How to Start Investing in Private Real Estate Deals

This post may contain links from our sponsors. We provide you with accurate, reliable information. Learn more about how we make money and select our advertising partners.

The process of investing can be intimidating. There’s a lot to learn, and there are so many options – even narrowing down to just a few investments can be difficult.

But if you’ve been reading this blog for any amount of time, you know that real estate investing is (in my opinion) the quickest way to build streams of passive income and ultimately, achieve financial freedom.

So where do you start? Well, this article will give you a good idea of the path you can take to making your first real estate deal. Let’s jump right into it.

Educate Yourself

The first step in any new venture is to educate yourself on as much of the process as you can. While learning as you go is great, the more prepared you are ahead of time, the better.

First, it’s important to determine your investment style. Some people prefer a more active approach, while others prefer their real estate investments to be as passive as possible.

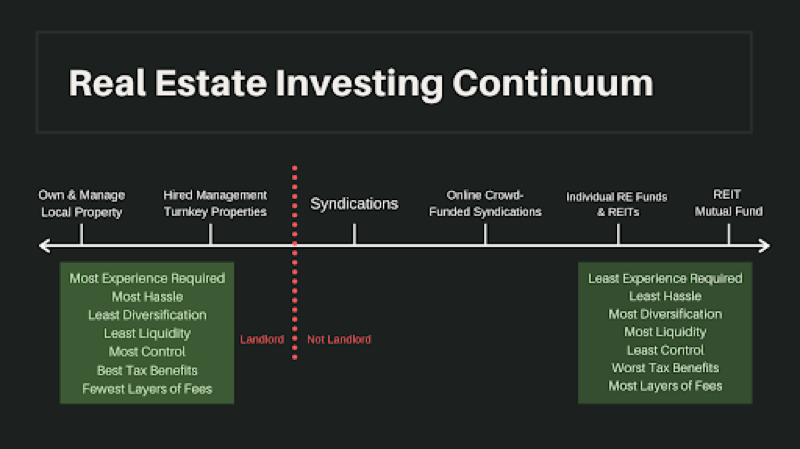

I lay out the “active versus passive” investment strategy in more detail here. But to summarize, real estate investments largely fit into this spectrum:

On the left side, you have active investments. The key takeaway from this category is that you are the landlord, and investments are more hands-on. In general, the more work you need to do on a monthly, weekly, even daily basis, the more active the investment is.

On the other end of the spectrum, you have things like funds and REITs, which offer a much more passive approach.

The point of this education isn’t to choose exactly which investment option is right for you (that comes later), but simply to determine how active you want your investments to be. Do you prefer the liquidity of more active investments? Or are you okay with tying up some funds long-term for a more passive approach?

Really, it’s all up to you and your personal goals.

For the rest of our discussion, as you might have guessed, we’ll be focusing more on the passive side of the spectrum. However, most of the steps listed will apply to just about any real estate deal.

Once you’ve determined which end of the continuum you feel most comfortable (and which fits your goals), you can begin to narrow down exactly which investment options will work best for you.

Narrow Down Your Investment Options

As you might have noticed, there are several ways to generate passive income through real estate investing. In a way, this is a continuation of the “educate yourself” step, but with more specific goals in mind. Here are a few of the ways you could invest, as well as some things to keep in mind as you look into them.

Syndications

In short, a syndication forms when multiple investors contribute to a large pool of capital, which is then used to invest in a single real estate opportunity. This strategy allows each investor to get in on a deal that might otherwise have been cost-prohibitive.

Usually, these syndications are formed by a “syndicator” for the purchase of a specific property. For the investor, this is great because you know exactly what you’re getting into before investing.

Real Estate Funds

Funds, of course, work a bit differently. Generally, real estate funds are not focused on specific properties. Rather, capital is pooled together and then used to either purchase multiple properties with the intent to sell at a later time (equity funds), or to lend money for short term returns, like to fix-and-flippers (debt funds).

There are actually many types of funds that fit many different goals. While they are a great way to invest in real estate, performing your due diligence is vital to your success (we’ll talk more about that later). For more information, be sure to read this post.

REITs

Real Estate Investment Trusts (REITs) are companies that own or operate real estate investments. As an investor, you're not investing as an owner in the properties, you're essentially a shareholder of the company. These shares are typically traded on the public stock market and therefore are easy to buy and sell.

However, as an investor, since you're not considered an owner in any actual properties, you typically don't take advantage of all the great tax benefits of investing in real estate and ultimately your upside potential is capped as well.

There is also plenty of debate whether it actually provides true diversification because values tend to correlate with the stock market quite a bit more than other passive real estate opportunities like syndications and funds. For the purpose of this post, I'll be focusing more on the latter.

Crowdfunding

Crowdfunding is a great way to get started in real estate investing. Like a syndication, you’re able to contribute to a larger pool of capital, which is then used to purchase on or more properties. After investing, you sit back and wait for the dividend checks to come in each month.What makes crowdfunding great for beginners, though, is that investments are done through an online platform that makes it very simple to find deals. You also don’t have to contribute much – I started in crowdfunding with just $5,000. And while due diligence is still important, most platforms take the guesswork out of it.

In fact, performing your due diligence is important no matter which option you go with. We’ll talk about this more in a bit, but it’s worth repeating. Researching a good deal goes a long way, and to bring it back around, you’ll be much more effective at finding those deals if you’ve taken the time to educate yourself.

And while it’s not terribly exciting, before making any decisions, take the time to learn the numbers. At the very least, you should understand the numbers involved in the deal and how that will play into your goals. You don’t have to be a numbers guru or anything, but a basic understanding will go a long way.

Find Deals

Now that you understand the categories and overall investment options (and have hopefully decided on a method that suits your goals), it’s time to find some actual deals to invest in.

But where do you find them?

In the past, your only option was to be well-connected. You basically had to know the right people who knew the right people.

But with the JOBS act, many deals were legally allowed to be posted online for everyone to see. These deals evolved into the crowdfunding platforms I mentioned earlier. Again, these are a great way to get started, and I’ve even compiled a list of sites that I recommend.

However, many people say that the best opportunities are still the ones you’ll never see advertised in public.

To find deals like these, it helps to frequent real estate conferences and network with experienced syndicators in the space. Conferences like these are often held local or even nationally. These are a fantastic place to learn, meet people, and even find opportunities. You can read about our conference last year here.

Aside from conferences like these, it also helps to network with other experienced investors. You can find like-minded investors just by asking around. You may be surprised to learn how many of your coworkers are investing–or at the very least, are interested in discussing their own goals.

Finally, you join an investor club. There are many, many options out there for this, each with different criteria for joining and goals in mind. If this idea interests you, we’d love for you to join ours! We often present opportunities you won’t easily find elsewhere. Learn more here. Note: you do need to be an accredited investor to join.

Perform Due Diligence

I briefly touched on this earlier, but it’s such a crucial step that I think it deserves its own section.

Once you’ve narrowed down the types of deals that will work for you and then actually found one, it’s time to put that education to use. The next step is to vet the deal and make sure it’s an investment you want to make.

The most important parts of due diligence can be broken down into three categories: who’s running the deal, the property itself, and the market the property is in.

Who’s Running the Deal?

Often called the sponsor, syndicator (in the case of syndications), operator, or manager, the group in charge of running the deal can make or break the investment.

Before investing, it’s important to look at their track record. How successful have they been in the past? How long have they been doing this? How does the group deal with risk?

A huge part of choosing a sponsor is based purely on trust. Make sure that they present information clearly, and are fully transparent about their past business dealings.

For a deeper dive on vetting the sponsor, check out this case study.

The Property

In the case of syndications and crowdfunding, where you know what property will be involved in the deal, dig deep into the history of the property and what the plans are for its future.

Make sure you understand what condition the property is in. It likely won’t be in terrible shape, but will it need a new roof? Will the flooring need to be replaced soon? Look into any upcoming costs related to upkeep.

You’ll also want to look closely at how the property currently performs and how it’s performed historically. You can even look at other properties in the area to get an even better idea. You also want to keep your eyes open for any expected renovations or remodels that might improve operations.

The Market

Finally, you want to take a look at the market where the investments will be made. Important questions to ask include: is the surrounding area up-and-coming? Are businesses opening up in the area, or are people moving away? What’s the general purpose of the surrounding area, ie: residential, industrial, etc., and is this likely to change soon?

Ultimately, you want to get a full feel for as much of the investment as you can – not just the investment terms.

Invest

At last, the time has come. You’ve narrowed down a type of investment, picked a deal, and done your due diligence. It’s time to make your investment.

Though you’ll likely have determined this in the research phase, it’s important to make sure that you're qualified for the deal you’ve chosen. Usually, being “qualified” means being an accredited investor.

While many deals don’t require that you be accredited, many do. Such deals usually have minimum investment thresholds of $25,000 – with some as high as $250,000.

Whether or not you’re an accredited investor shouldn’t keep you from investing, but it could exclude you from certain deals. You can learn more about what it means to be accredited here.

Alright, with the last hurdle out of the way there’s just one more question. How do you actually make the investment?

Well, you usually have to wire the funds, just as you would do in any real estate transaction. The operator or platform hosting the deal will have an account, and you’ll need to wire the funds into that account.

The key here is to make sure that this is done safely and in the most secure way possible. After all, it’s likely that you’ll be dealing with a lot of money. Making sure it gets to the right place and is protected along the way is crucial.

Wait

The last step is sometimes the hardest. Until this point, it’s been all up to you–from education to research to making the investment. Now, you just have to sit back and wait, and trust the sponsors to execute their business plan. This can be the hard part.

The great part, on the other hand, is simply waiting for the distributions. Eventually they’ll start returning capital and one day, the building will likely be sold. After all the initial work, all you have to do is watch for those checks to hit your bank account.

At this point, it’s my hope that you’re able to take this information and narrow down a course of action that works for you. Education is key, and while being as prepared as possible beforehand is the best way, there will always be some lessons learned along the way. The key is to just get started.

Of course, if you’d like to see each one of these steps broken down in detail, and have a resource to help you learn to confidently invest in passive real estate deals, then I would definitely recommend checking out our course, Passive Real Estate Academy.

Not only will you learn in depth, but it’s a great opportunity to meet like-minded people along the way. Enrollment opens up. again next month, so if you’re interested, get on the waitlist for exclusive discounts! >>JOIN THE WAITLIST HERE.<<

Disclaimer: The topic presented in this article is provided as general information and for educational purposes. It is not a substitute for professional advice. Accordingly, before taking action, consult with your team of professionals.