How Should You Invest in Real Estate?

This post may contain links from our sponsors. We provide you with accurate, reliable information. Learn more about how we make money and select our advertising partners.

What is the best real estate structure for you to use? REITs, direct ownership, crowdfunded or direct syndications? Today White Coat Investor maps it out.

Today’s Classic is republished from White Coat Investor. You can see the original here.

Enjoy!

How should you invest in real estate? Well, there are a lot of different ways. As those who have taken the Fire Your Financial Advisor online course know, there is basically a real estate investing continuum with maximum control on one side and maximal diversification on the other as shown in this slide from the course. The idea is to match the investment structure to the investor.

However, a lot of people are still a bit confused about the various methods to invest. Bear in mind I’m not talking about the different types of real estate (mortgages, hard money loans, mezzanine debt, preferred equity, equity, single-family homes, self-storage, trailer parks, multi-family, commercial, retail, industrial, etc.) I’m talking about the structure of the investment. Just like the relationship between investing accounts (think different types of luggage) and investments (think different types of clothing), pretty much any type of real estate can go into any type of investment structure.

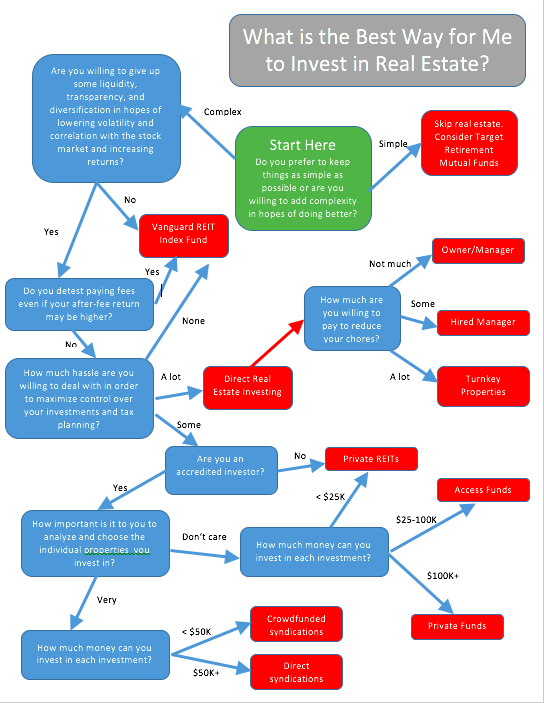

In an effort to make this even easier and straightforward, I have put together a flow chart that should help. If you work your way through the questions, you should end up knowing how you should best invest in real estate.

If that is too hard to read increase the magnification of your screen or click here to download a PDF.

How Should You Invest in Real Estate?

Keep Things as Simple as Possible

If you start at the top, you’ll see the first question deals with whether you should invest in real estate at all! I view real estate as a completely optional asset class. Technically you own at least a little bit if you own a stock market index fund. REITs make up about 2% of the US stock market. If you are the type to keep things as simple as possible, just skip a separate real estate allocation in your portfolio altogether. But if you, like me, see the high returns and low correlation with both stocks and bonds that real estate offers and think that’s worth a little more complexity, then move on to the next step.

REITs

The next two questions will help you decide whether or not to just do what I did for years — a slice of your portfolio dedicated to publicly traded REITS, usually via a low-cost index mutual fund or ETF like the one offered by Vanguard. For just 12 basis points, you get all the publicly-traded REITs you want in a very liquid, very cheap, very diversified investment. These tend to be large companies that own large real estate assets and they tend to have moderate correlation with the overall stock market. But you can’t beat the ease of investing in them. For this reason, I’ve held this particular investing structure since I started getting serious about investing 15 years ago.

If you’ve decided that you’re willing to pay a little more in fees (to be fair, the expenses of the companies and the properties they own are not included in the expense ratio of the mutual fund), be a little less diversified, and deal with a little more hassle, we’ll keep moving through the flowchart.

Direct Real Estate Ownership

The next question deals with hassle. If you don’t want any hassle, again, that mutual fund is pretty attractive. If you are willing to deal with a lot of hassle in order to be able to drive your friends and family past your property and have the greatest control over your investment and taxes, then direct real estate is for you.

You can reduce some of the hassles by hiring them out, but every time you pay someone else to do something, you lose some control over how it is done and your return is reduced by the fees. This is one reason that many real estate investors think they’re getting outsized returns — because they’re not counting in the value of their time buying the property, managing the property, and selling the property.

For Accredited Investors: Private REITs, Crowdfunded Syndications & Direct Syndications

If you’re willing to deal with some hassle, but still don’t want a second job, the rest of the chart is for you. It basically comes down to your accreditation status (accredited investors either have $1M in investments or make > $200K/year), how much you have available per investment (while still maintaining a reasonable level of diversification), and whether or not you like picking your own properties.

Most funds and syndications aren’t available to unaccredited investors, so their only options are the private REITs available from online crowdfunding companies. The properties in these REITs are much smaller than those in the big publicly-traded REITs and there are usually fewer of them. You may not have the economies of scale either and so fees may add up too. But in reality, you’re investing in different assets. Instead of huge malls and massive apartment complexes, you might have a collection of single-family homes, triplexes, and tiny strip malls.If you are accredited and like picking your own properties, you are likely looking for syndicated deals, where a large number of investors pool their money to buy a property. Going directly to syndicators generally requires a higher investment than going through crowdfunding companies.

If you do not wish to pick your own properties or think you just aren’t any good at it, then you’re probably more interested in a real estate fund. Minimums on these tend to be high, so if you can’t meet them and maintain diversification, your only options are access funds which will lower your minimum investment in exchange for an additional layer of fees, and the private REITs.

Examples of Real Estate Investment Structures

What are some examples of each of these structures? Well, at some point or other, I’ve invested in most of these structures and I currently have affiliate deals with providers of many of them.

- REIT Mutual Fund: Vanguard Real Estate Index Fund Admiral Shares

- Individual Properties/Managers: RoofStock

- Turnkey Real Estate Providers: No recommendations

- Private REITs: Fundrise, RealtyMogul

- Crowdfunded Syndications: Crowdstreet, RealCrowd, Equity Multiple, PeerStreet, Fund that Flip

- Direct Syndications: 37th Parallel

- Access Funds: CityVest

- Private Funds: MLG Capital, Origin, Broadmark, Arixa

You can check out other real estate investing companies from our list, but be aware that due to the long term nature of real estate investments and the difficulty in truly vetting these companies, this list is much more of an “introduction list” than most of our “recommended lists”.

You can also subscribe to receive my Real Estate Opportunities email giving you information about specific deals, special discounts, and invitations to webinars. You’ll receive a couple of emails a month, you can unsubscribe at any time, and it’s FREE.

What do you think? How do you invest in real estate and why? Argue your case for your favored method! Comment below!

Disclaimer: The topic presented in this article is provided as general information and for educational purposes. It is not a substitute for professional advice. Accordingly, before taking action, consult with your team of professionals.