Active vs Passive Real Estate Investing

This post may contain links from our sponsors. We provide you with accurate, reliable information. Learn more about how we make money and select our advertising partners.

As you probably know, investing in real estate is my favorite way to achieve financial freedom.

Part of what makes it interesting to me is how versatile real estate investing can be. It can be passive, something that provides ongoing returns without a lot of micromanaging. On the other hand, it can be quite active.

Now, I know what you’re thinking, Isn’t this blog called Passive Income MD? Isn’t the whole idea of investing to create passive income?

That’s a good point. Let’s think for a moment about what “passive income” really means. It’s income that is not proportional to the time you put into acquiring it. In very basic terms, it means that you’re not trading time for money, which is what most people do.

Almost no one is looking for an additional job, after all. If you’re like me, you need money to live and provide for your family, but you value time. And we all know that medicine isn’t getting any better in terms of the income/time ratio for physicians.

With real estate investing being such a huge industry with so many players and ways to get involved, you just have to find out which part of it will help you accomplish your goals. And since it’s so versatile, you can truly decide how much time, energy, and effort you want to put into it.

Active vs. Passive

The way I think about whether an investment is active or passive has to do with the amount of ongoing work is involved to maintain the investment.

There are some investment methods that I don’t mention much because they’re so extremely active (e.g., fix-and-flipping).

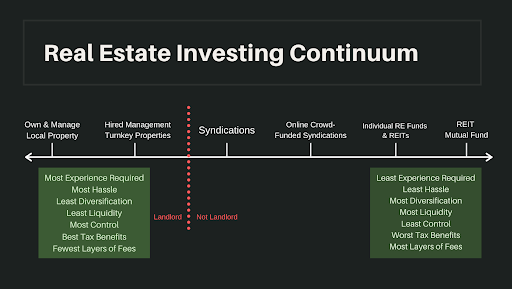

However, most people think of real estate investing as one or the other. Either it’s active or it’s passive. In reality, it’s more of a spectrum, with passive on one end and active on the other. For me, the dividing distinction between the two is whether or not you’re a landlord.

To illustrate this concept, here’s a little chart that I’ve adapted from the White Coat Investor’s “Fire Your Financial Advisor” course.

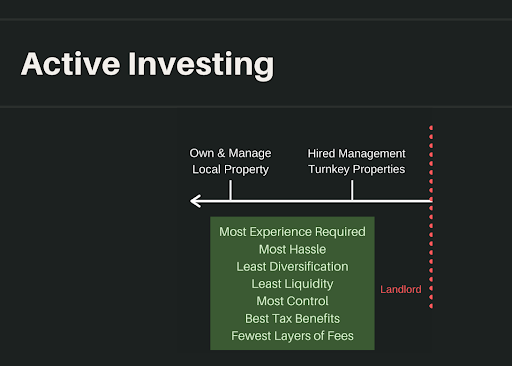

Active Investing

Everything that involves being a landlord I put on the active side.

Owning rental property is definitely active if you’re self-managing. This means that you purchase a rental property, lease it to tenants, and handle all of the property management issues like collecting rents and dealing with maintenance calls.

For the most part, I’m against self-managing. I think it’s better to outsource by finding good property management. Your time is better spent finding new opportunities, overseeing the operations of your portfolio, or simply spending time with your loved ones.

Now, if you do hire property management, your investment starts to swing toward the passive side. Once you identify the property you want to purchase, do the due diligence, and actually hire good management, you should only be getting calls for major issues.

Turnkey rental property companies try to make this process even easier for investors. They tend to identify good investment properties, often do the necessary renovations, find tenants, and provide property management. This moves you even further to the passive side.

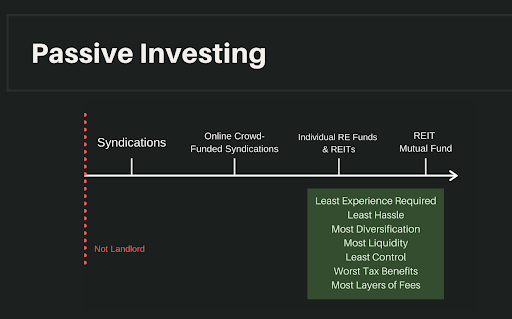

Passive Investing

What’s in the passive real estate investing camp?

Passive Investing

What makes a real estate investment truly passive is not directly owning the property yourself. In these cases, you are definitely not the landlord.

Examples of investments like these include syndications, real estate funds, crowdfunding opportunities, and REITs.

Now, let’s spend a little time defining each of these a little more in-depth.

Syndications are essentially a pooling of funds to purchase a real estate investment. The company or people running the syndication (known as syndicators, operators, or sponsors) find a deal, put together the business plan, and raise money from investors to fund the deal. They then manage the deal and pay out investors according to the terms of the deal.Syndications are different from real estate funds in that the asset or opportunity is already identified and money is being raised specifically for an asset.

With real estate funds, the fund operators raise money from investors, then use those funds to purchase different investments. Investors typically invest blindly, meaning that they trust that the fund operators will be able to follow their business plan. These funds typically purchase multiple properties.

If syndications are like individual stocks, real estate funds are like mutual funds, a collection of stocks. There are pros and cons to investing in each, all of which I’ve discussed in a previous post.

Crowdfunding is a term that really defines how investors get access to deals. Usually, crowdfunded deals are found online, and they seek to raise money from investors. It typically allows them to pool or “fund from the crowd,” so that each investor is able to put down a smaller amount toward the investment. For example, my very first investment was in a crowdfunded deal, and I only had to put down $5,000.

REITs (Real Estate Investment Trusts) are companies that own income-producing real estate. They are in many ways similar to real estate funds, in that investors invest passively into these opportunities and the REIT operators manage and pay distributions to those investors. When someone invests in a REIT, it’s more like they’re purchasing a share of the company. Contrast that to a real estate fund, wherein they’re purchasing shares of the properties themselves.

These are all very general terms, but they get the point across.

Now that we have an idea of what’s out there, let’s take a look at some of the pros and cons of passive and active investing.

Active Investing: Pros and Cons

Pros

Control – When investing in a more active way, the investor has the most control of these investments. They can decide exactly how to run the investment, like whether they’d like to refinance or sell.

Taxes – Since the more active types of investment are usually directly owned, there are often more tax benefits provided to investors. They can decide how to take those tax benefits and use them to their benefit.

Cons

Experience – Active investments require a bit more knowledge on actual operations in order to be successful. The burden of knowledge rests on your shoulders, and you have more responsibility.

Time – The fact that it’s considered “active” means the work is slightly more ongoing, with more decisions having to be made by the investors. All of this adds up to a much higher time commitment.

Passive Investing: Pros and Cons

Pros

Time – It’s passive, meaning that most–if not all–of the work done by the investor is upfront. You choose which operator or sponsor to work with and what to invest their money in, and then you’re pretty much done.

Experience – Often, you don’t need a lot of experience because you’re leveraging the experience of the sponsors and operators. You’re letting the experts do what they do best.

Cons

Lack of control – Since you’re not completely in charge in this situation, you’re relying on management to make the best decisions for the project. They decide how to operate it, what rents to set, whether to refinance, and ultimately when to sell.

Lack of liquidity – As the investor, you don’t have the ability to necessarily make the decision of when to sell. Because of this, it can be hard to get your money out if you need it.

There are some exceptions to the rule, though. For example, some of these deals have provisions that allow for an exit in special circumstances and conditions, but you have to carefully read the PPM for that.

There are other specific types of investment that are more liquid than others, but generally, that money will be tied up for a while.

What Do Most Physicians Prefer?

Well, I did a recent poll in our Facebook group, and about 2/3 of physicians said they prefer passive investments, while about 1/3 preferred active ones.

Many people feel they have to do one or the other. Personally, I do both. But lately, I’ve been investing slightly more into passive deals.

Passive investments can allow for the creation of cash flow. Over time, this can add up to significant sums that can help replace some or all of the income necessary to become financially free.

That’s always been the goal for me with the real investments I make; to ultimately replace my day job income so that I choose to work on my own terms.

When choosing an investment for yourself, it’s important to ask what you want out of it. Find a deal that matches your goals and go for it. It may be passive, it may be active, or it may be somewhere in between. As long as it gives you what you want, then that choice will almost always be the right one.

Join our community at Passive Income Docs Facebook Group. Just click below…

Disclaimer: The topic presented in this article is provided as general information and for educational purposes. It is not a substitute for professional advice. Accordingly, before taking action, consult with your team of professionals.