How I Bought My First Apartment Building

This post may contain links from our sponsors. We provide you with accurate, reliable information. Learn more about how we make money and select our advertising partners.

What comes to mind when you read the words “rental property?” For me, it’s pure excitement. In those two simple words, I see opportunities just brimming with potential. It’s no secret that I believe that owning property is one of the best ways to develop long-term and generational wealth. It can be a great source of passive income and, ultimately, it can help you achieve true financial freedom.

If you’ve been sitting on the fence, not sure if owning and renting out property is right for you, this is for you. In this post, I’d like to share how I bought my first apartment building and show you that I’m nothing special. In fact, I've made a good number of mistakes, some of them are highlighted here, but in the end, it’s turned out well.

Okay, yes, it’s my first and only building–but I’m optimistically planning for future posts (second, third, fifth, etc.). I do own fractional shares of some other properties through investments in a few syndications and crowdfunding, but I consider that to be slightly different than actually owning it and being able to make your own decisions on how to handle the investment.

Even though I chose to do this DIY, there are other great options out there like real estate crowdfunding for those of you who might not want to take on what I did initially.

I’m going to break this post up into several different, easy-to-digest parts, so that maybe, just maybe, you can apply them to your own endeavors.

So, without further ado, let’s begin.

THE SETUP

I had been reading about investing in apartment buildings since 2011. I told myself that when I had enough capital, I would take the plunge. Cut to several years later, and I had saved up the capital . . . but I was still hesitant. What if I messed up and bought the wrong building? Would I lose all my money? The risk seemed too great.

Then, in 2015, a friend of mine (who happened to also be a physician) came to me and asked me if I would consider buying an apartment building with him. We would be equal partners, split the cost, and since we both had no experience, we would learn together.

Understandably, I was a little wary of investing with a friend. But we both seemed to have the right attitude: a willingness to learn. We also decided to put everything in writing so there would be very little miscommunication. We decided to pool our resources and go for it.

THE HUNT

We had taken the biggest step by simply deciding to buy a rental property in the first place. But that didn’t mean that we knew where to go from there. Luckily, a mutual friend of ours (also a doctor) had recently purchased a building of his own, so we took him out for coffee to pick his brain a little.

We asked him to tell us all about his experience, hoping to gain some insight on what we should do next. He immediately suggested that we use his broker and they would teach us the ropes. He also offered to help us with any questions we might have.

Going right along with his suggestion, we reached out to his real estate broker and expressed our interest in purchasing a rental property. The broker asked how much we were willing to put in. We each came to the consensus that, given the “right property,” we’d each be willing to put in $100,000-$200,000. Luckily I had been saving for this moment. With that kind of down payment on a commercial loan (which would likely require 30-35%), we could look for a property of up to one million dollars in value.

With all of that figured out, the broker began looking around town. His suggested criteria were simple: it must be within our price point, and it must have at least five units. Why the minimum of five units? Because at five units and above, you’d be able to get a commercial loan with easier lending standards. This is because your “lendability” –that is, the likelihood of getting the loan–is determined more by the building itself rather than your personal qualifications. That usually means a lot less paperwork and a much smoother transaction.

The broker then asked us in which areas we’d like to start looking. Obviously, the price point helped determine much of that (in our area, our highest price point would barely get you a single-family home). We had to look in areas that were considered less desirable in terms of location and possibly not the greatest condition (commonly referred to as B or C Class areas). But we also didn’t want to drive multiple hours every time we visited the building.

And so began the hunt. Our broker would line up properties for us and on an off day for both of us, we’d all hop in the car and drive around. We looked at building after building trying to get a sense for how far our money would go, and what to look for in terms of the property (condition, surrounding area, etc.).

After a couple of weeks, we both seemed to settle on a certain area of town. There was a good deal of new development happening in the area and new public transportation in the form of a metro line was being built. Both of us were able to look beyond the current state of the development to see its true potential. So, we decided to focus here.

There were only a couple of buildings on the market in that area, and in just two weeks, we had narrowed it down to one. Our agent let us know that the asking price of $800,000 was fair, and with a little haggling, the sale ended at $795,000. The cap rate* was around 5% and with market rents we could end up at a cap rate closer to 7-8%. So there was upside that could dramatically increase the value of the building. (*Cap rate is essentially the rate of return on the property based on current income it brings in.)

THE INSPECTION

Once our offer was accepted, we hired an inspector and walked the units ourselves. Based on the inspector’s report and our own observations, it was obvious that the building hadn’t been maintained all that well. The property was older, but thankfully it had good bones and was deemed structurally sound. The same could not be said of the roof and plumbing, however, and was a possible (large) future expense. Based on these things, the broker had us go back to the seller, and while we didn’t get the full credit we wanted, we did get some money back to put towards those capital expenditures.

THE MONEY

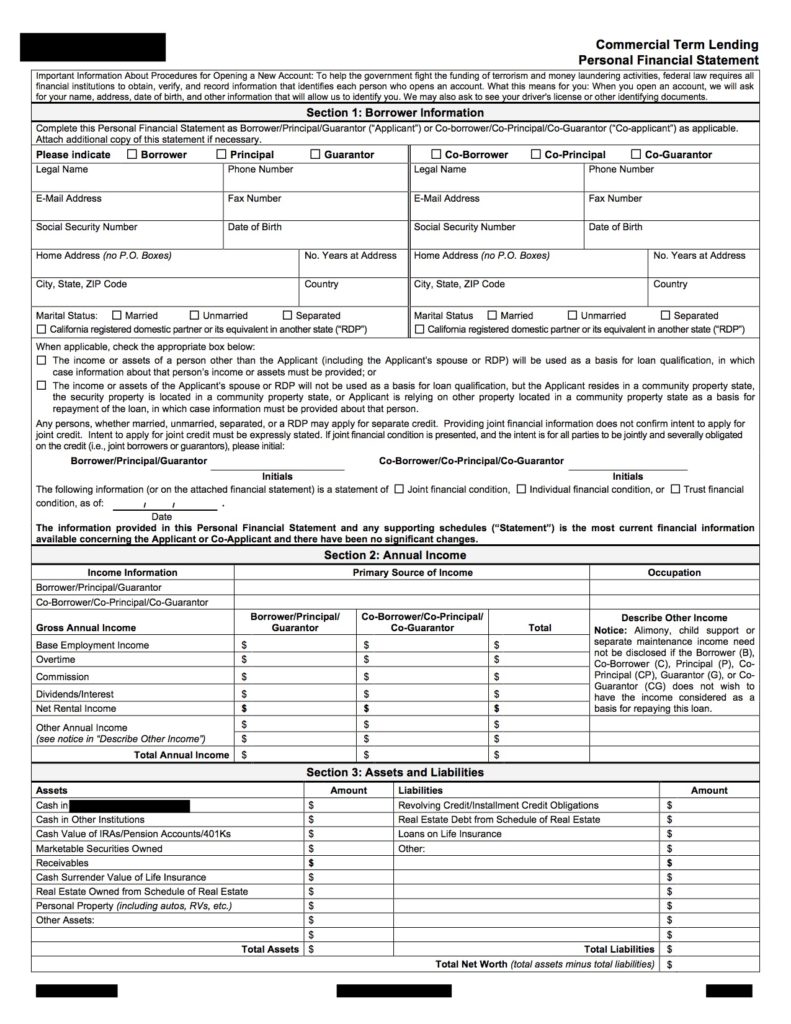

Being first-time commercial buyers, finding a loan wasn’t all that easy. We had to move quickly and ended up going with one of the bigger banks. They were known for being very lenient with first-time buyers, but their terms weren’t always the best. We locked in a 5/1 ARM and had to make a down payment of 35% (~$278,000 or $139,000 each).

Now, if you’ve recently purchased a home, you know what a nightmare it can be. But this process was a breeze compared to that. We never even had to provide our own personal bank statements. The bank was betting on the property and, knowing that we were both professionals, that was enough.

After a total of 60 days, the building was ours, and we felt that we had received the best education possible—the kind that only comes from experience. Could we have done a better analysis? Definitely. Could we have negotiated more from the seller? Probably. There were plenty of reasons not to invest in that property, but perhaps the biggest was fear of the unknown. Thankfully we were able to push past that fear.

NEXT

In my next post about the apartment building, I’ll share what’s happened since. It’s been a wild ride, to be sure, and in terms of experience, it has been immensely valuable. Suffice it to say, it’s now two years later, and a recent appraisal of our building showed that its value has increased a hefty 52%. Of course, not all of that is the pure return (some rehab money was required to get to this point), but we have made money. Got an education and made money at the same time? That’s something you’ll never hear me complain about.

Now that we have a deeper understanding of the process so much better, I’m confident that we’ll only do better next time. Apparently, once you’ve started, the hunt never stops.

Disclaimer: The topic presented in this article is provided as general information and for educational purposes. It is not a substitute for professional advice. Accordingly, before taking action, consult with your team of professionals.