Diversify Like Crazy for Financial Security

This post may contain links from our sponsors. We provide you with accurate, reliable information. Learn more about how we make money and select our advertising partners.

We all know the importance of diversification when investing. It's been said that you should diversify for financial security. In fact, it's preached by just about every authority on the subject, and for good reason. Diversification provides a hedge against the unknown or, as Warren Buffett puts it, “a hedge against our own ignorance.” The fact is, we simply can’t know the future, and despite our best efforts, we can't always make perfect decisions.

Medicine is not immune to the force of change and the great unknown. Our industry is evolving and as always, it pays to diversify – both in our investments and in life.

Let’s examine different areas of your financial life where that diversification might make a huge difference.

Diversify Your Income

I began my career at a very low point in the economy. Elective surgeries were down and so was the need for anesthesiologists. The competition for cases was pretty fierce. At the same time, I saw some of my former residency friends’ groups being taken over by larger corporations. They were told to accept 20-30% less or move on. I also saw discontent amongst certain colleagues, and I saw some of them “burnout.”

That’s when I realized I needed to diversify in every way I could. I hoped things would improve, but even if they did, what would stop them from happening again? The problem was, I had been on one track my whole life. One hundred percent of my income was provided by my medical career. What would happen if that money were drastically reduced, or worse yet, our positions were eliminated?

Even though it seemed like a challenge at the time, I count myself fortunate to have experienced these things early on, as it began to change my mindset. Since then, my goal has been to never have to rely fully on one source of income. Through time and hard work in building other streams of income, I'm very fortunate to be able to say that I’m financially free from medicine. However I don't plan on quitting anytime soon. I love my job, I just want to do it less.

On the other hand, I also want to make sure that I’m not 100% reliant on any other income stream either. Personally, my goal is that any one single income stream does not account for more than 50% of my overall income, ideally not more than 33%. (If you’re a newsletter subscriber, you’re able to see my different income streams and the percentage they account for.) You can also see that I’m not exactly where I want to be…yet. Currently, I have a mix of active and passive income streams, but the goal is to have the passive income streams account for as much as possible.

Take a moment and tally up your monthly income. How diversified are those sources?

Diversify Your Investments

I’ve so often read and heard that diversification is the key to smart investment. I'm sure you have as well. The experts are usually referring to investing in a broadly-based index fund. Why buy individual stocks when you can buy the whole market in one low-fee index fund? And when it comes to allocation of stocks & bonds, you'll see the rule of thumb, take 120 minus your age to figure out how much of your portfolio should be in stocks.

However, I personally believe that diversification doesn’t mean that you have 70% or 80% of your investable funds in one asset class. So I've tried to spread it out over multiple asset classes including stocks, bonds, and real estate.

I also believe that you should diversify significantly with the actual asset class itself. That means that in the stock market, I carry broad-based funds covering the US stock market as well as International markets.

When it comes to real estate, I diversify by owning different types of rental properties (condos, single family homes, multifamily properties) in different parts of the country (West Coast, Midwest, & South). I don’t currently own anything on the East Coast or in other countries, but that time may come. I'm currently looking at investing in mobile home parks because they're typically known to do well in down housing markets. I also often invest passively in real estate funds, in syndications, and in crowdfunding.

Ray Dalio, who runs one of the largest hedge funds in the world, stated this in a recent interview, “I learned that if I could have 10 or 15 uncorrelated bets, and they're all about the same return, that I could cut my risk by 75% or 85%. That would mean that I would increase my return to risk ratio by a factor of five through diversification.”

I can't quite say I'm at 10 uncorrelated bets unless you count some of the businesses I'm involved in, but I'm always open to adding more as the opportunities present themselves.

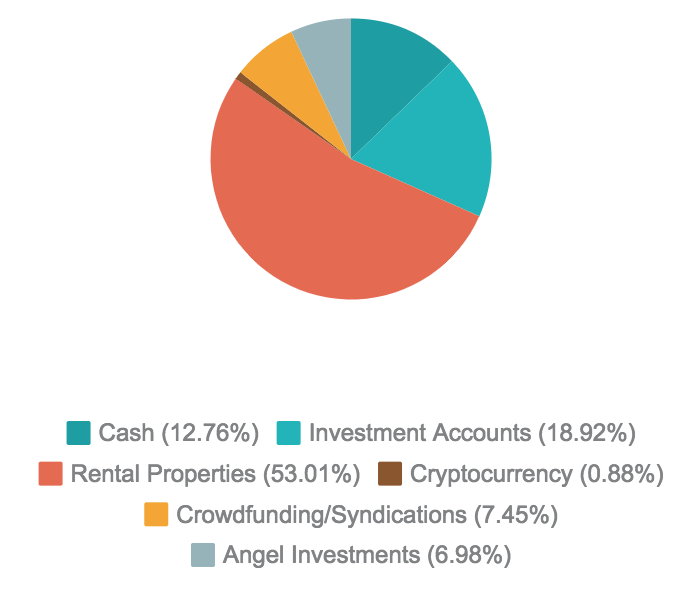

Again, it's still a work in progress but here is my current allocation of investable assets (excluding my primary home.) Just to be clear about the chart, the equity in my rental properties makes up 53.01% of my total investable assets or equity.

Personally, I don’t want any one type of investment taking up more than 50% of my allocation. So I still have some work to do.

Personally, I don’t want any one type of investment taking up more than 50% of my allocation. So I still have some work to do.

Diversify Your Businesses

Businesses are essentially income streams but I thought it important to dive a little deeper into it. The nature of business is that what was once a good, profitable idea can quickly turn obsolete. Therefore, I decided to diversify by being involved in multiple businesses in different sectors.

My main business is the business of medicine. However, all of us in this industry know that change is happening quickly and sometimes without warning. It doesn't matter what your specialty or field is. So, I say, diversify outside of medicine. It might start out as a side hustle but can turn into a full-fledged income-producing machine. In fact, it's ideal if you can make medicine a hobby.

I've explored different industries including media & the internet (blogging), real estate, skincare, fashion, you name it. I believe if you've made it through medical school and residency, you have the drive, intelligence, and resiliency to be successful at nearly anything you dedicate yourself to.

However I'm also aware of the problem of spreading myself too thin, so I try to make sure that I don’t play an overly-large part in any of them, automate & delegate where I can, and partner up with great people (a little trick I learned from Tim Ferris in the 4-Hour Work Week). Unfortunately, it's somewhat hard to do that with this blog, but I enjoy this and don't necessarily consider this work.

The Cost of Diversification

What is the cost of diversification? Sure, just as diversification mitigates risk, it also may dampen earnings. You may end up with a little less money in the short run, but the increased financial security is, to me, much more valuable.

Diversification also requires some extra time and effort. It means that you always have to be thinking of the next thing. You can’t just sit and expect that things will remain the same. In fact, I believe that stagnation is the biggest risk of all. Assuming that things will continue as they are, and continue to be profitable, is dangerous because we know that this is almost never the case long-term.

The Mindset of Diversification

How do you avoid stagnation and narrow thinking? It all starts with educating yourself. Read blogs and books written by people who have different perspectives and are doing things differently from the way you’re doing it. Try to avoid confirmation bias by only following and agreeing with the people who seem to be doing the same thing you are. Try your best to stretch.

I understand that at the beginning of our careers, our medical skills and our time working are the main drivers that create income. As high-income professionals, we’re fortunate to have that available to us. In fact, in many ways, it’s the easiest way – in the beginning.

However, I believe that we need to be looking for how we can move to the next level as early as possible. The mindset should be, how do we take that income and move to the other side of the cashflow quadrant where we create passive income and time freedom?

Some people have called me crazy for juggling so many things while being a physician. Start a blog? You’re crazy. Try to be a serious real estate investor? You’re crazy. Even my own father initially told me, “You’re a doctor, just focus on being a doctor.”

But I refused to listen to the naysayers and diversified like crazy. Now that I can safely say that I no longer rely on medicine to pay the bills, I couldn’t be happier. It’s been well worth it.

Disclaimer: The topic presented in this article is provided as general information and for educational purposes. It is not a substitute for professional advice. Accordingly, before taking action, consult with your team of professionals.