7 Great Tax Benefits of Investing in Real Estate

This post may contain links from our sponsors. We provide you with accurate, reliable information. Learn more about how we make money and select our advertising partners.

If you've been exploring different ways to create passive income, you may already know about the many benefits of real estate investing. After all, real estate is one of the most popular side hustles for physicians and for good reason.

The ability to create generational wealth and cash flow that replaces the need for your day job is definitely possible using this vehicle. In fact, we created our Facebook group, Passive Income Docs, so people could share such stories with each other.

I’ve previously mentioned the top ways to make money through investing in real estate. As a quick summary though, the main four ways to do this are:

- Appreciation – The property goes up in value over time.

- Cash Flow – Real estate can be a source of monthly recurring cash flow.

- Mortgage paydown – Your mortgage gets paid down by your tenant increasing the amount of equity you have in the property.

And last but not least (and the topic of today's post):

4. Taxes

I’ve touched on a few of these tax benefits in the past, but I'd like to elaborate a little further–since we're approaching the end of this tax season. Of course, tax law is complicated, but for this post, I’m going to try to break down some of the ways you can use these benefits to your advantage.

Disclaimer: I am not a tax professional and you should always consult your CPA or tax professional before making any decisions.

Capital Gains

“Capital gains” are simply the profits you receive from the sale of a property. Just like any other gains, it is subject to being taxed. However, depending on a few factors, it's taxed differently, and knowing what those different ways are, you might be able to work things in your favor.

1. Short-Term and Long-Term Capital Gains

Depending on the length of time that you hold the investment before selling it, those capital gains can be classified as either short-term (less than a year) or long-term (a year or longer).

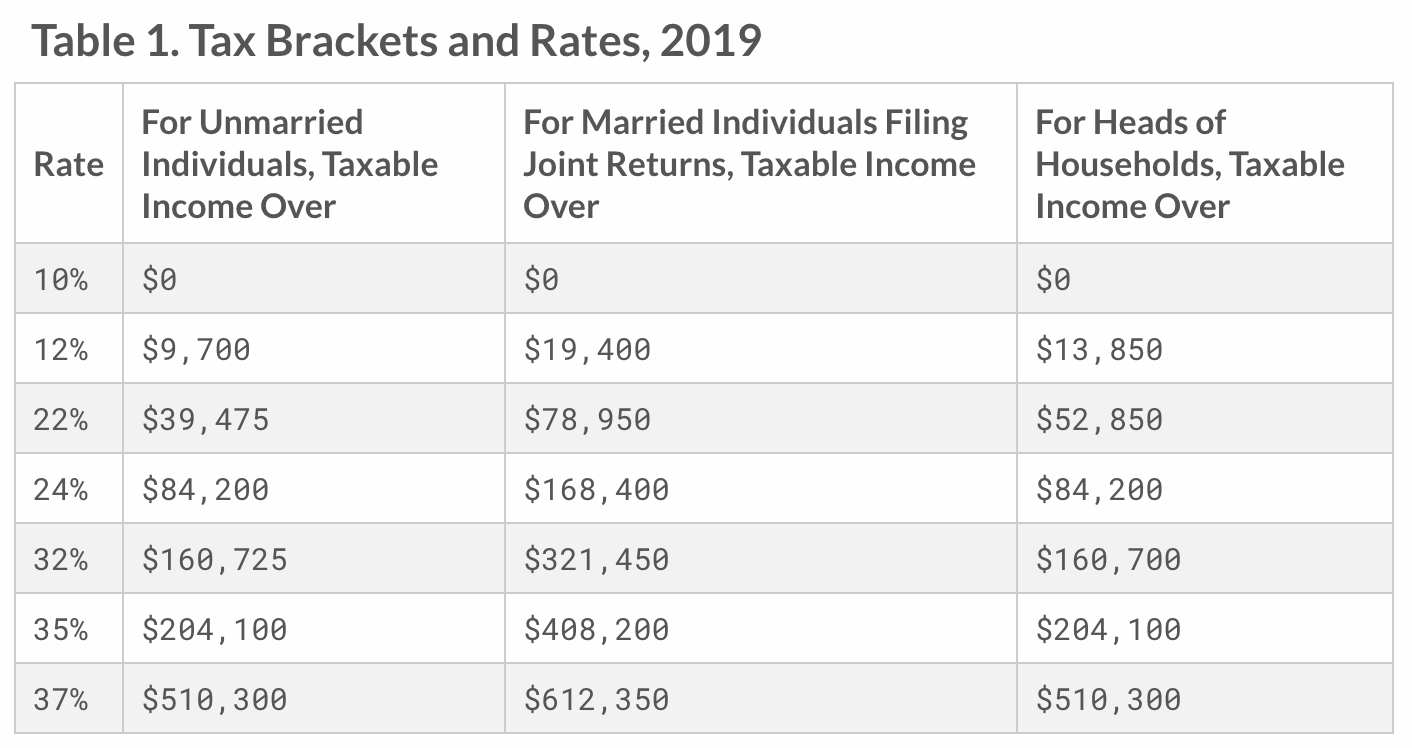

Short-term capital gains are taxed as ordinary income, so it depends on whatever tax bracket you're in. For the typical physician, this usually puts us in one of the higher brackets which could be at 35% or 37%. Here's a quick refresher on the current tax brackets.

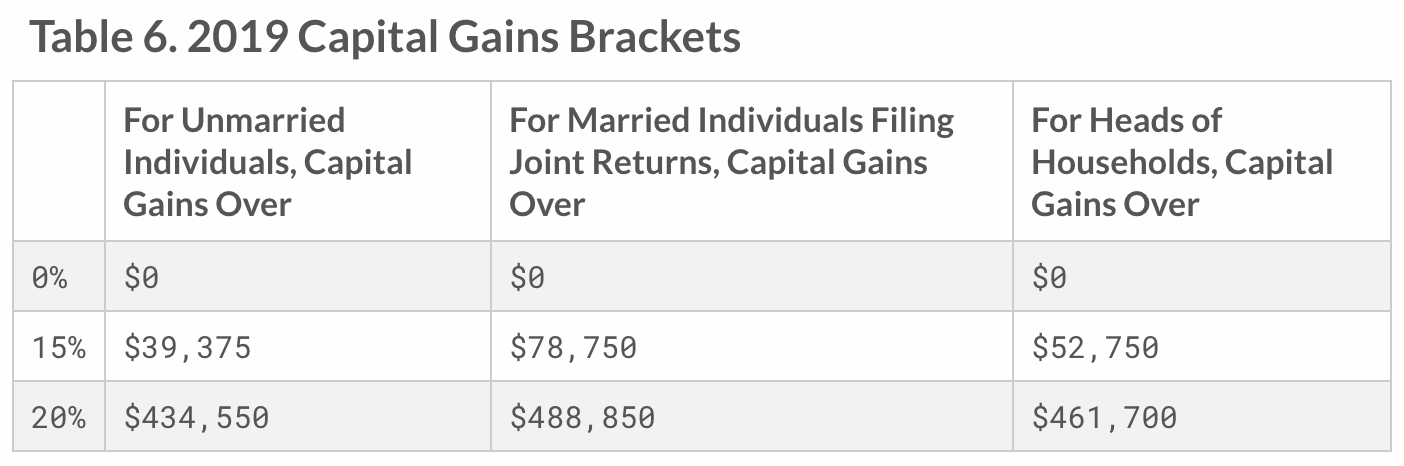

However, long-term capital gains fall into one of three buckets depending on the income and your marital status. See the chart below.

So, with all that in mind, let’s say that you sold a rental property for a profit of $450,000. As a married couple filing jointly, you would be paying a capital gains tax of 15% on that profit, which equates to $67,500. Compare this to if you had to pay the normal 35%. If you’re in that tax bracket, you'd pay $157,500– a $90,000 difference!

To benefit the most from reductions in capital gains, it pays to be in the long-term bucket.

2. Capital Gains Home Exclusion Tax Benefit

If you have owned and used the property as your primary residential home for at least two out of the last five years before selling it, you’re eligible for this exclusion.

This exclusion according to the IRS states that “if you have a capital gain from the sale of your main home, you may qualify to exclude up to $250,000 of that gain from your income, or up to $500,000 of that gain if you file a joint return with your spouse.”

Here’s a simple example. Let’s say you’re married and bought a home for $500,000. You lived in it for two years, then rented it out for the last three years and decided to sell it. It sold for $1,000,000, leaving you with a $500,000 profit. Well, you qualify under the exclusion to receive that profit completely tax-free. If you’re a high-income professional in a higher tax bracket, that can be significant savings.

3. No Self-Employment or FICA Taxes Paid on Rental Income

Rental income is not subject to social security and Medicare taxes. Depending on whether you’re employed or self-employed, you could be paying 7.65% to 15.3% toward this FICA tax on other income. The tax is in the amount of 15.3% and it is split 50/50 between the employer and the employee. If you are self-employed, however, and have no employer, you are responsible for the full 15.3%, and this is known as self-employment tax.

Again, this might depend on how you classify your self-employment (example S vs C), but that 15.3% could be a significant amount. It just goes to show that all income is not treated equally. It’s a reason to push for more passive income sources–particularly those designated as such in the eyes of the IRS.

4. Depreciation

Another big deduction is depreciation, whereby the IRS allows you to deduct the cost of business items that have a “shelf life,” like the building itself. Some might consider this the most powerful tax benefit of investing in real estate.

Over time, the real estate in which you’ve invested is going to start breaking down. Fortunately, you're allowed to write off an income-producing property based on wear and tear.

How does it work?

First, you have to determine the value of the actual building apart from the land and then divide that value by the useful life of the property. According to the IRS, that lifespan equates to a number, which is 27.5 for residential properties and 39 for warehouse/commercial properties. Then, you deduct that precise amount each year.

For example, if your rental property (the building itself) is valued at $500,000, you would divide that by 27.5 years (~$18,000). Now, you can deduct $18,000 as a depreciation expense each year for 27.5 years. This deduction allows you to report a smaller profit to the IRS, thereby reducing the amount you ultimately owe in taxes. In this way, you can offset the gains.

Normally, if you show a loss on paper as a result of depreciation, you can only use it to offset passive gains from other properties or investments. But if your modified adjusted gross income is less than $100,000, then you can offset $25,000 of your income. Otherwise, if there is an excess loss, you have to carry it forward to the next year.

There are two exceptions to this: 1) You are able to deduct of all of the cumulative passive rental loss against non-passive income the year you sell the rental property. Or, 2) If you or your spouse qualify as a real estate professional, you’re able to offset active income. This is a very powerful tool and something my friends behind SemiRetiredMD utilize. I also plan to do the same this year (and report back!).

5. 1031 Exchange

The 1031 Exchange is named because of where it sits in the IRS tax code (Section 1031). It states that a taxpayer may defer recognition of capital gains and related Federal income tax liability on the exchange of certain types of property, including real estate. What that means in simple terms is that capital gains taxes are only paid upon the sale of a property, without an exchange. Otherwise, these taxes are deferred.

This deduction is valuable to investors because you can roll over capital gains from one investment property to the next and avoid being taxed until you sell your property.

There are some specific rules, however. First, the replacement property must be equal to or greater than the existing property. Second, the exchange should be for an asset (e.g., a real estate investment trust). Third, the property needs to be “held for productive use in a trade or business or for investment and can be exchanged for like-kind property”.

If you end up holding it until your death, whoever inherits your property does not “inherit” your tax burden. They receive the property on a stepped-up basis, meaning it’s as if they bought the property at the current market value. They only pay taxes going forward based on that current value.

The only consideration is that estate taxes may come into play if your estate is greater than $5 million. This situation would fall squarely into the category of a “good problem to have.”

6. Tax-Free Borrowing (Refinancing)

If you refinance, you are able to borrow against the appreciation and increased equity of a property tax-free. You can then use those funds for other investments and acquire more (units if that’s your goal).

For example, let’s say you bought an apartment building for $500,000. The property is now worth $1 million. You do a cash-out refinance and pull out $500,000 to put toward the purchase of the next building. This is a tax-free situation, and one you can utilize to continue growing your streams of passive income without paying more in taxes.

7. Opportunity Zones

This one is a bit new and part of the Tax Cut and Jobs Act of 2017. Special zones around the United States have been designated as “Opportunity Zones” and the government is trying to stimulate growth and investment in those areas. They've decided to do so mainly through tax incentives.

I go deeper into the benefits in my post Investing in Opportunity Zones: What's This Amazing Opportunity All About? However, in essence, it's an opportunity to further delay paying taxes on gains for nearly 10 years as well as put those gains to work and not get taxed on the profits from it.

It can be a tremendous incentive that people are just figuring out how to take advantage of. In fact, investment opportunity zones are popping up all around and I think you'll see more of them as the year goes on.

Conclusion

If you’ve begun investing in real estate, whether, through crowdfunding or other passive income strategies, it pays to know about the many tax benefits like these. You might've heard it said that you shouldn't let the “Tax tail wag the dog” meaning you shouldn't make investment decisions based on the tax benefits.

However, in real estate, the tax benefits are often so powerful if used correctly that it makes sense to make investment decisions with them in mind.

Of course, having a good CPA can take a lot of that load off your shoulders. But knowing what’s out there not only makes things easier for you come tax time, it also makes you a more savvy investor.

Disclaimer: The topic presented in this article is provided as general information and for educational purposes. It is not a substitute for professional advice. Accordingly, before taking action, consult with your team of professionals.