What’s Your Part Time Number?

This post may contain links from our sponsors. We provide you with accurate, reliable information. Learn more about how we make money and select our advertising partners.

How much money do you need to save and what should you consider for taxes until you drop to part-time? Maybe you're on the cusp of the move? Or, maybe not quite there yet but want to be? Wherever you are, here's some insight into achieving the level of financial freedom you need to make the transition.

Today's Classic is republished from Physician on FIRE. You can see the original here. Enjoy!

I recently revealed my plan to decrease my workload as a part-timer this fall. I detailed the schedule and the math behind the taxation in a post on this site (So Long, Full-Time Employment!) and the news has also circulated amongst my real-life colleagues at work.

While I do get my share of quizzical looks due to my relatively young age in my early forties, I honestly haven’t been on the receiving end of much negative feedback, at least not to my face. More often than not, the response is some combination of “good for you,” and “I wish I could do that.”

Well, maybe you can do that!

I waited until I was easily financially independent (FI) with more than 25x the anticipated annual expenses saved before even contemplating a part-time position, but that doesn’t mean FI is a prerequisite.

To be honest, you don’t have to have anything saved up in order to work part-time, but it certainly helps, particularly if you have an interest in retiring early. In one of the 4 Physicians posts, we learned that working full-time prior to making part-time can decrease the time to FI dramatically.

What’s Your Part-Time Number?

Dr. Am Requests Permission to Go Part Time

Last fall, a physician in his early forties asked the Bogleheads if he or she (we’ll go with her for the sake of this post) could afford to go part-time. Dr. Am gave us some details of her situation.

- She’s got 8x to 10x desired retirement spending saved up.

- Halfway done saving for college (presumably, she has children).

- House is paid off.

- Saving 1/3rd of her income annually.

- Not interested in retiring until at least age 55 to 60 (in about 15 years)

- Expects a combination of pension and social security to deliver $37,000 a year at age 62 (but not counting on it).

What do you think? Yea or nay?

It helps to have a framework to come up with a reasonable answer. We’ll have to make some assumptions, too, since there’s just not enough information to say positively yes or no. But we can come up with a good idea of her best move and figure out how to think through the question and the variables.

The Analysis for Dr. Am

Let’s make some assumptions so we can do some math.

- Retirement Savings $800,000.

- Desired retirement spending $80,000 to $100,000 per year.

- Working part-time will give her enough to live on and finish saving for college.

- No net additions to retirement savings as a part-timer.

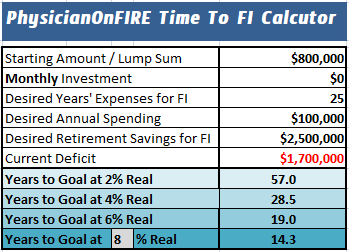

Here’s a peek at how long it will take Dr. Am to reach FI if she goes part-time and stops contributing to retirement assets now.

Based on our assumptions, to have $100,000 a year in today’s spending power, it will take 19 to 57 years at 2% to 6% real (inflation-adjusted) returns. If we bump it up to 8%, the goal is achieved in a timeframe that Dr. Am will be happy with.

My recommendation to Dr. Am would be to work at least a few more years full-time if possible and consider dropping to part-time in her mid-to-late forties. It might also be worthwhile to earn enough to continue putting some money towards retirement each month.

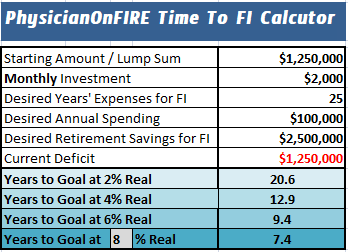

If we have her work full-time for several years until she is halfway to her $2,500,000 target and have her contribute $2,000 a month as a part-timer, the goal could be reached within a decade or two after that depending on returns.

Keep in mind this reports the number of years remaining to the goal after working a few more years to build up the nest egg to $1,250,000.

How does that compare to the status quo option of continuing to work full time?

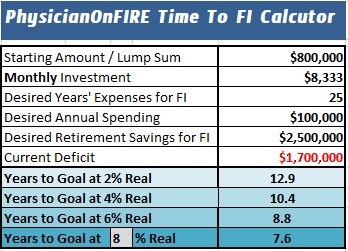

Let’s assume Dr. Am has accepted my Live on Half Challenge (whether she’s heard of it or not) and is saving $100,000 a year while living on an equal amount.

If she simply decides to work full-time to reach her goal faster, she’s got 9 to 13 years to go at 2% to 6% real returns.

Part-Time Work Isn’t All About Math

Math is wonderful, but the numbers don’t know what Dr. Am or any of us plan to do with the newfound free time that comes with a part-time gig.

Just as we love to say you should have a plan to “retire to something,” you should also have a plan for how you’ll spend the additional time you’d be purchasing by dropping to part-time status. You might be escaping burnout. Perhaps you’ll be spending more time with your kids or just carving out more time for yourself.

While working part-time will prolong your working years, improving your work/life balance may make work more enjoyable, and you might also be more relaxed when away from work.

One decade of a hectic, stress-loaded career with little time for yourself or your family sounds terrible when compared to a couple of decades of a more leisurely paced where you’ve got time for your patients, your hobbies, and everyone else that wants or deserves some of your precious time.

For an excellent and thorough guide that explores the many facets of part-time work, be sure to check out The Happy Philosopher’s Physician’s Guide to Working Part Time. He has walked the part-time walk for a number of years and can relate better than I can at this point, as I am four months away from beginning my own part-time schedule.

What is Your Part-Time Number?

Would you consider part-time work at some point? How close to FI would you need to be? Dr. Am asked the question with no more than 40% of her goal number achieved. That may not be enough, particularly if future returns are tempered as many experts expect them to be.

What if you were 60% of the way there with 15x expenses saved? Or 80% with 20x? I’ll leave you with one more Excel spreadsheet that you can use to help think through the answer. All of the gray fields in this one are customizable.

I encourage you to play around with the numbers to best fit your current situation. If you’d like a copy of this spreadsheet to play with at home, please subscribe to the e-mail list and you’ll be able to download the Excel file that has this and all the other calculators from the site.

Great post from Physician on FIRE! Have thoughts of going part-time? Share with your peers at Passive Income Docs on Facebook.

Disclaimer: The topic presented in this article is provided as general information and for educational purposes. It is not a substitute for professional advice. Accordingly, before taking action, consult with your team of professionals.