How to Leverage Your Retirement Account for Real Estate Investment

This post may contain links from our sponsors. We provide you with accurate, reliable information. Learn more about how we make money and select our advertising partners.

Have you ever lined up a dream purchase or investment only to realize you were short on funds? For me, this experience goes back to my childhood. One of my favorite pastimes was going to the grocery store to scope out the candy and soda aisle. Sometimes, I’d put a couple of treats on the checkout conveyor, open my wallet, and then the realization would hit me: I had no cash. Cue disappointment.

As adults, we occasionally experience a similar I-wish-I-could-buy-that letdown when it comes to investments. The opportunity sounds great, and research shows it’s low-risk, but then we look at our bank accounts and there’s not enough cash to close the deal—the money is being utilized by other investments and accounts.

For most, that’s where the story would end. For the financially savvy, the process continues with a question: How can I find money when I feel like I don’t have any? An often overlooked resource is leveraging your retirement accounts. You read that right.

Why does the answer seem so surprising? It’s because we often view retirement accounts as hands-off. Many of you have probably been at your jobs for a while, and on the advice of your CPA, you’ve been funding your retirement account for many years. After all, it’s a smart way to sock money away.

However, these accounts have a narrow focus. They tend to invest in a smattering of stocks and bonds. And that doesn’t always work. According to a 2014 Fidelity Investments report, the traditional retirement for doctors replaces, on average, only 56% of income at retirement. That’s a hefty downgrade to your post-retirement quality of life.

I’m here to tell you that there are other ways to grow your retirement. You can invest your retirement savings in alternative assets, like real estate.

I know what you’re thinking: “Why invest using my retirement account? What benefits would I see?” Let’s take a look.

Benefit #1: Compounding

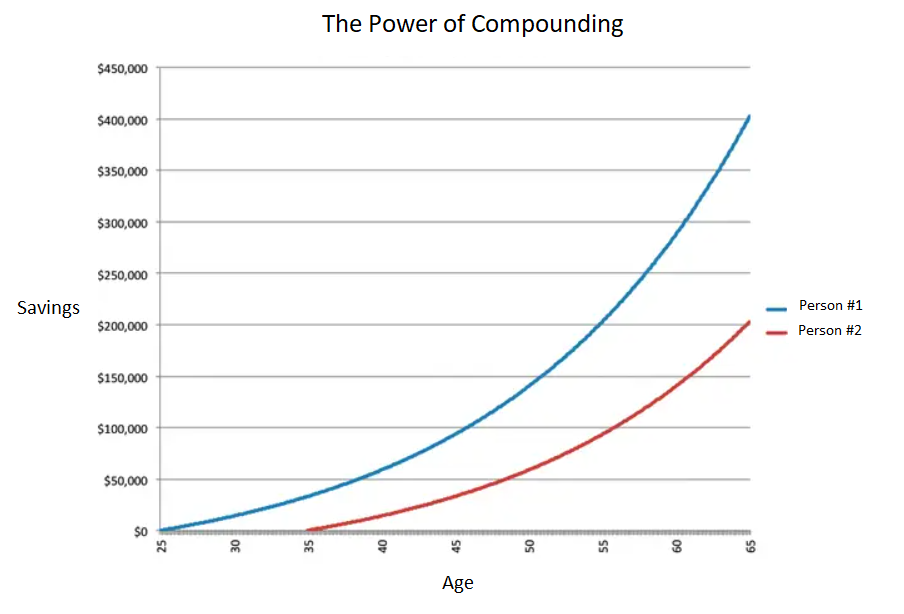

The power of compounding is profound. And the concept is simple: You earn interest on the money you put into your retirement account as well as any returns or dividends earned. Over time, this can scale your money. You’ve probably seen the graphs on compounding. Here’s one.

In this graph, each individual puts the same amount of money in their retirement account each month. But because Person #1 started ten years earlier, and because compounding exponentially grows an investment, they’ll have twice as much money than Person #2 by the time both are 65. That’s a staggering difference, and it positions compounding as perhaps the most efficient form of investment. But let’s take it one step further. Putting away monthly savings is one thing. Now imagine a steady stream of real estate income growing your compounding power.

But that’s not all. Without the impact of taxes on your retirement account’s funds every year—taxes can be up to 50% in some states—your money will grow even faster. Speaking of taxes…

Benefit #2: Tax Advantages

Years ago, a Peter Thiel interview opened my eyes to the tax advantages of retirement accounts. As the co-founder of PayPal, he made the unusual move of placing his early stock holdings into a retirement account. When his PayPal stock scaled in value, and because they were sitting in his retirement, those massive earnings were tax-free.

What if your real estate investments and passive income grew tax-free through your retirement account? To say the least, it would have a life-changing impact on your retirement.

Retirement Account Options

Not all retirement accounts are completely tax-free, though, so carefully plan your retirement with your CPA. For traditional retirement accounts, your earnings will be taxed when the funds are extracted. But for Roth IRAs and other forms of retirement accounts, you’ll never pay taxes on earnings, capital gains, or dividends.

If this sounds intriguing to you, here are a couple of retirement accounts to consider.

Self-Directed Roth IRA

Self-Directed Roth IRAs are so-called because they can be used for alternative investments, including real estate. Unlike 401Ks, Roth IRAs are not employer-sponsored. Because of that, and relative to other options, they have lower contribution limits.

Like with any IRA, your contributions will be taxed upfront. However, invested contributions grow, compound, and can be withdrawn tax-free. As with most retirement accounts, there are penalty fees for withdrawing money before your turn 59 ½. But because the compounding of retirement accounts is, in practice, a long-term investment, you’ll be setting yourself up for your future.

Roth Solo 401K

Usually, 401Ks are employer-sponsored, and that often means the investments are controlled by the employer. This locks you into a certain kind of traditional investing. On the upside, they feature employer-matched contributions, and they have relatively high limits on contributions.

However, there are third-party companies that can unlock what’s possible with these accounts and set you up with a Roth solo 401K. This opens up a world of possibilities and allows for more flexibility in investing. Best of all, five years after your first contribution, all funds withdrawn from your Roth Solo 401K are completely tax-free (and penalty-free after turning 59 ½).

Retirement Investing: Real Estate

Why should you use your retirement money to invest in real estate? Real estate has historically been one of the best hedges against inflation and does well against the volatility of stock markets. Best of all, most real estate investments are long-term, making them suitable for compounding growth in a retirement account.

That all sounds great, but real estate investing can be complex. Let’s simplify it by looking at a few of my favorite real estate investments to take to your CPA.

REITs:

An acronym standing for “real estate investment trusts,” these are blind or semi-blind trusts where your investment is handled by a decision-making management team or party. The best REITs are managed by groups with industry-leading expertise. They are publicly traded like stocks and are open to all investors, giving exposure to real estate investment without the risk of direct ownership.

REITs provide steady income into a retirement account. There’s also the end-of-investment upside. When the REIT property is sold, you stand to gain a one-time lump sum based on your investment agreement.

Syndications and Funds:

With syndications and funds, investors become the bank. You lend a specific amount of capital to the fund for a promised annual return percentage. Make sure you choose an accredited fund to invest with confidence.

MLG Capital is one such company that builds relationships with investors and makes smart investments. They prioritize cash flow as well as their unique tool-sourcing strategies.Debt Investment:

Similar to funds, debt investments are like private lending mortgage notes. Your investment money provides borrowers a loan for the purchase or development of real estate and receives a steady return.

Income from debt investment gets taxed in the same bracket as your medical income. However, if you invest in these debt deals through your retirement account, you don’t have to worry about that tax. Your steady, predictable income will go into your retirement account to compound over time.

Equity Investments:

This is the ownership of an investment property outright or through shared ownership with somebody else, such as rental properties or development projects.

When equity investments are tied to retirement accounts, you lose access to depreciation and loss tax breaks. However, the amount flowing into your retirement account should compound far beyond that tax advantage.

Diversification and Risk

Leveraging your retirement account to fuel your real estate investments can grow your retirement portfolio through long-term capital appreciation. When you mix a variety of real estate investments with the standard forms of retirement investment, you provide diversification that can protect against downside.

Take me, for example. It’s great knowing I have debt investments that inject steady, non-taxed income into my retirement accounts. But I also have equity investments to take advantage of the returns of a surging or steady home market. When my retirement is flush with too much cash, I put it in syndications to make sure I’m beating inflation but also seeing excellent returns. Creating a diverse mix of debt and equity mitigates risk and optimizes returns.

Tap into what’s possible with your retirement accounts; they provide a great opportunity to generate passive income that builds wealth for your future. You won’t have access to it now. But that money will be there, and it will be tax-free.

Of course, the choices and options involved are difficult to parse through, so consult your CPA or financial advisor. Use your team to make great decisions while looking at your portfolio holistically. As Bill Perkins, author of Die with Zero, says, “Don’t let difficulty dissuade you from living your best life!”

What do you think? What real estate investments might work for your retirement account? Comment below!

Disclaimer: The topic presented in this article is provided as general information and for educational purposes. It is not a substitute for professional advice. Accordingly, before taking action, consult with your team of professionals.