Should You Put Rental Properties in an LLC?

This post may contain links from our sponsors. We provide you with accurate, reliable information. Learn more about how we make money and select our advertising partners.

[Editor’s Note: I am not asset protection, legal, financial, or tax expert. I can only tell you the things I've learned when researching whether an LLC is the appropriate structure for holding my own rental properties. Please consult a professional being making any decisions in this arena.]

Should you form an LLC and put your rental properties in it?

If you have rental properties or are looking to purchase some, the question of whether or not to form a Limited Liability Company (LLC) has probably come up at some point. I see this question posed quite often on related forums, as well as on the Passive Income Docs Facebook Page. LLCs can be a great way to protect yourself and your assets, and as an owner of several rental properties in various states, I’ve pondered this question myself.

Unfortunately, it’s never completely cut and dry. There are many factors at play, particularly asset protection and taxation issues, that need to be considered before making this decision. For some, it may be better to simply increase your insurance coverage. But finding unbiased advice on this question can be difficult.

If you ask an entity lawyer whether you should form an LLC, they’ll say yes. If you ask an insurance agent whether you should increase your liability and umbrella insurance instead, they’ll say yes. The old saying, “Never ask a barber if you need a haircut,” seems to hold true.

So, should you put your rental properties into an LLC? Well, the answer is. . . it depends. Once you’ve weighed the options, the answer to your situation will hopefully become more clear. So let’s try to break it down a bit with a classic advantages/disadvantages list–one for the LLC, and another for simply increasing your insurance coverage.

Advantages of an LLC

Asset Protection

One of the major reasons LLCs were created in the first place was to limit personal liability. This is probably the main incentive for investors to have rental properties in an LLC. The risk of a lawsuit is hypothetical, but every one of us in the medical field knows to take the threat of a lawsuit seriously. The last thing anyone wants is for a tenant in a rental property to have an issue, even if it’s out of your control, and have them go after your personal assets.

Tax Advantages

LLCs can be designated as different types of tax entities, but I would venture to say that if you’re reading this, you would likely have it taxed as a “pass-through” entity. This means that the income and capital gains from the LLC pass directly to the owner. Taxes are then paid as an individual. However, the owner still gets to enjoy the protection afforded by the LLC. The recent changes in the tax law have made some adjustments to how pass-through entities are taxed. Whether that is to your advantage, specifically, is something you should discuss with your CPA.

Anonymity

When you own rental property, the name on the deed (yours) is public knowledge. In a very bad scenario, they could see you’re a high-income professional with M.D. status. This knowledge may determine their behavior. This is exactly why many of my colleagues say they will never put an M.D. vanity plate or hospital bumper sticker on their car in case they get into an accident. If you have a holding company in a state that allows for total anonymity like Wyoming or Nevada, it’s even more difficult for anyone to figure out who the owners actually are.

Disadvantages of an LLC

Cost

There is a cost to forming and maintaining the entity you create. There may also be an additional cost for tax preparation. I’ve talked to lawyers who will charge $600 for an entity creation and others that will charge $2,000. There are companies like IncFile who only charge $49 + state fee to get started, then there’s always LegalZoom which will do it for a couple hundred but who knows whether it's good enough. I’ve found that just to maintain any of my California LLCs, it’s about $800 a year for each one. Is the cost worth it? Well, that leads me to the next point.

Unclear Asset Protection

Unfortunately, simply having the letters “LLC” on the deed doesn’t necessarily fully protect the owner. There are situations where it does protect well. . . and there are times when it doesn’t. Again, it's not fully clear what those situations might be. What’s in your operating agreement may help, but that depends on who helps create the entity. The only way you’ll know for sure is when a suit arises.

Trouble Getting Financing

Good luck trying to get a loan when purchasing a single family home (or a duplex/tri/quad) under the name of the LLC. As far as I know, almost all lenders will not let you borrow in the name of the LLC. Instead, they want someone personally liable. This may require you to buy the property entirely in cash, or you can try to deed the property to the LLC after purchasing in your own name. Which, again, leads right to my next point.

Due-on-Sale Clauses

It’s quite possible that if you try to convert ownership over to an LLC, your lender will view that as a complete change of ownership and ask for full repayment of the loan. I’ve talked to many investors who say they’ve done this conversion with no issues, but there’s no guarantee that the bank won’t ask for full repayment of the loan. At that point, you’re left to either pay it off in cash, refinance (which might be difficult–see my above point), or sell the property.

Insurance

There is another option altogether, which is to protect yourself with liability and umbrella insurance. Sure, tenants can sue you personally, but if you have enough insurance to cover, then you’ll likely be just fine. However, as always, there are some advantages and disadvantages.

Advantages of Increasing Insurance

It’s Simpler

We all have to get insurance for the property anyway. While you’re at it, you just have to make sure the policy covers the proper limits, add umbrella insurance, and you’re done.

Cost

Umbrella insurance is typically pretty cheap for the type of coverage you get. It's a small fraction of what the primary insurance premium is. The concept of umbrella insurance is an add-on to cover you above and beyond your typical insurance.

Disadvantages of Increasing Insurance

Potential loss

If you’re sued with a property-structured LLC, the worst case scenario is you declare bankruptcy on the LLC and you lose the property. With only insurance as your protection, if the lawsuit exceeds your policy coverage, then you may have to pony up the money yourself and lose personal assets beyond just that single property.

Exclusions

Insurance policies often have exclusions which you have to account for. You really need to know what they will cover and what they won’t. Are you willing to take that risk?

What About My Properties?

It all comes down to a matter of risk tolerance. After all, isn’t that really what insurance is? You’re paying to mitigate risk and to sleep easier at night. When it comes to my rental properties, I pretty much have all of them under an LLC, and the ones that aren’t yet are in that process.

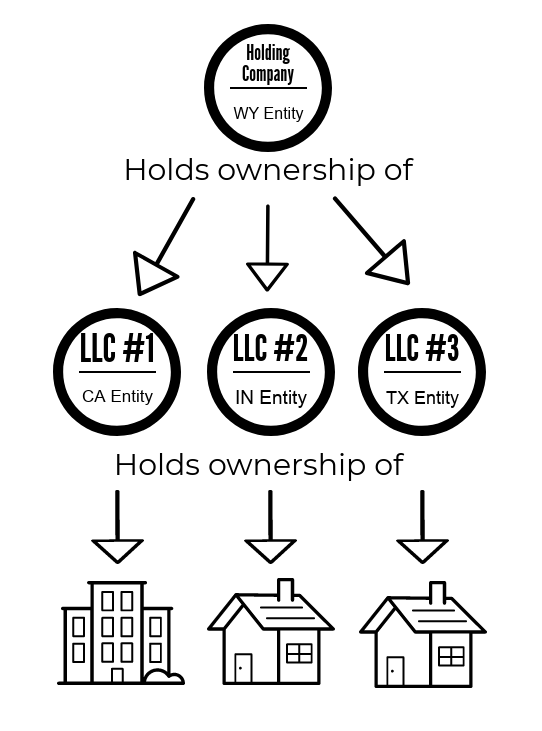

Through the LLC, my lawyers and I have created a structure that seems to offer me good protection. Of course, nothing is ever ironclad, but it helps to have some structure. In case you’re curious, here’s a very simplified representation of what I have set up.

In this simplified diagram, you can see that the holding company holds owner interest in each of the separate LLCs. The one big tip I will give you is that if you are planning to buy properties with an LLC, it is much easier if you have that entity created prior to taking ownership of the property. If you're buying an apartment using a commercial loan or an investment property in cash, you will be able to directly buy it in the name of the LLC, otherwise you have to convert it later.

I’m going through that process right now with some properties and it’s time-consuming and expensive to hire the lawyers to change over the deeds. I’ve had to pay extra for title insurance companies to continue with my policy. So, try to have the entities created beforehand if possible.

In my own case, the anonymity of the LLC under a holding company has definitely made me rest easier. In the area of asset protection, one term that you’ll hear is “piercing the veil.” This means that when sued, the lawyers will do their best to keep tracing back the lineage of origin or ownership to see exactly who can be brought into the suit. If they can “pierce the veil” they can hold the owners of shareholder personally liable. So in my case, they may get to my holding company if they are able to get past the LLC, but that’s pretty much as far as they can go–the owner of my Wyoming holding company is not public.

How much did all that cost? I actually knew I would be forming a good number of companies and ended up doing an unlimited LLC formation plan. This cost me $6,000-$7,000. I invite you to tell me if that seems ridiculous or if it’s a good deal. But after forming 8 entities with more coming, I think I made the right decision (so far).

Beyond the LLCs, however, I also maintain a decent umbrella insurance policy. I believe that the best idea is to have both the protection of the LLCs and the coverage that insurance provides. Based on my assets, I currently have $3 million in umbrella insurance, but I’m continuing to evaluate that as I go.

By going with both approaches (LLCs and good insurance), I feel as well-covered as I can be. Yes, there will be lawyers who tell you it’s not enough. I spoke to one lawyer who pitched me a plan that would’ve cost me close to $30,000 to make my asset protection “totally ironclad.” Perhaps it would have been, but I wasn’t willing to pay that much and I felt that my current level was enough to put my mind at ease. Don’t be afraid to get a second opinion and learn from each expert’s advice. I’m still learning as I go, but for the moment, I can rest easy at night.

Disclaimer: The topic presented in this article is provided as general information and for educational purposes. It is not a substitute for professional advice. Accordingly, before taking action, consult with your team of professionals.