Our Drawdown Plan in Early Retirement

This post may contain links from our sponsors. We provide you with accurate, reliable information. Learn more about how we make money and select our advertising partners.

By now, you're in a position to learn more about financial freedom. One of those things is having a drawdown plan. Read as Physician on FIRE challenges us to think through what it takes to reach retirement early.

Today's Classic is republished from Physician on FIRE. You can see the original here. Enjoy!

We know how to become financially independent. We work, we earn, we save. We invest in a simple and sensible fashion. Perhaps we’ve accepted the challenge to live on half. Eventually, we reached our magic number.

We’ve got 25, 30, or 33.33 years worth of anticipated annual expenses for a 4%, 3.33%, or 3% withdrawal rate spread across various tax-deferred, tax-advantaged, and taxable accounts.

We are experts in adding to them.

But how do we best subtract from them?

Today, I’d like to share our drawdown plan for early retirement.

Our Drawdown Plan in Early Retirement

Know Your Starting Point at Retirement

There is no one-size-fits-all plan, but I’ll share our strategies and rationale which should provide you with a good framework of how to best design a drawdown plan of your own.

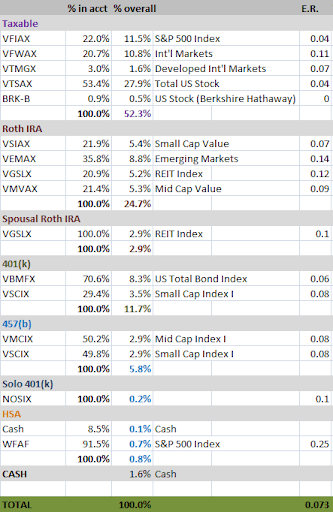

To best formulate a plan, you must first know what you’re starting with. It can be tough to track multiple accounts, so I use Personal Capital to log into all of my accounts at once and update this spreadsheet in a matter of a couple of minutes.

This represents all of the money we plan to use in retirement. I’d like to point out a few tidbits before we start pretending to spend these dollars.

First, my average expense ratio is ludicrously low. With extremely low expense ratios for the Vanguard Funds I own, the weighted average expense ratio in my portfolio is 0.073%. That’s a cost of $730 per year per million dollars invested.

If my money was being managed by an advisor with an AUM fee and more expensive funds like this couples’ portfolio with overall fees of 1.37%, we’d have annual fees of $13,700 per million dollars invested. At a not unheard of 2% to 3% total fee structure, the portfolio would cost $20,000 to $30,000 per million invested. Fees matter.

Second, my portfolio is set up very well for early retirement, with a majority of the dollars in a taxable account. Most of my tax-advantaged money is in Roth contributions and a mega Roth conversion I made more than five years ago. With better than 80% of my money available today without penalty, this exercise becomes pretty easy.

Third, this doesn’t represent all of our assets. Our first and second home, 529 Plans, donor-advised funds (not technically ours anymore but controlled by us), properties, and microbrewery investments are not listed above. Still, what you see exceeds 30x our anticipated retirement budget, so financially, we are ready to pull the trigger at any time. I’m not leaving my job tomorrow, but plan to do so in another year or two, so our portfolio will look a lot like this when the time comes.

The First Moves We’ll Make When We Retire

Thankfully, I have excellent investment options in my 401(k) and not much in the way of additional fees. But, the fees exist, and I’d prefer to consolidate our money by removing it from our employer’s plan and rolling it over into one of two accounts — either my eTrade individual 401(k) or our currently empty traditional IRA with Vanguard.

The main advantage of rolling it over the individual 401(k) would be the continued ability to make backdoor Roth contributions. Since we don’t anticipate having a huge income as early retirees, this is likely a moot point.

Rolling my employer 401(k) over into a traditional IRA will allow us to make annual Roth conversions in lower tax brackets when retired, much like my friend will be able to do. Based on the current tax code, this move makes more sense.

We’ll want an income stream. With anticipated expenses of about $80,000 a year as a family of four, we’ll want $6,000 to $7,000 a month. I based this number on our actual spending from 2016, with a healthy allowance for additional healthcare costs.

The first income stream will be created by logging into Vanguard and having quarterly dividends sent directly to our checking account. Currently, I have dividends directed to a Vanguard money market fund within the account and I manually reinvest them. The only reason I don’t automatically reinvest dividends is to avoid a potential wash sale if I have done some tax loss harvesting within 30 days of a dividend payout.

In retirement, I’ll manually spend the dividends. The income should cover about 1/3 of our expenses.

The second income stream will come from our non-governmental 457(b). Unlike a 401(k), there is no penalty to withdraw this money at any age once you separate from your employer. When I make my exit, I plan to set up withdrawals of about $3,000 a month, and that should last a good five years or more depending on the total return and sequence of returns.

These two moves should cover about 85% of our anticipated needs, at least for the first five years. What do we do to cover the shortfall, especially after the gravy boat of a 457(b) runs dry? We have numerous options, but there is a clear winner.

Sell From the Taxable Account First

We’ll have money growing tax-free in tax-deferred and Roth accounts. Although there are easy ways to get to it, I’ll act as though we can’t touch this money. The longer those dollars grow unperturbed, the more tax-free benefit we get.

Our plan is to **gasp** sell funds owned in our taxable account. Yes, I dread the day I click the Sell button and watch my balance shrink a tiny bit, but that’s what the money is there for. I could have aimed to own stocks paying a higher dividend, but I didn’t want the tax drag associated with the dividend darlings, so sell is what we’ll do to cover the difference.

It’s going to be alright. Ignoring the dividends, the 457(b), and the likelihood of portfolio growth, we’ve currently got nearly 20 years' worth of living expenses in our taxable account. We can sell early and often if necessary.

By the time we’d be selling the last scraps of the taxable account, I would have reached the magical age of 59.5. I’ll have a lot less hair and what’s left will be gray, but I’ll have easy access to the rest of my retirement savings. So I’ve got that going for me. Which is nice.

Touch the Roth Money Last

At any age, I could sell any Roth contributions plus conversions that took place more than five years ago, but that would be pure folly when taxable money is still hanging around.

Unless major changes take place in the treatment of these accounts, Roth accounts should be treated like a sleeping baby. Don’t go near them; try not to make a sound when you’re logged in to check on them. Admire them from a distance and let them rest.

The 401(k) to Roth Transition

Since Roth money is the most valuable money we can have, why not get some more?

We touched on Roth conversions in a previous post, and the topic has been covered extensively elsewhere. Briefly, a good strategy is to convert some tax-deferred money to Roth without bumping yourself into the next tax bracket each year. Commonly, there is an initial step of rolling the 401(k) over to a traditional IRA as I anticipate doing.

You’ll likely incur some taxes (although with very little taxable income, it can be done tax-free), but if you can convert it all from traditional to Roth by the time you turn 70.5, you won’t have to worry about taking out Required Minimum Distributions (RMDs).

Alternatively, if we find ourselves needing that tax-deferred money after age 59.5, we can simply withdraw some each year to spend and expect to pay income taxes on the withdrawals. The more we spend it down or convert it, the less likely we are to be bumped up to higher tax brackets when RMDs become mandatory as septuagenarians.

Need the money before age 59 1/2? I’m sure we won’t, but if you find yourself in that situation, there are ways to get at it penalty-free.

What to do with the HSA

I’ve only had access to an HSA for a few years, and it represents less than 1% of our portfolio. I’ve been saving receipts for healthcare services for a couple of years, and I’ve found it rather cumbersome. While I could continue to save, scan, and store receipts for years to come, I am unconvinced it is worth the effort.

Our plan is to cash out the sum total of the collected receipts from the HSA upon retiring, which will about cut the value of the account in half. What’s left can be used to pay healthcare costs but not insurance premiums. I suspect the account will run dry if we don’t continue to add to it.

If you end up with a sizable HSA and don’t anticipate using it all for healthcare, the money can be withdrawn for any and all expenses after age 65.

I’m not sure if a rhinestone grill could be successfully argued as a dental orthotic, but once you reach a certain age, you can buy a set with your HSA. Keep in mind you will pay income tax on withdrawals not used to pay for eligible healthcare expenses.

No Annual Fee, a $500 welcome bonus with $3k spent in 3 mo. & up to 5% cash back on certain purchases. More on why it's one of my favorite cash-back business cards here.

A Couple Caveats on Our Retirement Plan

Did you notice what I said about adding to the HSA? How does a retiree do that?

With income.

Like WCI recently said, retirement is squishy. My retirement from clinical medicine will not be the day all income ceases. While I give away half of my profits from this site, there will still be some income left over for us. There will be additional income opportunities like freelance writing and public speaking, neither of which require carrying a pager or exposure to bodily fluids (or so I’m told).

You may continue to earn money as a retiree, as well. For you, it may be from real estate or part-time work in a hobby job. None of it invalidates the plan I’ve outlined above, the general outline of which existed before I started a website.

If anything, the income should be better incorporated into the plan, but for purposes of making this post more broadly applicable, I’ve chosen to largely ignore it save for the mention of the possibility of additional income for the sake of transparency.

I’ve chosen not to post blog income publicly, but I do share it with e-mail subscribers in a quarterly newsletter.

Disclaimer: The topic presented in this article is provided as general information and for educational purposes. It is not a substitute for professional advice. Accordingly, before taking action, consult with your team of professionals.