How to Keep Track of Your Net Worth: Review of Personal Capital

This post may contain links from our sponsors. We provide you with accurate, reliable information. Learn more about how we make money and select our advertising partners.

As many of you know, I’m a huge fan of goal setting. In fact, I believe it’s a huge part of your journey to financial freedom.

It’s also important to track your progress on a consistent basis. It allows you to not only see how well you’re on pace to achieve your goal but it also allows you to make course corrections as necessary.

So How Do You Go About Figuring Out Your Net Worth?

Well, I wrote a whole post on the topic but, in essence, you have to total up your assets and subtract out your liabilities. Assets are anything of value that can be turned into cash (stocks, real estate, etc.). Liabilities are things that you owe (like loans).

You could do this all by hand and I think it is a useful exercise at first.

However, as a busy professional, it can be time-consuming to do just that. So, I went on the search to find the best tool to automate this for me.

And that’s how I came upon Personal Capital, which has nearly two million users, and I’ve found to be a great tool to track my net worth.

Sure there are others, but in terms of getting a quick overall picture, I haven’t found one that I like better.

We’ve gotten the question several times on Passive Income Docs about whether it’s a good service to use and what the pros/cons are.

I decided to simply lay it out in a post and write a review of Personal Capital.

Here’s why I think the tool can be used by many of you to track your net worth.

It’s Free! Personal Capital Is a Free Net Worth Tracker

Let’s start with the best part: Personal Capital is a free platform to use. Anyone who knows me knows I love free stuff… who doesn't? You sign up and within a few minutes, you’re up and running. It keeps track of your assets as well as your spending.

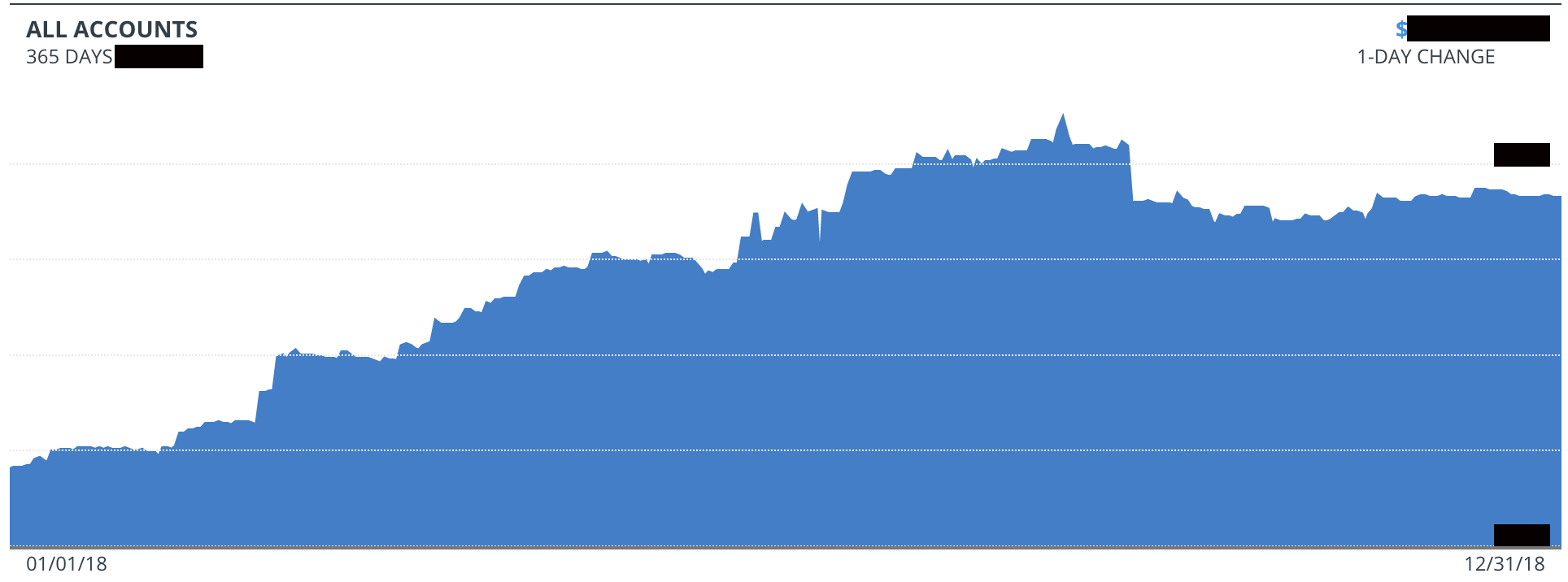

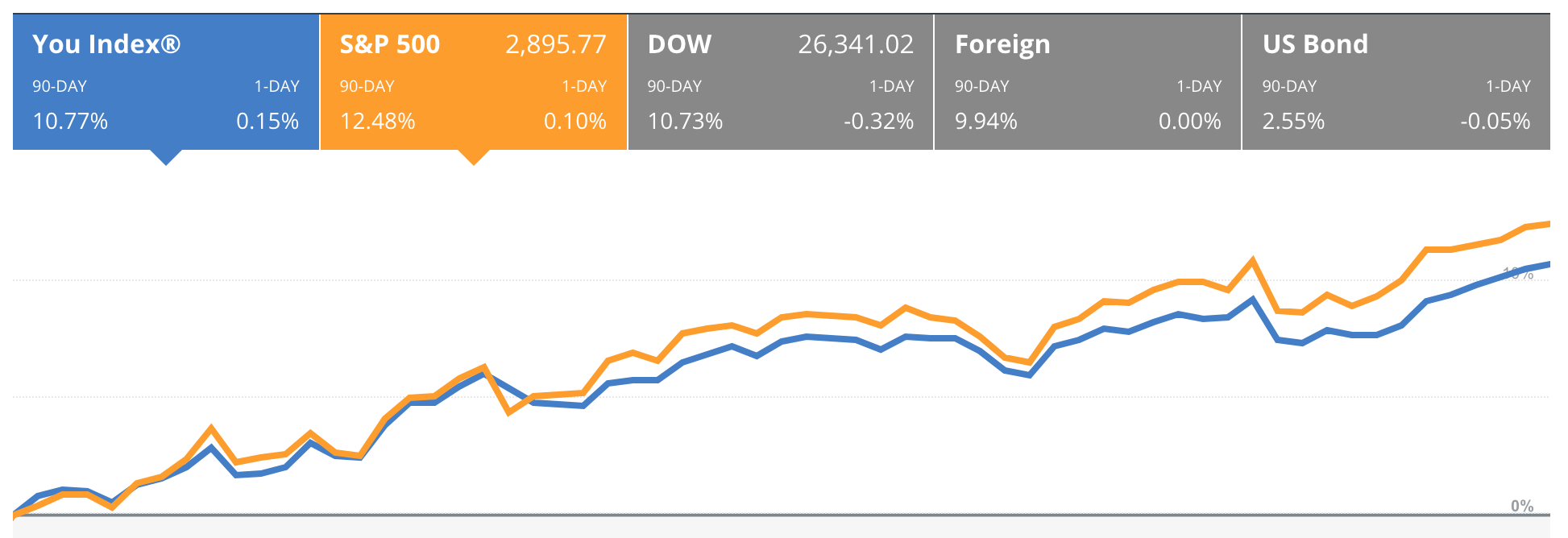

You can manually enter totals if you want, but if you’re like me, you have accounts all over the place for your bank, your portfolios, your credit cards, your mortgages, etc. So I like that they make it easy for you to link your accounts. Totals of all accounts are updated when you login and made into nifty grafts and charts that you can view by different date ranges.

Personal Capital Provides Free Budgeting Help!

Part of the platform, since it’s connected to your credit cards, is that it can help with budgeting to a degree. If you want it to, it pushes notifications to you for how much you’re spending and how it compares to the month before.

Sometimes all you need is a little nudge letting you know that you’re spending quite a bit more than a month before.

However, I don’t use it mainly as budgeting. I’ve found that other platforms like Mint or YNAB are better suited for that.

Honestly, though, I personally don’t follow a budget on a tight, minute-detail level as much as I used to. My wife and I spend far less than we make and have decided to spend less time fretting over every dollar. However, it is a helpful reminder to get notifications letting me know I'm above or below my spending level from the prior month.

How Does Personal Capital Make Money?

Well, even though the platform is free, they make money through their wealth management service which helps people manage their investments.

They list these as offered services:

- Budgeting

- Evaluating cash flow

- Analyzing 401(k)

- Planning for retirement

- Optimizing investments

- Calculating net worth

However, the wealth management option has some requirements that not everyone meets.

First, the minimum investment to start with is $100,000, though the company does try to encourage people with even more money than that to sign up (as the fees are reduced with higher investments).

The wealth management tool works with a variety of investment accounts. They include joint and taxable accounts, Roth IRAs, traditional IRAs, and trusts. So anyone who has at least $100,000 invested in any of these types of accounts should qualify for Personal Capital's wealth management tool.

The annual advisory fee is 0.89% for people who invest up to $1 million with Personal Capital. That drops to 0.79% with an investment of up to $3 million, and it goes down to 0.49% when the investment tops $10 million.

Personal Capital's wealth management tool boasts several features worth looking into. For example, there's smart indexing and automatic rebalancing, both of which can improve the investment portfolio– similar to a Wealthfront or Betterment.

This tool can also minimize the taxes to be paid in taxable accounts while supporting a variety of account types–including IRAs, Roth IRAs, trusts, joint accounts, and more.

Some however like knowing their financial advisors personally and ones that perhaps are compensated in different ways. For those, I recommend these financial advisors.

One of the ways Personal Capital does stand out from other companies is the level of access to its financial advisors for those who choose to go that route. People who invest at least $200,000 with the wealth management tool have 24/7 access to two advisors by phone, live chat, email, and web conference.

These advisors can provide guidance on retirement accounts, college savings, insurance, stocks, and other major financial decisions. Few other companies offer this personal touch, so this is definitely an advantage.

Disadvantages of Personal Capital

One of the drawbacks of the wealth management tool is that the fees are a bit higher than competitors, who tend to charge about half the 0.89% fee for investing the first $1 million.

So unless people plan to invest $10 million or more, they may be able to get lower fees elsewhere.

And while those who use the free budgeting dashboard will enjoy getting a clear picture of their finances on one page, they would likely get even more features if they switched to a specialized budgeting tool.

Granted, it works well for people who also plan to invest in the wealth management tool and want budgeting help on the same service. But those who just want free budgeting assistance can find more features on other free apps.

One common complaint I’ve heard is that once you’ve signed up, you’ll likely get a call from one of their wealth managers asking if you need assistance in managing your accounts.

If you’re not interested, you simply just have to say no “thank you” and “to please not be contacted again.” They’ve completely respected my wishes and I’ve heard they do the same for everyone.

Summary

At the end of the day, you have to figure out what works best for you to track your net worth, whether that’s by hand on a good ol’ spreadsheet or whether it’s using online software.

I’ve tried a few like Mint, and some of these might be better at budgeting like YNAB (You Need a Budget) but for tracking net worth, I haven’t found one better than Personal Capital.

How about you? What do you use to help track your net worth? Hop on over to the Passive Income Docs Community to share your thoughts!

Disclaimer: The topic presented in this article is provided as general information and for educational purposes. It is not a substitute for professional advice. Accordingly, before taking action, consult with your team of professionals.