How to Get an Infinite Return Investing in Real Estate

This post may contain links from our sponsors. We provide you with accurate, reliable information. Learn more about how we make money and select our advertising partners.

I’ll be honest; the first time I discovered the concept of “infinite returns,” I had a hard time wrapping my mind around it. I’m very familiar with terms like “return on investment” or “annualized returns,” and I often use these concepts when determining whether an investment is worth it or not.

But an infinite return? It sounded intriguing . . . but it also sounded like just another marketing buzzword. However, I decided to do a deeper dive into this concept, and this is what I’ve found.

What is an Infinite Return?

The definition is quite simple. “Infinite returns” are achieved when you no longer have any money in a deal, but you are still receiving the benefits of cash flow and other returns (like when a property sells).

For example, let’s say you invest $100,000 in a passive real estate deal in return for a 10% ownership stake. Over the next few years, your initial capital is returned to you – your full $100,000 – and you still get to keep the 10% stake.

Then you continue to receive distributions and cash flow based on your stake (10%), and in the future, if the property is sold, you would get a profit based on your percentage.

At the point when you receive your full $100,000 initial investment back, you no longer have any investment in the deal. That money can be spent or invested elsewhere. You also technically can’t lose money – everything from that point are true gains. It's like the term, “playing with house money.”

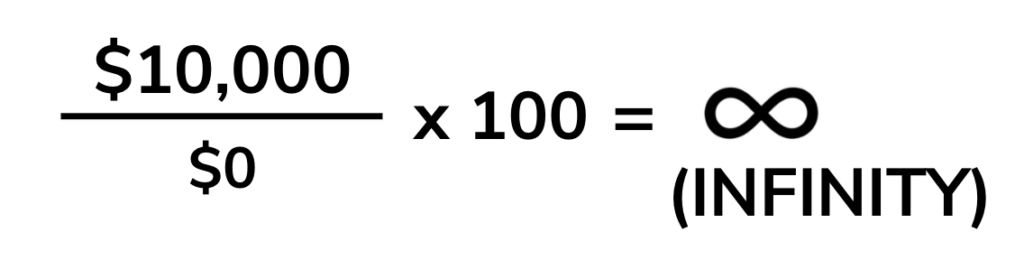

So, if Return On Investment (ROI) is calculated as:

If you received $10,000 that year in distributions but no longer have any money in the deal, you can see where this idea of an “infinite” return comes from. You receive investment income with no money tied up and no risk involved.

If you received $10,000 that year in distributions but no longer have any money in the deal, you can see where this idea of an “infinite” return comes from. You receive investment income with no money tied up and no risk involved.

I've found that there are two common ways to achieve infinite returns specifically in real estate. They are:

- No-money-down purchases

- Cash out refinance deals

Let’s take a look at each one of these in greater depth.

No-Money-Down Purchases

A no-money-down purchase is exactly what it sounds like – you purchase a property without a down payment. Though traditional methods would have you make a sizable down payment, I know of many physicians who have been able to purchase properties using this exact method and with great success.

You'd be hard pressed today to find a conventional bank that is willing to finance 100% of a purchase so you don't need to put down a down payment. However, if you get creative enough, there are still other ways to make it happen.

For example, I know investors who have had the seller of the property agree to “carry the loan” themselves for the full amount of the purchase. In other words, instead of having a bank lend you the money for the investment, the seller agrees to sell the property to you. You then pay the seller on a monthly basis, just as if you were getting a loan from them.

The collateral is the property itself and terms are created just as with a normal bank: the amount of the loan, the interest rate, and the length of the term.

If this is a rental property, the investor can receive cash flow from the property even while the seller carries the debt. This can result in an infinite return scenario where no money went into the deal initially, but you're able to benefit from the cash flow the property provides.

Alternatively, I've seen physicians purchase their primary homes using a 0% down physician loan. They then sell the home after it’s appreciated in value, and gain a profit. All of this without putting putting an initial downpayment.

Of course they're usually using the profit to put down a down payment for another home, but that profit was created with a no-money-down purchase.

Both of these situations are considered no-money-down purchases and can result in an infinite return scenario.

Cash Out Refinance Deals

The other situation is a bit more interesting to me and more of a strategy I look to take advantage of whenever I look for investment properties or passive real estate opportunities.

Here is the process in brief:

- Someone purchases a rental property

- Raises its value by increasing the net operating income (rehab & renovate, increase rents)

- Then refinances the property with the bank, pulling out their initial down payment and initial rehab cost out at the same time.

- At this point, they own the property, but have taken out their initial investment so in essence they have none of their own initial capital in the deal

Let’s dive into this a bit deeper.

How is a Property Valued?

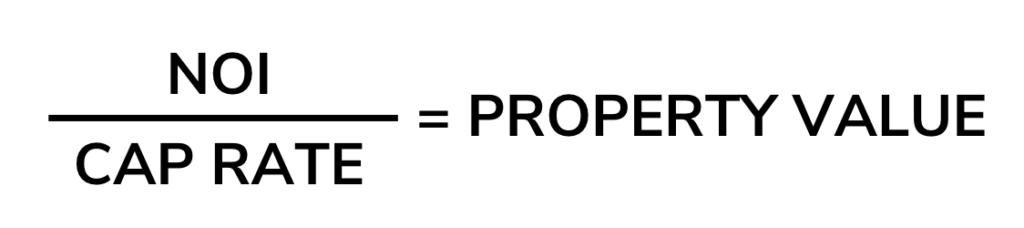

First, how is a property valued? Well, a multifamily property is valued by this simple equation:

Net Operating Income (NOI) is income minus expenses, essentially profit.

Capitalization Rate (Cap Rate) is a value used to estimate profitability of a property that is especially useful for comparing properties. Another way to say it is that the cap rate is the expected cash on cash return of a property (excluding any mortgages or debt payments).

So looking at the equation above, in order to increase the value of the property, savvy investors look to increase the Net Operating Income. This is accomplished by taking measures to increase the income, decrease expenses, or both wherever possible.

Taking these measures is what’s known as “forced appreciation” or “forced value creation.” It’s like taking a business and improving the operations, which then increases its value.

Banks & Cash Out Refinancing

Banks are willing to lend based on a “loan to value” percentage. So if for example, they’re willing to lend up to 75% of the value of the property, if you increase the value of the property, the amount they’re willing to lend increases accordingly.

If you're able to increase the value of the property, and you're able to refinance into a larger loan, you might be able to receive cash back.

Here's a simplified example:

Let’s say you put down $250,000 to buy a $1,000,000 building. That's accomplished by getting a $750,000 loan from the bank. This is a 75% loan to value loan: $750,000 loan for a $1 million value building. (750,000/1,000,000)

You renovate the property (spending $125,000), improve operations, increase rent, keep expenses low, and increase the property’s value. Over four years, the value of the property has now become $1.5 million, up from $1 million.

You then find a bank willing to refinance you into a 75% loan-to-value loan on that $1,500,000 value. That means the bank would be willing to give you a $1,125,000 loan ($1,500,000 x .75).

You take that $1,125,000, pay off the previous $750,000 loan leaving you with $375,000 left over.

Well, what do you know, your initial investment was a $250,000 down payment and $125,000 in renovation costs, for a total of $375,000. You pay yourself back that entire $375,000 and voila, you now own a $1.5 million valued property with none of your own capital in the deal.

Oh, and you still receive whatever cash flow it provides on a monthly basis. This whole process is tax-free until you sell.

This is what's know as a cash out refinance, and at this point, you’ve essentially achieved infinite return status. Moving forward, you have no more personal money in the deal, but you have the property, the cash flow, and the equity when you sell.

Can You Receive Infinite Returns in Passive Real Estate Investing?

Absolutely. When I invest in passive real estate syndications, this is one of the strategies I try to seek out.

Instead of you doing all the work to find the property, renovate it, increase rents, manage expenses, refinance, etc., you now leverage a team of professionals to accomplish this.

After all, the main goal of all my investing is for cash flow and I'm trying to find the right balance of leveraging my time and effort to achieve the maximal result. What better way is there to have cash flow than in a deal where you have no more of your own funds tied up in it?

Infinite Returns From My First Syndication Investment

I didn’t really know what I was doing with my first syndication deal. Luckily, it just happened to become an infinite return situation as you'll see below. I’ll write a fully detailed post on it in the future, but here it is in brief:

On September 12, 2014, I invested $25,000 in a syndication deal for a 1.04% stake in a $6.75 million dollar property.

On November 30, 2015, I received $13,188.36 as a distribution. The sponsors had improved operations quickly and were able to refinance the property and return some of my capital. That’s 53% of my original invested capital returned to me after 14 months, leaving me with 47% of my capital in the deal.

Every quarter I continued to receive distributions averaging $300-350. On occasion I would receive larger distributions (around $4,000-5,000) as they were able to return more capital to me.

On March 31, 2018, I received a distribution that put my total cumulative distributions in excess of my $25,000 initial investment.

At this point, it meant that I no longer had any capital invested in the deal and everything from that point forward was purely gravy. That happened in 3.5 years.

Every quarter since, I've received an average of $459 per quarter, which ends up being $1,836 a year. If I were to calculate a return normally, that would be $1836 ÷ $25,000, which is 7%. Not too bad, right?

But let’s remember, I have zero investment currently in the deal. So yes, it’s 7% if I'm considering my initial investment, but technically, it’s an infinite return in terms of cash flow since I have no more money in the deal.

Not only that, but I still own 1.04% stake in a building that just got appraised at $13.49 million. So if that sold, I would be receiving a nice profit. However, I’m happy with the infinite return cash flow I’m currently receiving.

Oh, and here’s the kicker: it’s all been tax free. Because of depreciation, I’ve shown a negative net rental income each year. So if anything, it’s offset any other passive income gains that I’ve received.

Should You Be Looking For Infinite Returns?

There are many ways to achieve great returns when investing, especially in real estate. As it turns out, “infinite returns” is much more than a buzzword, it’s a powerful way to maximize returns while reducing risk, which is basically the holy grail of investing.

It's also only one strategy when investing in real estate but it's definitely one of the tools I seek to use when making new investments.

Does this concept seem appealing to you? Have you utilized this strategy in your investing?

If you're interested in this concept and many others in passive real estate investing that can help you create cash flow toward financial freedom, join our Passive Real Estate Academy that teaches you how to confidently invest in real estate without being a landlord. Enrollment is only open for a few more days.

Disclaimer: The topic presented in this article is provided as general information and for educational purposes. It is not a substitute for professional advice. Accordingly, before taking action, consult with your team of professionals.