My Personal Real Estate Crowdfunding Results (So Far)

This post may contain links from our sponsors. We provide you with accurate, reliable information. Learn more about how we make money and select our advertising partners.

Back in 2014, I started going to local real estate investor meetings to learn from and network with seasoned investors. It was at once such meeting where I was introduced to a “new way” to invest in real estate known as crowdfunding. They explained that under new regulations, investors could now have access to so many more deals online and would be able to invest with significantly lower minimums.

Having no prior experience in real estate investing, that all sounded really appealing. At that same meeting, I met one of the founders of a crowdfunding site, and we talked at length about how it all worked.

I went home that night and signed up on a few platforms to view their deals. I figured the best way to learn was by jumping in and so I did and have never looked back. (You can read more about that first investment here).

I was able to dip my toes into real estate investing without putting too much capital at risk, and I know that this first step acted as a springboard to ultimately owning my own rental properties. It’s been a great source of passive income and the returns are attractive enough that I continue to invest today. You can see a list of my favorite crowdfunding sites here.

For this post, though, I’d like to share with you my personal returns. Let’s get right to it.

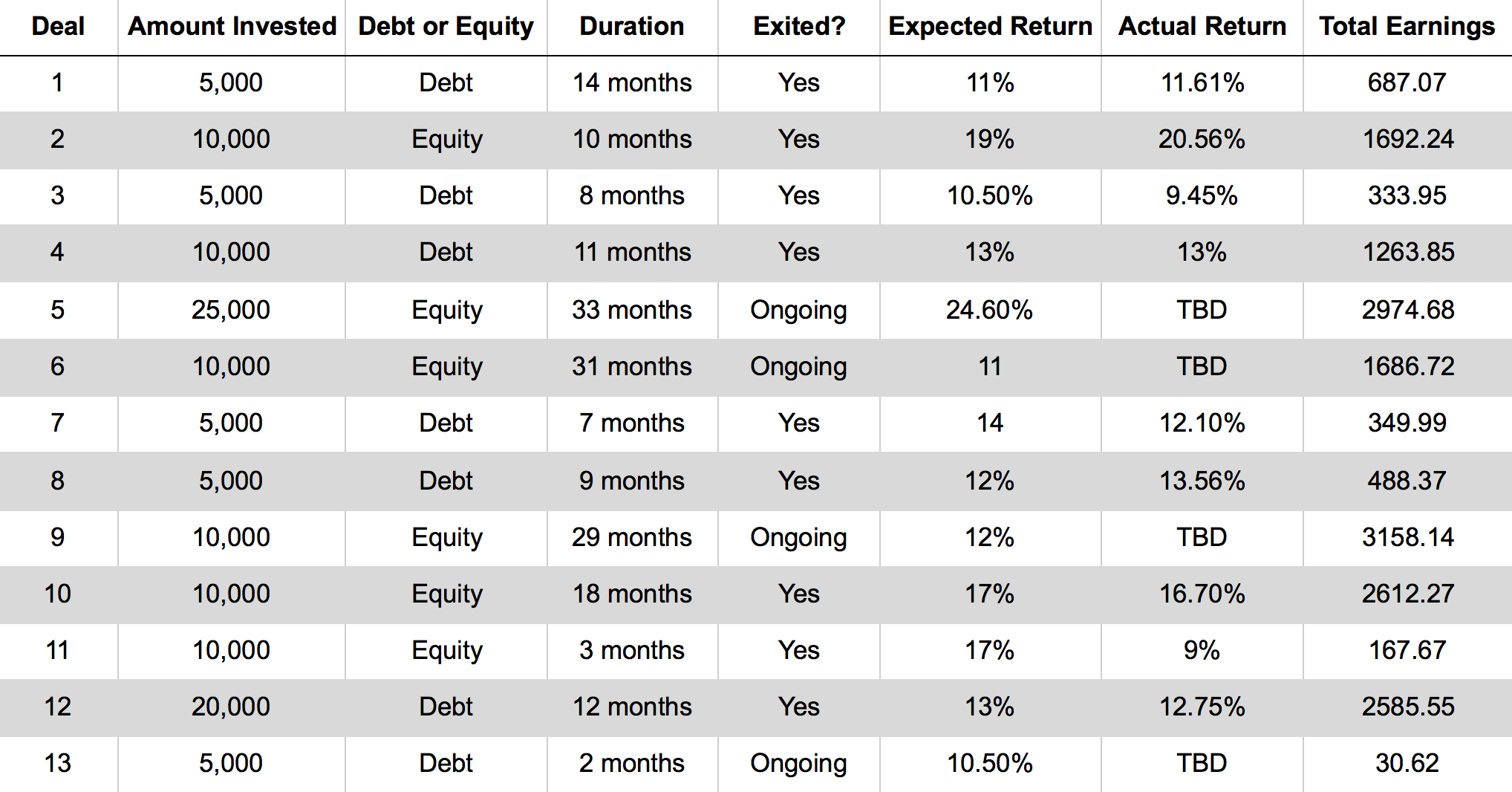

Note: I’ve invested in 13 deals and one fund so far. I invested a sizeable amount in the fund nearly a year ago, but I haven’t seen a return or distribution yet. This is due to an initial onboarding and repositioning period. Therefore, I won’t be reporting the results of the fund for now.

My Crowdfunding Results (So Far)

*TBD = To be determined (for ongoing deals)

Explanation

- Debt or Equity – I like to mix it up in terms of debt and equity deals. As you can see I've invested in 7 debt deals & 6 equity deals. Debt deals receive a predetermined interest return over the length of the loan, whereas the equity deals receive interest during the term as well as a payout when the property is sold.

- Duration – As short as 3 months to ongoing 3-5 year deals. Debt deals are typically shorter while equity deals have longer hold times.

- Expected Return – APR or IRR expected. Debt deals are pretty clear. For equity deals, they add in the interest rate that they will pay you over the term plus what they expect your share of the payout will be when the deal exits to calculate expected return.

- Actual Return – What I actually received based on length of investment and earnings. I actually calculated from the exact day I deposited the capital to the date of my last payout with return of capital.

- Total Earnings – The amount of capital earned. Most of these deals paid out interest on a monthly basis, some on a quarterly basis. For ongoing deals, it's the amount earned so far from debt interest payments.

Summary

Returns – Fortunately I've had no loss of capital yet (knock on wood). For exited deals, the best I can summarize it is that I've had a blended annual return of 13.2%. With all the deals moving in and out over the last 3 years, it's a little harder to determine actual or weighted returns. (If someone can help me with this, I'd welcome the help.)

Issues – A few deals experienced unexpected issues such as a tenant not paying rent and permitting issues. However, the platforms dealt with this and fortunately were able to resolve these issues. The deals have had adjusted times but at the very least I've received some interest while my money was being held.

Difficulty – I've found that this form of investing is extremely passive and the initial setup isn't difficult. The biggest challenge is trying to vet the deals quickly before they fill. That's why it helps to be alerted when new deals come up so you have to the most time to review them. At the end of the day though, some trust is required in the platforms themselves. That's why I stick to ones I'm familiar with.

Other Challenges – When a deal exits, you feel the need to reinvest those funds right away. If you're looking across multiple platforms, at least you should have access to a good amount of deal flow. However, I've had to tell myself to be patient and not just jump at any deal because I want to put those funds to use.

Risks & Other Notes – These are my personal results and no guarantee of results for anyone else investing. In fact, they're not even a predictor of future results for myself and I understand that. This type of investing, like any form of investing, is not without risk. However, I now feel relatively comfortable looking at deals on these platforms but that has come with experience.

Future – I plan on continuing to invest in real estate crowdfunding and in a good mix of debt & equity deals. I've worked outside of these platforms with syndicators in the past, but there's a comfort knowing that if things don't go well, that there is a company that will help me in that scenario.

Join our community at Passive Income Docs Facebook Group. Just click below…

Disclaimer: The topic presented in this article is provided as general information and for educational purposes. It is not a substitute for professional advice. Accordingly, before taking action, consult with your team of professionals.