Real Estate Investments Can Help You Profit From Inflation, Here’s How

This post may contain links from our sponsors. We provide you with accurate, reliable information. Learn more about how we make money and select our advertising partners.

For the last several years, inflation has taken its toll on our wallets. But what if I told you there is a way to profit from inflation?

Inflation has dipped in months—lowering from its June 2022 peak—but its price-gouging effects will stay with us for the long haul. Even with the surge fading, investors are worried. What does steadily rising inflation mean for your money and for your future? To hedge against inflation and to accelerate your wealth, consider the protective refuge of real estate investment.

Here at Passive Income MD, I’ve talked a lot about the importance of diversifying your passive income through real estate investment. Beyond the opportunities for enduring wealth that real estate offers doctors, it can also keep your long-term financial goals safe during any inflation period—one that is stable or volatile.

But before we talk about how real estate investment can act as a safe haven against inflation, let’s understand exactly what inflation is.

What is Inflation?

Inflation is measured by the Consumer Price Index as it tracks the price of goods and services. By directly comparing the prices of these goods and services over time, the CPI calculates percentages by which costs have risen—a number that reflects inflation.

Many market factors affect inflation, and it is generally accepted that minimal and steady inflation is necessary for economic growth. But what does inflation mean for you? It means that your money has more value today than it will tomorrow. In other words, inflation is the devaluation of currency over time, which also gradually decreases its purchasing power.

For example, in 1960, gas cost $0.30 a gallon. In October of this year, that same gallon of gas would cost $3.81. I don’t know about you, but my bank account would benefit from 1960s gas prices. When in a period of high inflation, the devaluation of your money might outpace your ability to earn new money to make up for that lost value. That’s where real estate investing in today’s economy comes in.

Interested in trending real estate investments this 2023? SUBSCRIBE AND TUNE IN TO OUR PODCAST: #170 Top 10 Real Estate Investment Opportunities for Doctors in 2023, ft. Dr. Peter Kim

Where Is Inflation Today?

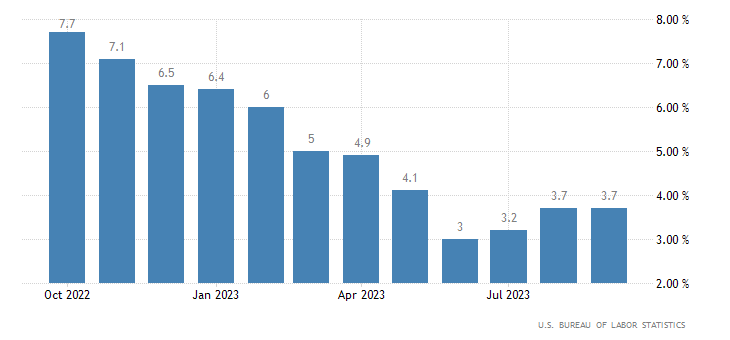

As of September of 2023, the monthly inflation rate lowered to 3.7%, a relatively low figure compared to the past two years. In 2021, the annual inflation rate was 4.7%. And in 2022, it ballooned to 8%. Think about that. Your cash lost 8% of its value in 2022 alone.

Many argue that inflation lowering to 3.7% is a good sign, but it is still a much higher rate than the 10-year average of 1.88% or the 2-3% average that most economists expect.

Thankfully, it looks like inflation stands a chance of stabilizing in the years to come. But even then, our cash is being devalued. Whether inflation occurs at stable or high rates, what can we do to protect ourselves against the devaluation of our money?

Leverage Inflation in Your Real Estate Investments

Let’s compare inflation with property value. From 1991 to 2011, home properties saw an average increase in value of 4.7%, far higher than inflation at that time. And since 2012, properties have averaged 7.7% annual growth. These figures demonstrate that, overall, property value tends to outpace inflation.

If you were to invest your cash into real estate investments—passive or active—you are creating a hedge against inflation. How does that work, exactly? Let’s look at four ways in which real estate investors can benefit from inflation.

1. Property Prices Appreciate

Despite some overvalued areas of the country, home prices remain high and continue to increase. Because property value increases tend to match or exceed inflation, real estate investment is a smart way to grow wealth.

So why do properties tend to increase in value, especially during a period of high inflation? One factor is that inflation increases the cost of the materials used to build houses. That means new construction units are sold at higher prices to reflect higher costs, increasing the value of already-built, comparable properties.

One byproduct of increased property value is increased profits from things like rising rents—which I’ll touch on in more detail briefly. Because real estate cash flow tends to increase from inflation, it makes it even easier to use gains to invest in additional properties, especially while only having to put down 20-30%.

2. Inflation Can Lessen Debt

Once a fixed-rate mortgage is acquired, the payment will never change. Whether you’re an active or passive real estate investor, you will pay back the bank the same amount of money each month regardless of whether it's the first year or the tenth year. Of course, taxes and other fees may adjust it slightly. However, over the life of a mortgage, inflation will erode the value of the outstanding debt.

How does this work? Let’s say your mortgage payment is $2,000. That means you’ll be paying $2,000 a month both this year and 25 years from now. By the twenty-fifth year, in 2048, $2,000 will buy quite a bit less than it does today. Inflation, in this example, lowers the loan-to-value ratio, and it effectively lowers your debt.

Your property’s equity will increase, your debt will decrease, and increasing rent will also put more cash in your hand—cash you can use to build out your real estate portfolio.

3. Demand For Rental Homes Increase

What we are seeing right now is a Fed that intends to continue raising interest rates to slow inflation. That means mortgage rates will continue to increase.

As the cost of borrowing goes up and property value increases, the cost of owning a home will be too much for some potential homeowners. Quite simply, fewer people will be able to afford a home.

Put in a tough situation by the Fed, folks will have to turn to renting. That will drive a large demand for rental properties, especially duplexes and single-family homes. That will further increase the value and rents of your real estate investment properties.

4. Rest Increases Provide Cash Flow

The same way the prices for any good or services increases during inflation, so too does rent.

Inflation increases rent in two ways. First, the property’s increased value demands that rent be priced appropriately to match the market value of the home. Second, and according to the law of supply and demand, the increased demand for rental properties creates a competitive pricing environment—driving rents up.

When demand is high, rental properties aren’t likely to see short-term or long-term vacancies. That means that inflation-based rent increases are a natural extension of the market rather than some kind of cash grab.

As you collect more rent from your properties during high-inflation periods, you’ll have more money left over after you pay that locked-in mortgage rate, increasing your profit margins.

Profiting From Inflation

Inflation is here to stay. And it seems like increased borrowing rates will continue through 2023. Investors will need to adjust their strategies to keep ahead of the curve. That means taking inflation-based steps to growing wealth through real estate investments.

Real estate investing is a great opportunity to protect yourself from inflation while also profiting from it. To learn more, stay informed by joining the Passive Real Estate Academy (PREA). It helps doctors invest in real estate confidently. PREA only opens its doors a couple times a year, so visit our website at PREANOW.COM to become part of the community.

You work too hard to let inflation devalue your financial health. Smart real estate investing can ensure your financial freedom. Passive Income MD is here to support you on the road to the enduring wealth you’ve envisioned for your future.

Join our community at Passive Income Doc Facebook Group. And let us know in the comments below the freedoms you are excited to pursue.

Disclaimer: The topic presented in this article is provided as general information and for educational purposes. It is not a substitute for professional advice. Accordingly, before taking action, consult with your team of professionals.