate deals, I saw these terms more and more frequently. So if you, like me, have ever been confused by what all this means and how it might impact you, then you’re in the right place.

Real Estate Deals and the JOBS Act

As I’ve mentioned before, the Tax Cut and JOBS Act of 2012 changed many things when it came to the advertising and promotion of private deals–particularly concerning real estate.

Prior to the passing of this act, the only way to hear about private real estate deals was through personal relationships with sponsors. These relationships weren’t always easy to establish. Often, you’d have to rely on some kind of network. In fact, I’ve heard such deals referred to as “country club deals,” because you had to be in some sort of closed network to even hear of them.

But with the TCJA of 2012, all of that changed.

You see, the SEC considers these private real estate deals to be securities. To offer them at all, an issuer needs to register with the SEC. Standard SEC registration for securities is lengthy and quite expensive, and many of these private real estate deals are just single deals.

To lower this barrier of entry, the SEC split Regulation D into two sub-regulations: 506(b) and 506(c). These allow smaller companies to file with them if they meet a certain requirement. Whether a business decides to file as a 506(b) or 506(c) depends on their goals and how they want to market their services.

This helped launch the birth of real estate crowdfunding companies online and that’s how I got my start investing in real estate.

So, with all that in mind, let’s look at a few of the major differences between the 506(b) and 506(c) in a little more detail.

Sophisticated Investors vs Accredited Investors

Under Rule 506(b), the deal is open to any accredited investor and “up to 35 sophisticated investors.” While the definition of an accredited investor is well-documented, what it means to be a “sophisticated” investor is a bit more vague. This lack of clarity allows the issuer of the deal to essentially take an investor’s word that they meet certain requirements.

In fact, many high-income professionals, like doctors and dentists, do fit the “sophisticated” requirements if they have a good level of understanding of these investments or have invested before. If they’ve enrolled in Passive Real Estate Academy, they no doubt have the knowledge to exhibit sophistication when it comes to private real estate deals.

Still, it’s worth noting that due to the vague terminology supplied by the SEC as to what constitutes a sophisticated investor, many companies will simply require all investors to be accredited–even if it’s not strictly necessary.

Rule 506(c), however, requires that all investors be accredited. Because of this, there is a strict verification process, which requires proof of income and assets. This verification can be difficult to do on your own, so many people utilize a third-party service like VerifyInvestor to make the process a little easier.

Advertising and Prior Relationships

With Rule 506(b), the issuer must be able to prove an existing relationship with an investor before the deal is presented to them.

For this reason, a company operating under Rule 506(b) cannot advertise specific deals–whether that be online, on TV, or in print. They are, however, allowed to advertise their company and brand.

Then, once a potential investor has contacted them, they will often engage in several meetings before even mentioning an investment opportunity. This allows the issuer to prove a prior relationship and meet SEC requirements.

Under Rule 506(c), there are no restrictions, and an issuer can advertise any specific deal that they want. This makes it easier to attract potential investors, but of course, they do need to be accredited.

The Importance of Due Diligence

As is the case when investing in any type of real estate, the most important thing is to perform the proper due diligence.

This is always important with any investment property, but much more so when buying out of state. After all, you may never see the property in person. And if you do, it may be months between visits. It’s vital to learn as much as you can about the area, the market, and the people involved in the deal.

If you’re eying a certain market, there are a few things you can do to verify the local conditions. Online tools like Rent Range make this very simple.

When it comes to a specific property, it may also be best to get a full appraisal done by a third party. This will ensure that the value claimed by the sponsor is accurate. While online platforms like Roofstock offer trustworthy appraisals, you can never be too safe.

Lastly, and this is probably the biggest one, you should speak directly with the property manager. Many platforms will connect you with preferred property managers that have been thoroughly vetted, but don’t take their word for it.

Again, speak with them directly, and ask them questions. How long have they been in the business? What similar properties have they managed? What’s their communication style? More than that, you can also get a feel for who they are and how it will be to work with them. After all, they will be your point of contact with the property. It’s crucial to get this part right. For more on choosing a good property manager, be sure to read this article.

Summary

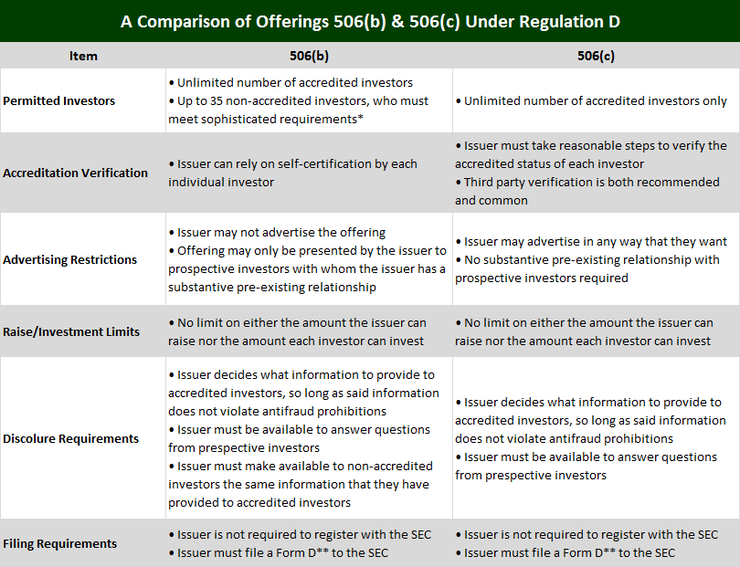

These are the main differences that most investors will come across. Of course, there are a lot of little differences, too, as the SEC documentation is very long and difficult to decipher. Fortunately, the good people at BiggerPockets put together this handy reference chart for those who like their data a bit more organized:

Ultimately, the differences between the two seem small on paper, but they can make quite a difference for both the issuer and the investor.

Under Rule 506(c), for example, it’s much easier to find and invest in specific deals without having to undergo a lengthy process to establish a prior relationship with that company. Plus, you know that the other investors in the deal have all been fully accredited.

On the other hand, the barrier of entry is lower with a 506(b), which doesn’t necessarily require you to be accredited.

It can be tricky, but even simply knowing these differences can make investing decisions just a bit easier. And as far as deciphering all the terminology, I hope this has made that just a bit easier, too.

Of course, when it comes to learning investment terminology in an easy-to-understand and engaging way, look no further than our upcoming Passive Income Academy. We’ll be discussing Regulation D, accreditation, IRR, and much more. We hope to see you there!

Disclaimer: The topic presented in this article is provided as general information and for educational purposes. It is not a substitute for professional advice. Accordingly, before taking action, consult with your team of professionals.