The Guide to Real Estate Syndications, Part I

This post may contain links from our sponsors. We provide you with accurate, reliable information. Learn more about how we make money and select our advertising partners.

I’ve referred to syndications often and mentioned I’ve found a good number of these opportunities on my favorite crowdfunding sites. We’ve also talked about them quite a bit in our Facebook group, Passive Income Docs. However, I’ve always been interested in taking a deeper dive into the topic.

My goal with this multi-post series is to explain what syndications are, the different roles involved, explain some of their inner workings, and how to start vetting these deals. All of this with the end goal in mind of helping you figure out how to potentially use this type of investment to create additional streams of income and meet your passive income goals.

What is a Real Estate Syndication?

In essence, it’s the pooling of capital to invest in a real estate opportunity. The benefit of putting this capital together is that it might make it possible to purchase and pursue opportunities that one person may not be able to on their own.

A famous example of this was the syndication led by Helmsley & Malkin where they ran a group of investors to buy the Empire State Building in the 1960s for $65 million, many of whom contributed only $10,000 each.

How a syndication differs from a real estate fund is that with a syndication, the asset is already identified and the money is raised for that specific opportunity. With a real estate fund, it’s more of a blind trust where capital is raised based on the sponsor’s vision, track record, and reputation. After raising that capital, the fund sponsors will then go out and acquire properties.

What are the Various Roles in a Syndication?

Sponsor

There is a person or company that organizes this investment and that is responsible for managing the whole operation on behalf of the investors. They are interchangeably known as the Sponsor, Operator, or Syndicator. (I’ll use those terms interchangeably in this post as well).

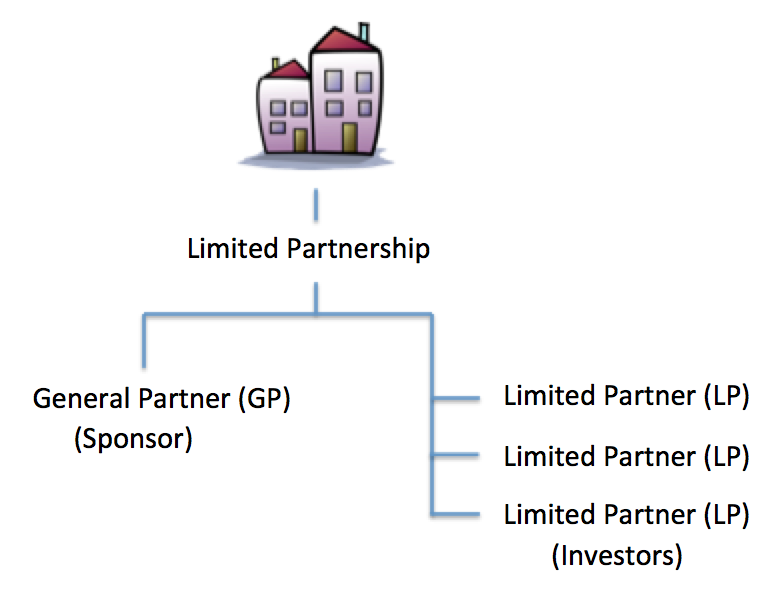

Depending on the legal structure of the organization created for the investment, the Sponsor is technically known as the General Partner (GP) or Manager.

Investors

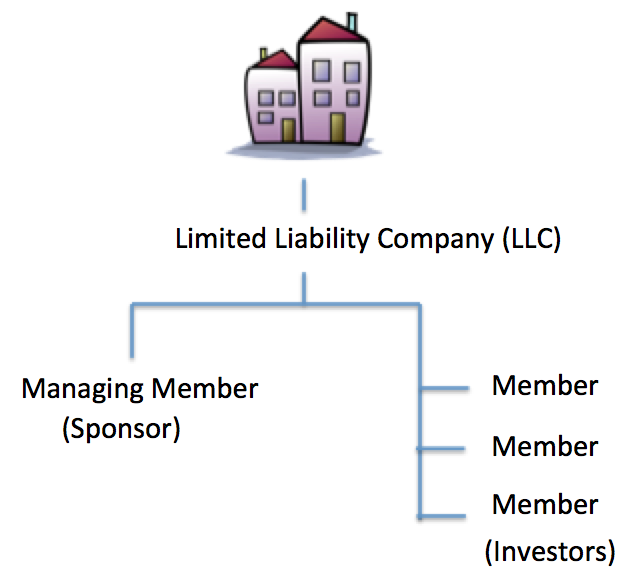

Investors are known as Limited Partners (LPs) or Members depending on the legal structure.

Legal Structures

As mentioned before, the syndication may be created with a certain tax and legal structure. It is usually created as a Limited Partnership (LP) or a Limited Liability Company (LLC) to own the property on behalf of investors.

The goal of this structure is to create a separate clean entity for management and control and also has the benefit of also protecting the individual investors from further liability beyond this one deal.

In reality, things can get a little more complicated with different classes within these structures and we’ll go into that in further detail in a future post, but at the core, the structures look like the following:

Simple Limited Partner Structure

Simple Limited Liability Company Structure

Accredited Investors

For the most part, syndications are typically open only to accredited investors.

To be considered an accredited investors by the SEC, you must either:

- Have an income of at least $200,000 each year for the last two years, or

- If you’re married, have a combined income of at least $300,000 each year for the last two years, or

- Have a net worth of at least $1 million, excluding your primary residence, either individually or jointly with your spouse

If you qualify based on income, part of the qualification is the expectation is that you’ll continue to make that income in the coming year.

Syndications will typically ask you to provide a letter from your accountant stating that you qualify, ask you for two years of tax returns, or send you to a third party site to validate your info.

The reason for this is that syndications raise capital through an exemption known as Reg D created by the SEC. In short, this states that these offerings do not have to be registered with the SEC if they are not marketed to the general public and the investors consist only of accredited investors. It’s usually quite expensive and complex for them to go through the SEC, so they often go the route of Reg D. With the JOBS act, some of that marketing has been relaxed but the need to have accredited investors remains basically the same.

An Example of How a Syndication Works

The following is how the process typically works, using a single property investment as an example.

A sponsor finds a property that they think would meet investment objectives, makes an offer, gets it accepted, tying the property up in what’s known as the escrow period. They perform their due diligence, figure out the financing necessary, then create an investment package typically referred to as a Private Placement Memorandum or PPM.

This PPM will include:

- Details of the property / deal

- Terms, sponsor contribution, equity splits

- Investment projections

- Fees

- Payout & distribution details (waterfall structure)

- Comparable properties

- Risks

The sponsor will then go about raising money from investors. They will decide a minimum investment amount and therefore have a certain number of shares or slots available. Once there is enough capital and the financing is worked out, the property will be purchased and the sponsor manages and operates the property.

Distributions and profits are given as outlined in the PPM (waterfall structure). Fees are taken as well. Upon disposition of the property (sale), the proceeds are given out and split up as again outlined in the PPM.

Types of Properties

There are many ways to invest in real estate, and syndications are formed for nearly every type of investment property. Every type has its own special set of strategies and therefore you will usually see operators sticking to what they know. For example, the big multifamily sponsors typically stay in that lane and the ones in the hospitality sector stick to their own. Once in a while though, you’ll see a group venturing out.

The strategy is of these syndications is basically to improve the operational numbers of the property (increase net operating income) and ultimately sell the property down the line, for example in 5-7 years.

Multifamily

This is just another term for apartment buildings. This type of investment is easy for the average investor to understand to a certain degree. People need somewhere to live and with the rates of homeownership dropping particularly in metro area, rentals (particularly apartments) will continue to be in high demand.

Sponsors run and operate these properties and manage income (rent & other income producers like storage space, garages or laundry income) and expenses (utilities, maintenance & upkeep, landscaping, renovation, etc.).

Retail

Retail properties are stores like strip malls or large tenant stores with an anchor like a Target, grocery store or Home Depot. They have longer-term leases and carry its own set of unique challenges. Keeping vacancy low is important but finding tenants for these properties can be more difficult. You’re somewhat reliant on traffic into the area so understanding the winds of change and economic dynamics in that area are important.

Hospitality

Hospitality properties like hotels and motels are usually housed under retail, however, understanding how to invest in one of these opportunities conceptually seems very different. Therefore I like to put it in its own category.

Sometimes you will see these opportunities as building their own brand of hotels, but often, the opportunities I’ve seen are of syndications purchasing existing properties, usually branded ones like a Residence Inn franchise, and figuring out how to improve the operation overall.

Industrial

This category is made up of warehouses and production facilities and often deal with larger and longer-term leases. Companies need places to manufacture, store, and distribute products from. Think of Amazon and the warehouses they use to do all their shipping.

Office

Office space is easy to understand, especially for physicians. Who owns and operates the building you have your clinic in? It may be the hospital, but it also may be a syndicate. Just like it is for all of these other opportunities, keeping occupancy rates high with good rents is the goal.

Pros and Cons of Investing in a Syndication

Like any other investment opportunity, investing in syndications has its pros and cons. It’s important for you to understand what they are and if it helps meet your financial objectives.

Pros

- You know which exact property you’re investing in, as opposed to REITs and RE Funds and you can see the exact strategy the syndicator is planning to use

- Pass-through tax treatment, in particular, depreciation and interest expense

- Can participate in a 1031 exchange

- Can allow for diversification – Because you're only buying a small share, you may have the ability for you to invest in other opportunities at the same time instead of having all of your funds tied up in one property

- Access to large investments with professional management

- Liability protection and protection from personal credit risk

- Very passive investment – Majority of the work is done up front by vetting the opportunity and sponsor

Cons

- Lack of liquidity – Locked in for whatever the term might be. It may be possible to sell your interest but it’s not easy.

- Lack of control – Sponsors decide when to refinance, sell, etc.

- Costs and fees are not always easily understood (we'll cover this later…)

- You’re not building equity and cash flow in a long-term asset like you might by owning your own property

- You have to find another deal when it exits

Again, in the next couple of posts in this series, we'll dive into fees, how to vet deals, and the type of returns you might expect in these type of opportunities.

Disclaimer: The topic presented in this article is provided as general information and for educational purposes. It is not a substitute for professional advice. Accordingly, before taking action, consult with your team of professionals.